Can Zomato Cook Up Returns To Match Its Global Peers?

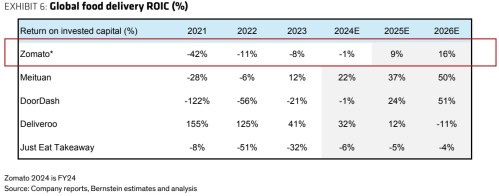

Indian food delivery giant Zomato can boost its return on invested capital (ROIC) from -1% in FY2024 to a mouth-watering 35% by FY2030, according to a new projection by Bernstein. But can the company truly deliver such tasty returns in a notoriously low-margin business?

Key ingredients in Zomato’s recipe for ROIC expansion, per Bernstein:

1. Market domination: Zomato holds a 54% share in India’s food delivery duopoly, giving it significant pricing power.

2. Quick commerce growth: The company’s Blinkit unit is expected to overtake food delivery as its largest business by FY2030.

3. Margin expansion: Increased platform fees, ad monetization, and lower delivery costs are all on the menu.

4. Asset-light model: Limited capex requirements should keep invested capital intensity low.

But here’s where things get spicy: Bernstein expects Zomato to achieve a 35% ROIC by FY2030, significantly higher than established global peers. For comparison:

Is Bernstein’s outlook too optimistic? Or does India’s underpenetrated market and favorable duopoly structure justify such lofty expectations?

Zomato’s ability to execute on its quick commerce expansion while maintaining discipline on costs and capital allocation will be crucial.

One thing’s for sure – with a current market cap of $20 billion and sky-high growth expectations baked in, Zomato can’t afford to deliver cold results to investors hungry for returns.

The post Can Zomato Cook Up Returns To Match Its Global Peers? appeared first on INDIA DISPATCH.