Goldman Values Zomato’s Blinkit at $18B as Quick Commerce Outpaces Food Delivery

Goldman Sachs now values Zomato’s quick commerce unit Blinkit at Rs1.51tn ($18.1b), making up 56% of the parent company’s target valuation, as the quick commerce business continues to show exceptional growth with orders more than doubling year-on-year.

The Wall Street bank’s bullish stance is backed by Blinkit’s strong operational metrics: the platform maintains nearly 1,500 orders per day per store despite aggressive expansion, new stores reach break-even quickly, and its scale is now almost two-thirds that of Zomato’s core food delivery business.

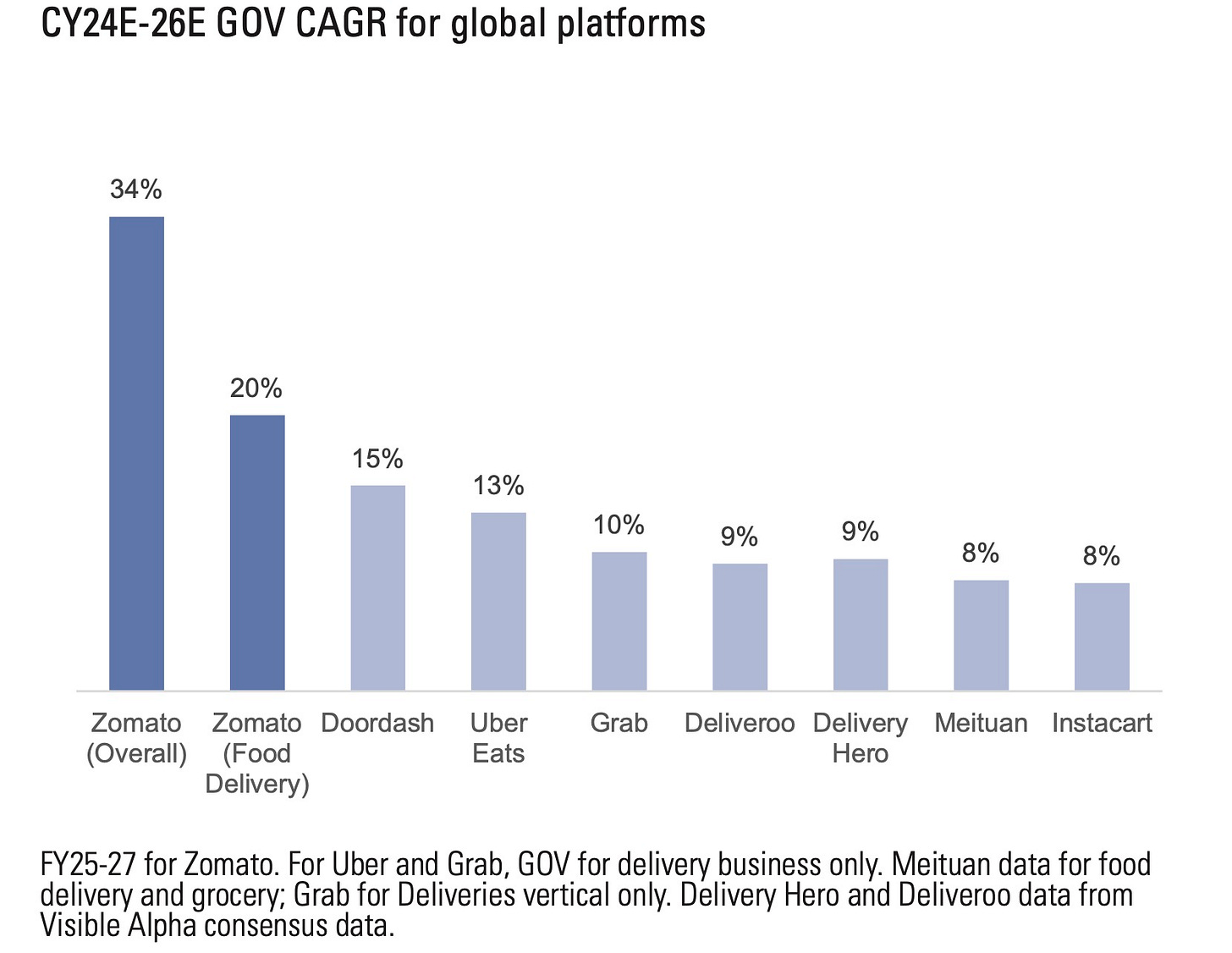

The company added 152 new dark stores in the quarter while keeping margins stable at 3.8%. Goldman has raised its target price for Zomato to Rs315 from Rs280, predicting that Blinkit’s quick commerce division will eventually achieve higher profitability than the food delivery business. The bank forecasts Blinkit’s gross order value to grow at 71% annually through FY27, driving Zomato’s overall revenue growth of 43% during the same period.