Food Delivery Apps Are Crushing India’s Fast Food Chains

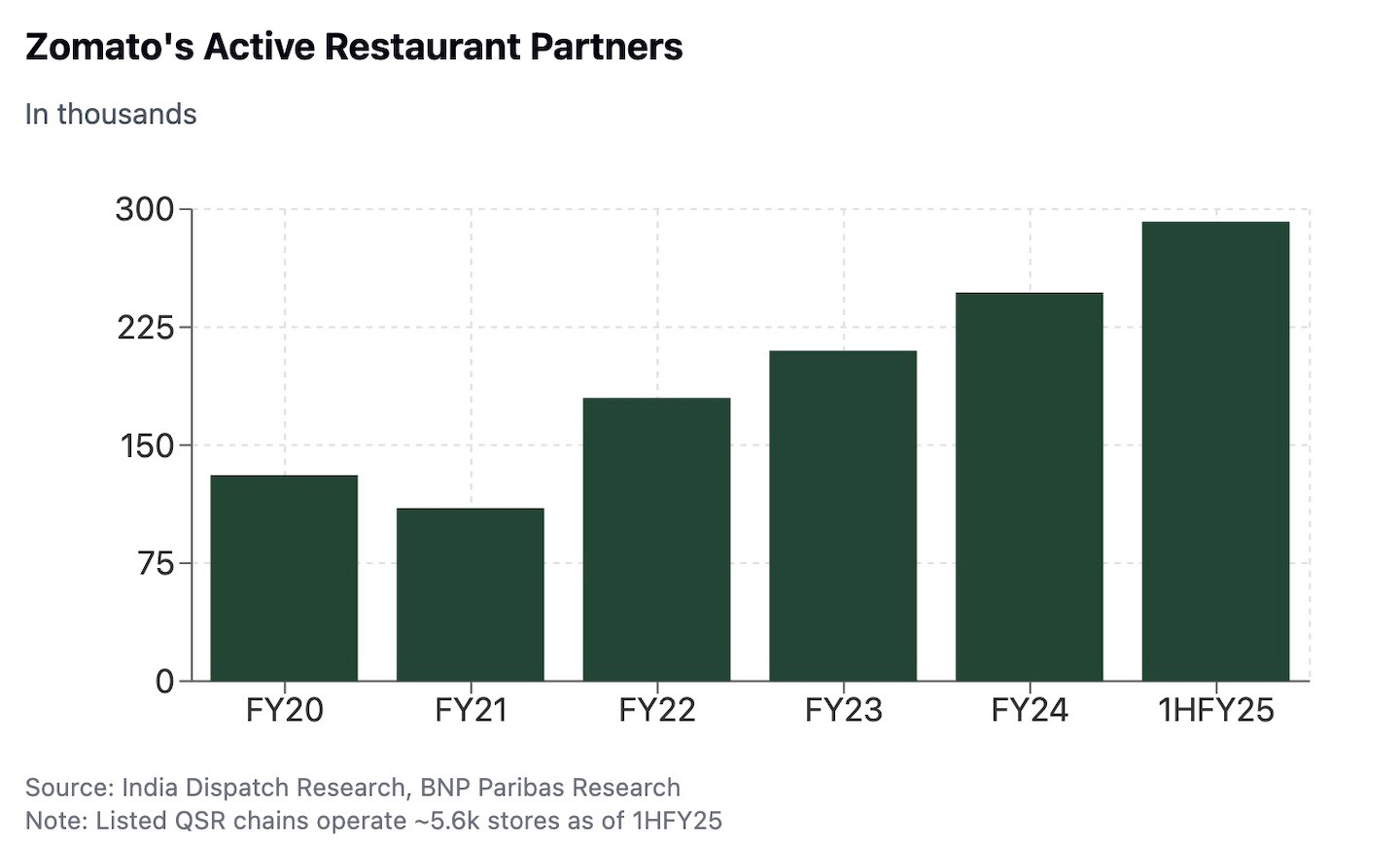

Delivery platforms in India now host more than 290,000 restaurants* against just 5,600 outlets run by established QSR chains, marking a fundamental shift in the country’s food service market.

The impact is clear in the numbers. Revenue growth for listed QSR companies fell to 7% year-on-year in Q2FY25, with most chains reporting negative same-store sales. Operating margins are similarly compressing.

Zomato alone has expanded from 61,000 restaurant partners five years ago to over 290,000 today — 52 times the collective footprint of India’s listed QSR chains. This rapid scaling has effectively commoditized food delivery, eroding the traditional moats of brand and location.

(*Swiggy has more than 230,000 restaurant partners as well. India Dispatch is making an assumption that there is a significant overlap between Swiggy and Zomato restaurant partners.)

Even Domino’s India is struggling. Despite cutting delivery minimums and increasing promotions, its EBITDA margins dropped 150 basis points year-on-year.

At stake is the fundamental economics of QSR chains in India’s urban centers, where delivery now represents up to 70% of sales for some operators. Unit economics are under pressure as platforms continue to add restaurants at scale while taking a cut of each order.

The next few quarters will likely prove critical for the sector as it attempts to adapt to what looks increasingly like a structural rather than cyclical challenge.