Bernstein Isn't Buying India's AI Story

"Staring down a strategic tech crisis"

While India’s policymakers talk up ambitions of sovereign AI, the country’s already-thin roster of domestic AI players — hamstrung by a massive funding shortage, regulatory “double standards,” and their own government’s red-carpet treatment of Silicon Valley — stands no chance against U.S. giants now moving to lock up the market permanently.

That’s the blunt warning from investment research firm Bernstein that pulls no punches on what it sees as a dangerously naive policy stance.

India is staring down a strategic tech crisis... Indian policymakers appear blind to the dangers of their stance on U.S. tech dominance and predatory pricing in AI. India is rolling out the red carpet for US AI, letting them lock in share with unsustainably low prices, a playbook that was used in the past.

The American giants are already moving with devastating efficiency against India’s handful of homegrown efforts like Sarvam AI and Ola Krutrim. Perplexity Pro is available free for a year to the 350 million subscribers of telecom giant Airtel, while OpenAI’s ChatGPT recently launched an India-focused $5 a month subscription — compared to $20 in the U.S.

Bernstein analysts are also baffled by the misplaced enthusiasm they see among some Indians. When OpenAI, which is reportedly looking to set up a data center in India, announced the plans to launch a new office, it was met with another round of excitement — “as if Open AI will hire all Indians at hefty salaries,” the firm wrote in a note to clients Thursday. Bernstein analysts pour cold water on this excitement, dismissing it as a “repeat of the 90s” and arguing that the hype misses the fundamental power imbalance.

Anyone, we repeat anyone, can build a data center... This is the start of the dominance of US tech in Indian AI environment ensuring Indian entrepreneurs do not get a fighting chance to stay relevant. They will run on the sidelines - piggybacking on the US foundation models or maybe even the Chinese.

This leaves Prime Minister Narendra Modi’s calls to India to build its own platforms sounding, in Bernstein’s words, “almost wistful.”

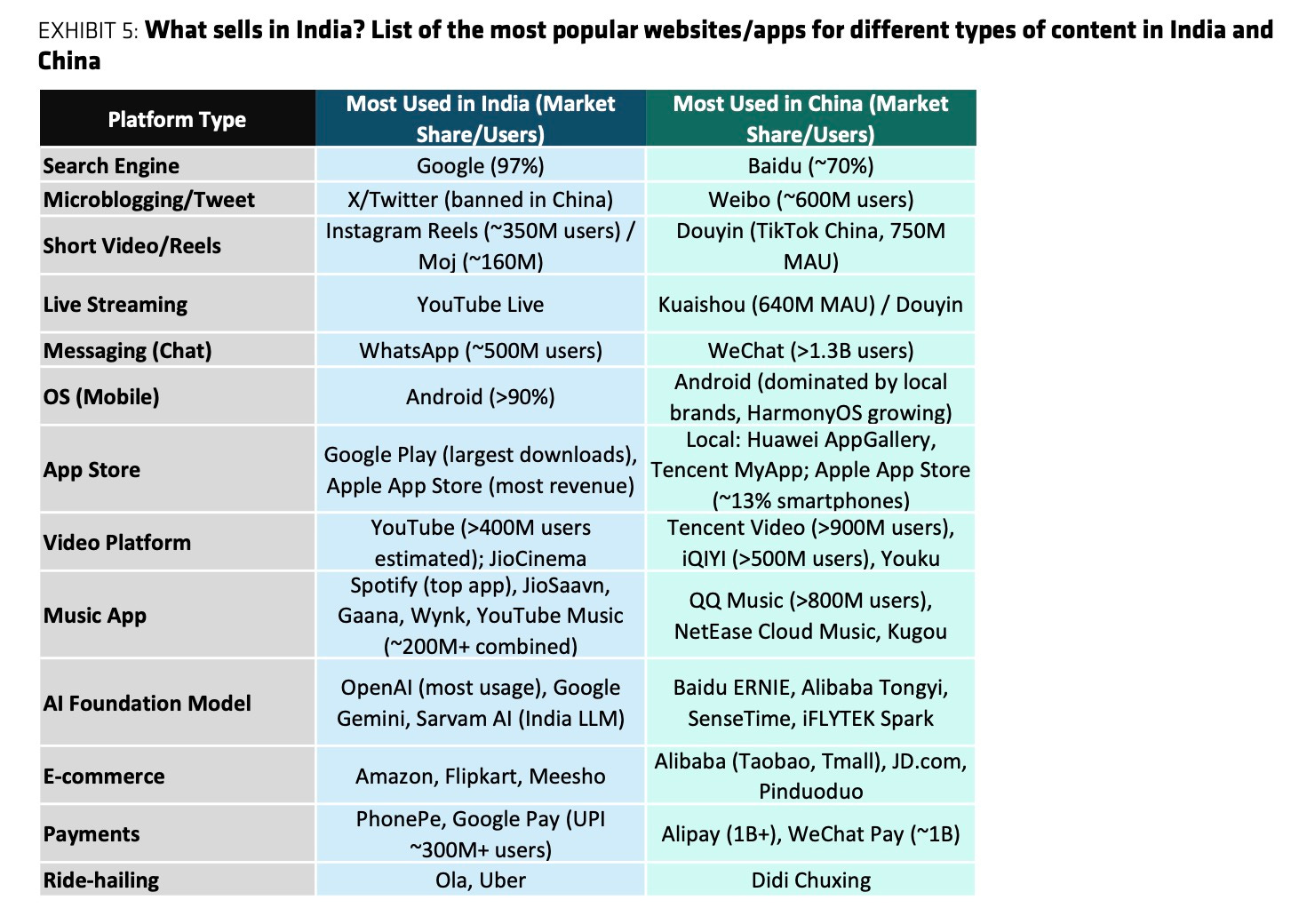

The analysts point to an uncomfortable reality where every major digital platform in India — search, messaging, social media, and commerce — is already under U.S. control. They highlight what happened after the TikTok ban: “it wasn’t an Indian challenger that rose, but Instagram swept up millions of users.” (YouTube did well, too.)

India’s AI ambitions are lacking on multiple fronts, including funding. Between 2013 and 2024, private AI investment in the US hit $471 billion, with China at $119 billion, compared to India’s $11.29 billion. The Indian government’s much-touted AI fund is just $1.2 billion, while OpenAI had already secured $13 billion before launching ChatGPT.

Adding insult to injury is what Bernstein calls a regulatory “double standard.” While foreign tech gets the red carpet treatment, local innovators face “crushing rules and government-led ‘tech stacks’ that make private business unviable,” with fintech cited as the prime example of domestic dreams destroyed by regulatory overreach.

Venture capitalists in India have coalesced around the view that local founders should build applications rather than foundational models, a strategy that Bernstein says carries the risk that specialized vertical solutions become “ineffective and not worth the extra money” once global tech giants acquire sufficient sector knowledge to replicate their functionality.

The analysts warn that Indian tech continues riding “the wave of labour arbitrage” — the same model that kept IT services from ever making “the leap to successful products” and now leaves them “staring down the barrel of AI-driven disruption.”

With signs of India-China relations warming and the potential re-entry of Chinese tech giants, Bernstein spells out the sobering endgame: India risks being “reduced to a mere digital marketplace, not a creator,” locked in a commoditized market where local players are perpetually dependent on the very behemoths they claim to compete with, in what the analysts call “certainly not where one expects to see a future top economy in the AI race.”

This assessment resonates deeply. The telecom story you cite is instructive, India's 5G journey epitomizes the pattern. While South Korea's Samsung and China's Huawei invested billions in indigenous 5G development, India's largest telecom player chose the safer path of foreign partnership. The opportunity cost is stark: Korea now exports 5G technology globally; we import it.

But history need not repeat itself with AI. India's top wealth creators, several now among the world's richest, built their empires on the foundation this nation provided: its talent pool, its markets, its infrastructure. The Tatas demonstrated a different possibility when they acquired Jaguar Land Rover and transformed it through innovation investment. More recently, their semiconductor foray and Air India's modernization show appetite for long-term, capital-intensive bets.

The AI moment demands similar vision from our leading industrialists. Not incremental IT services, but foundational IP creation. Not risk-averse partnerships alone, but bold R&D commitments that may take a decade to bear fruit. Nations don't become technology leaders through arbitrage, they get there when those who've benefited most from national advantages reinvest audaciously in national capabilities.

The talent exists. The capital exists. What's needed is the conviction that wealth created on Indian soil carries with it the responsibility to ensure India isn't merely a consumer of the next technological revolution, but a creator of it.

Why isn't this message not amplified.