Global Private Equity Giants Pivot To India as China Loses Lustre

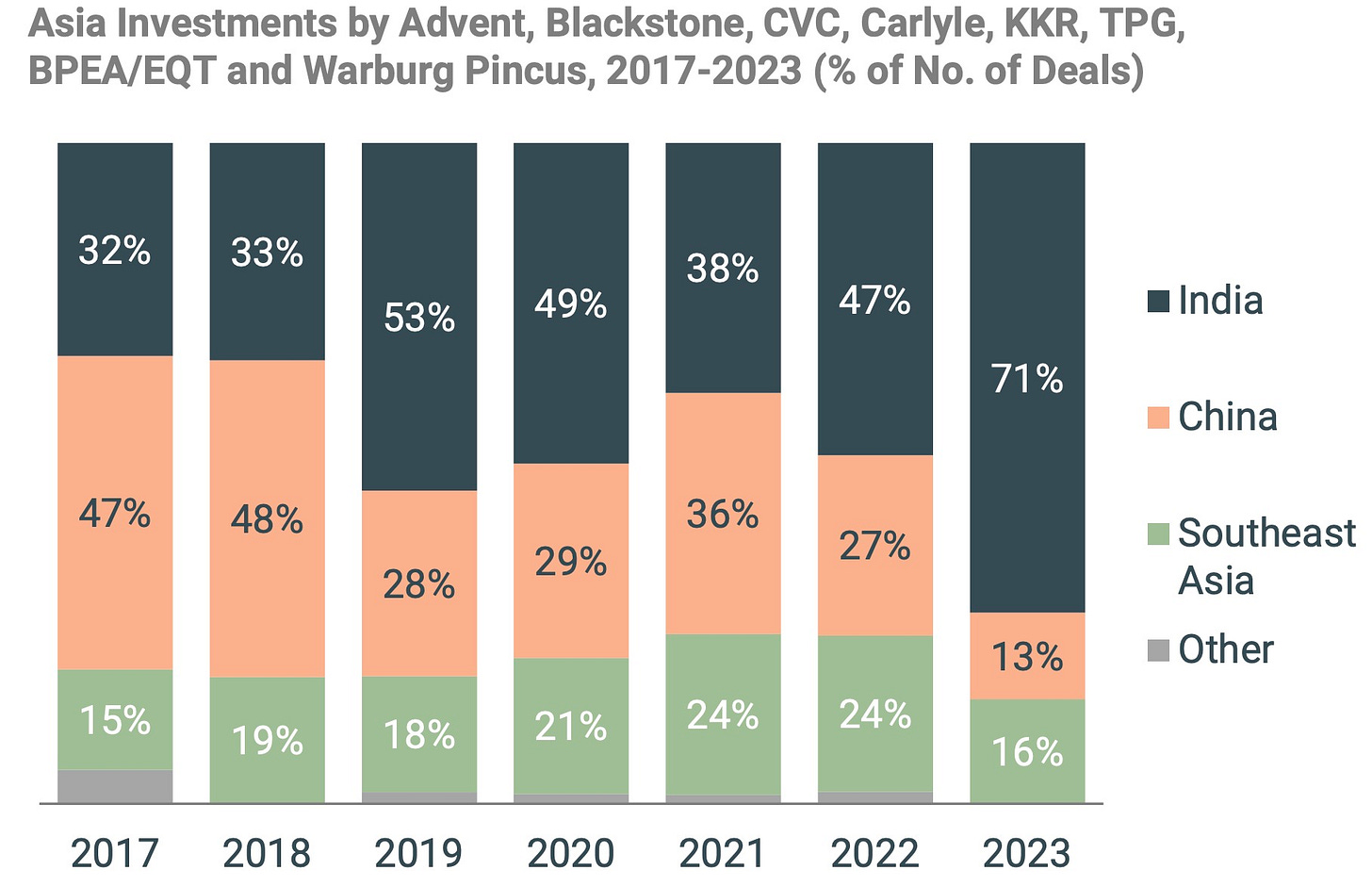

The sands are shifting in Asia’s private equity landscape, with India emerging as the new darling of global buyout behemoths while China’s star continues to wane. According to data from the Global Private Capital Association, the likes of Advent, Blackstone, CVC, Carlyle, KKR, TPG, BPEA/EQT and Warburg Pincus have been steadily increasing their deal activity in India over the past seven years, with the subcontinent accounting for a whopping 71% of their Asian investments in 2023 – up from a mere 16% in 2017.

This seismic shift comes as no surprise to industry watchers, who have long predicted a cooling of enthusiasm for Chinese assets amidst geopolitical tensions, regulatory crackdowns, and a property market teetering on the brink of collapse. The Middle Kingdom’s share of deals from these PE juggernauts has plummeted from a high of 48% in 2018 to a paltry 13% in 2023. Southeast Asia, once touted as the next frontier for private equity riches, has failed to pick up the slack, too, its share of deals remaining stubbornly flat over the period.

Follow India Dispatch on WhatsApp Channel.