Changing Contours of Indian Household Savings

A new Goldman Sachs report outlines the shifting landscape of Indian household savings, as financialization drives a move from physical assets to non-bank financial instruments, with implications for funding the investment cycle and shaping the bond market.

Some key takeaways:

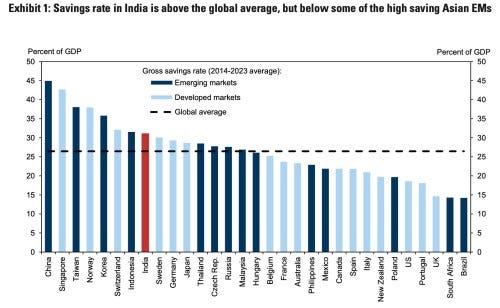

India’s gross savings rate, at 31% of GDP, exceeds the global average but trails high-saving Asian emerging markets such as China and Taiwan.

Households remain the primary savers in the Indian economy, though private corporate savings have risen since the pandemic due to deleveraging and increased profits.

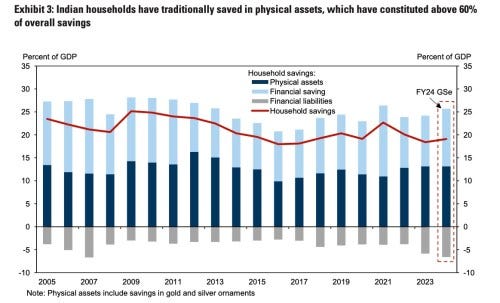

Indian households have traditionally preferred physical assets like real estate, which accounted for 61% of their savings from 2010 to 2020.

Net financial savings hit an 18-year low of 5.1% of GDP in fiscal year 2023 as household liabilities climbed. Goldman estimates they rebounded to 6% in FY2024.

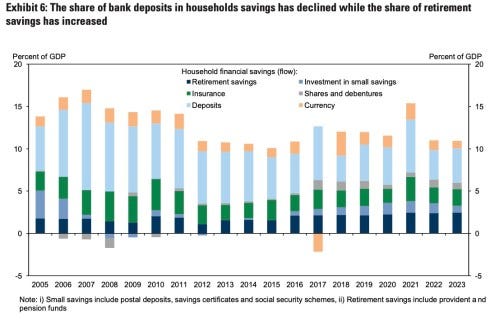

The financialisation of household savings has seen a shift from banks to non-bank assets, especially retirement savings. Pension, insurance and mutual fund assets have grown faster than bank deposits.

Bank deposits’ share of household financial savings has fallen from about 50% in 2005-2015 to around 35% in 2016-2023.

The share of retirement savings like pension and provident funds has increased from 11.5% in FY2005-2012 to 18% in FY2013-2023.

Retail participation in equity markets has surged to decade highs, particularly after the pandemic. Mutual fund assets under management have grown five-fold in 10 years.

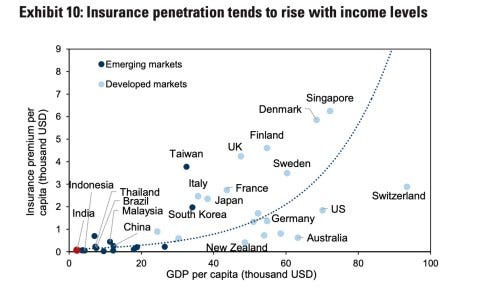

Insurance has maintained an 18-20% share of household financial savings since FY2005, with scope for further growth as incomes rise.

Indian households’ allocation to non-bank savings remains well below developed markets and emerging market peers such as South Korea.

Boosting domestic financial savings can help fund India’s investment cycle without excessively widening the current account deficit or increasing external vulnerabilities.

The growth of long-term investors like pension and insurance funds has spurred demand for duration assets, resulting in a flat government bond yield curve.

As the government consolidates its fiscal position, the corporate bond market should be incentivised to increase long-dated issuance to channel savings to infrastructure.

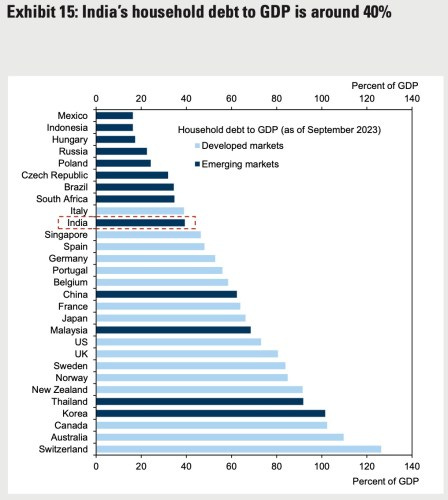

India’s household debt-to-GDP ratio, at around 40%, exceeds most emerging markets at similar income levels. But the household share of total debt matches EM peers.

Negative correlations between past increases in household debt and subsequent GDP growth are higher in developed than emerging economies. But debt accumulation is associated with faster EM growth in early stages before tapering off at high levels.

Demonetization in November 2016 and increased digital infrastructure have contributed to the financialization of household savings in recent years.

Robust real estate demand post-pandemic led to a decline in the housing inventory-to-sales ratio to its lowest level in 15 years, supporting a recovery in the real estate cycle.

The pandemic saw an increase in household financial savings as spending opportunities were limited and precautionary savings rose due to income and job losses.

India’s investment rate improved from 28.2% of GDP in FY2018 to 30.7% in FY2023. To reach peak investment/GDP ratios by 2030, it needs to increase by around 5 percentage points over the next seven years.

India’s growing services exports have helped cushion its external balances from commodity and supply-side shocks in recent years.

The Reserve Bank of India’s regulatory intervention in November 2023 helped moderate personal credit growth to 17.7% in March 2024 from 20.4% a year earlier.

Goldman Sachs estimates that a 100 basis point slowdown in total credit leads to a 20-25 basis point slowdown in real GDP growth over the next four quarters, with personal loans accounting for about 5 basis points of this impact.

The post Changing Contours of Indian Household Savings appeared first on INDIA DISPATCH.