Credit Card Giants Tighten Grip As Market Moves To Consolidation Phase

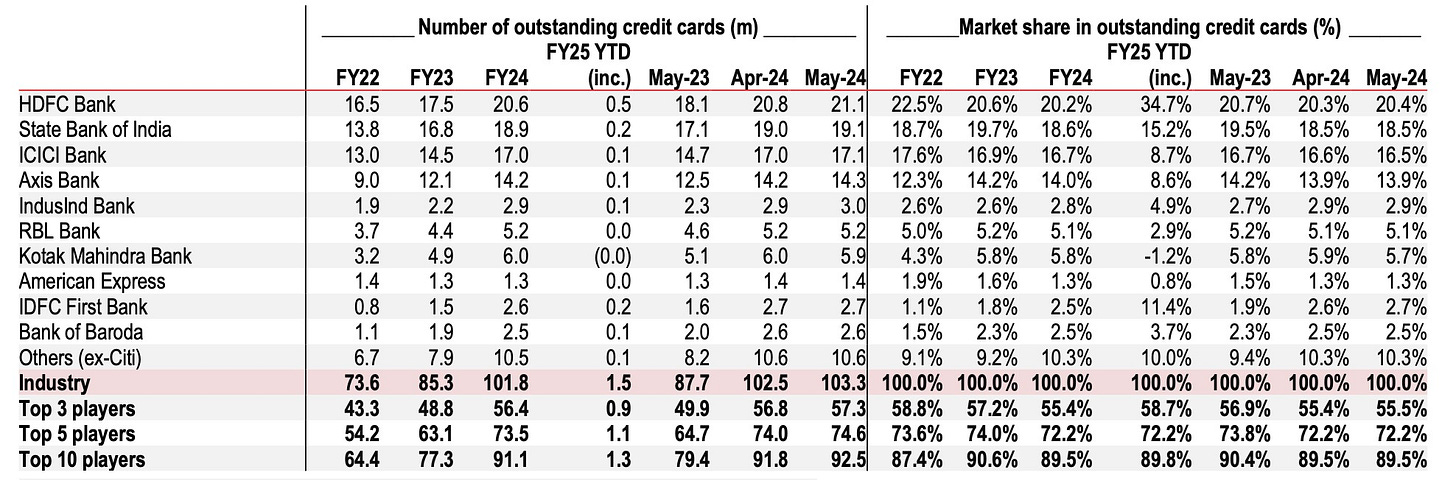

New data from the Reserve Bank of India suggests a shift towards consolidation in the country’s credit card market as smaller players face headwinds and industry giants solidify their positions.

Net credit card issuance in May 2024 slowed to 760,000 (PDF), down from 1.2 million in the same month last year. This moderation was particularly pronounced among issuers outside the top 10, with public sector banks seeing a notable slowdown.

HDFC Bank continues to dominate, accounting for 38% of new cards issued in May despite holding only 20.4% market share of cards-in-force. Other major players like ICICI Bank, IndusInd Bank, and SBI Card saw issuance rates 21-48% below their six-month averages.

The spending landscape is evolving, too. While overall credit card spending grew 17% year-on-year to ₹1.65 trillion in May, HDFC Bank’s market share in spend has dipped to 25% from 27-29% in FY24. This shift comes as e-commerce spending growth lags behind other segments.

Profitability pressures are mounting. The share of high-yielding revolving loans remains below pre-pandemic levels, squeezing margins for established players and extending break-even timelines for new entrants. In response, issuers are rationalizing costs through measures like devaluing rewards, introducing new charges, and trimming marketing budgets.

Regulatory actions are adding to the consolidation narrative. Kotak Mahindra Bank saw its cards-in-force decrease by 65,000 in May following restrictions on new card issuance by the central bank.

This confluence of factors – slowing growth, profitability challenges, and regulatory scrutiny – points towards a period of consolidation in India’s credit card market.