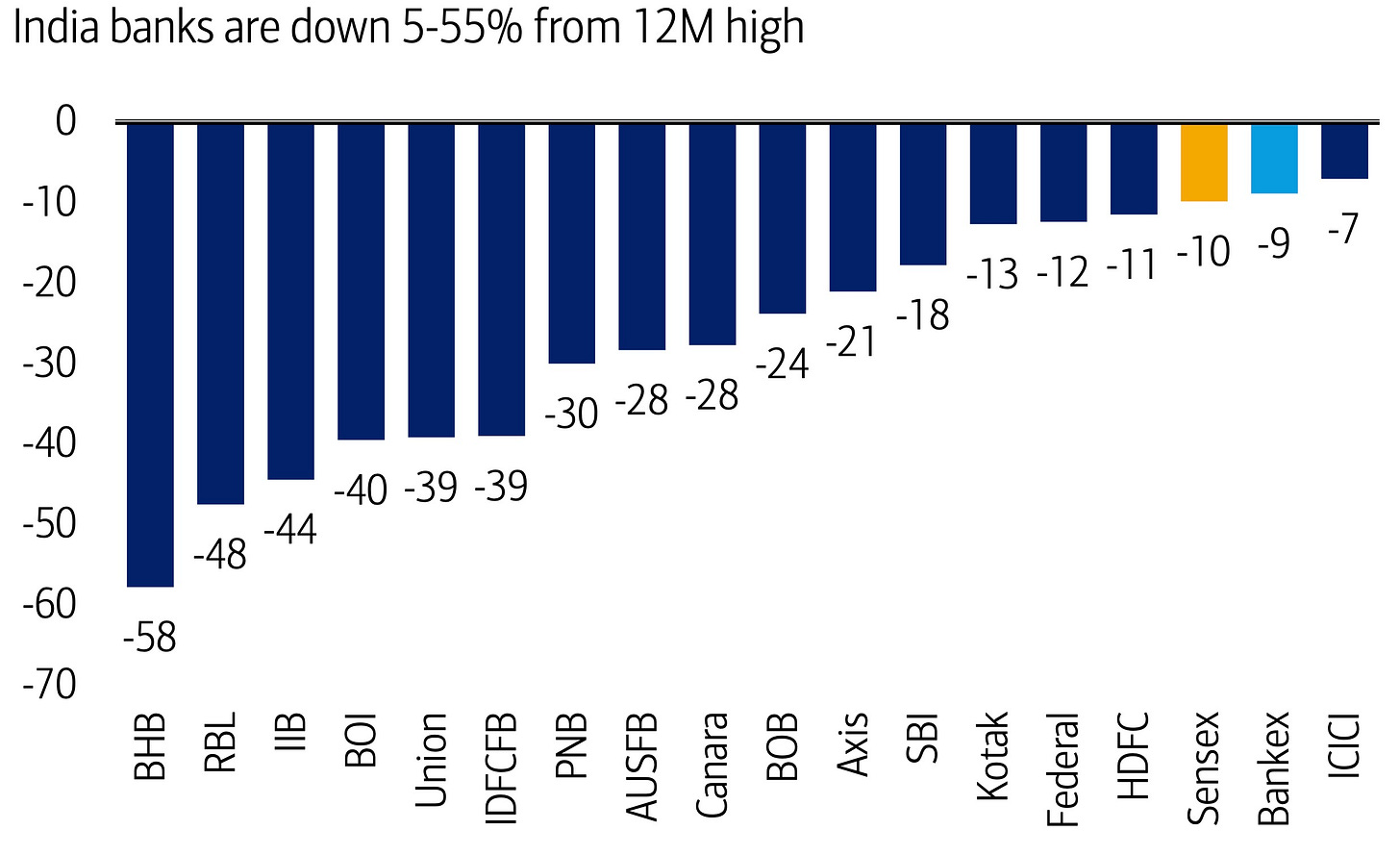

After 20 Years on Top, HDFC Falls Out of Favor as Indian Banks Sink Over 55%

HDFC Bank, Asia’s most overweight stock for nearly two decades, is now an underweight position for investors in a dramatic reversal that marks the end of a long-running investment theme.

Indian banks have seen more than $1 billion in foreign institutional outflows over the past three years, with mid-sized private lenders hit hardest. Their valuation premium over state-owned banks has almost disappeared, down from 200% in pre-Covid times.

Bank stocks have fallen between 7% and 60% from their highs, underperforming the benchmark Sensex’s 10% decline. System-wide loan growth has slowed from 18% to 11% in recent months.

Most banks now trade at price-to-book ratios of 1x or below. Only ICICI Bank remains among Asia’s most crowded stocks, according to Bank of America research.

BofA cites weak emerging market sentiment, retail asset quality concerns and expectations of slower credit growth behind the sell-off.