ASEAN Capital Markets Lose Ground as India Dominates New Listings

Singapore, once a magnet for international listings and local blue chips, now sees more companies exiting than joining its exchange.

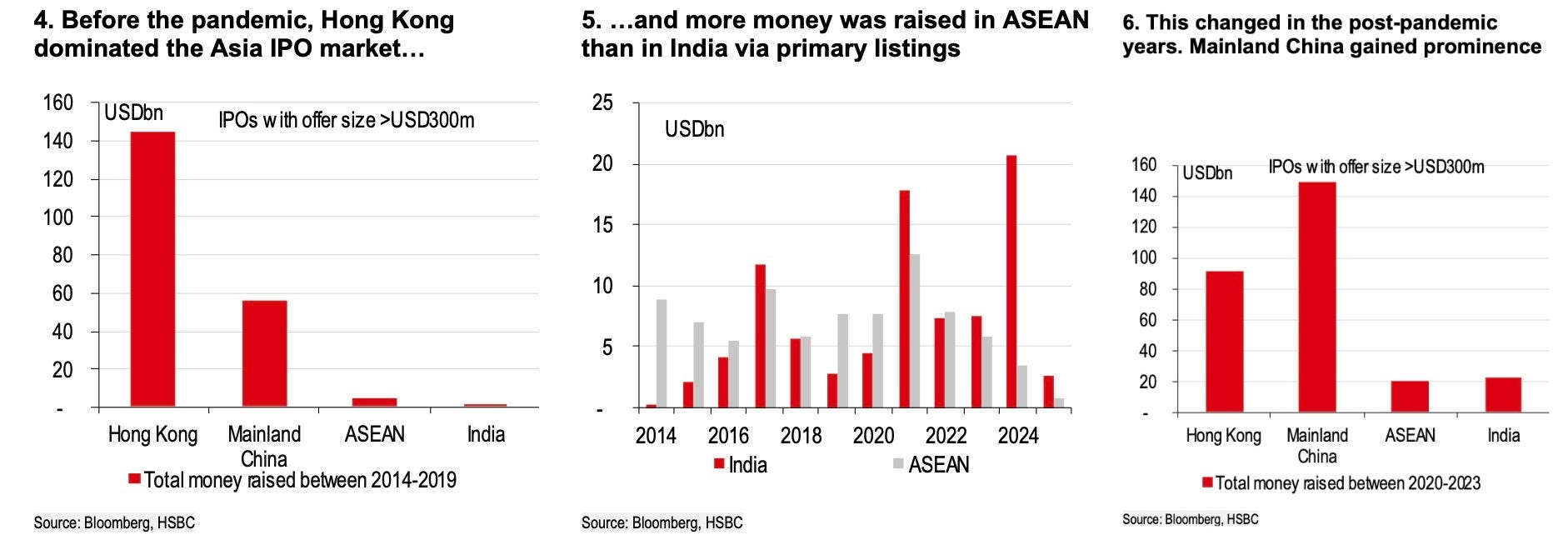

India’s remarkable transformation into a global equity fundraising powerhouse is coinciding with a profound collapse in Southeast Asian capital markets, creating a sweeping realignment in Asia’s financial architecture that challenges long-held assumptions about regional development patterns.

Throughout 2024, India hosted an unprecedented 338 initial public offerings that raised $21 billion — leading the world in deal volume and trailing only the U.S. in capital raised — while simultaneously, the ASEAN-5 economies (Singapore, Malaysia, Indonesia, Thailand, and the Philippines) recorded their weakest fundraising performance since 2010.

It’s a complete inversion of pre-pandemic norms when Southeast Asian markets consistently outperformed India in both IPO frequency and proceeds, establishing themselves as the region’s fundraising leaders before their dramatic fall from prominence.

The IPO activity has slowed across ASEAN, except in Malaysia, with fundraising capabilities diminished to levels not seen in over a decade. The once-vibrant Singapore exchange, long established as a premier destination for international listings and a benchmark for blue-chip corporate governance, now sees more delistings than new arrivals.

These contrasting trajectories underscore deeper structural transformations within Asia’s financial architecture, creating mirror-image challenges on either side of this widening divide — India confronting the consequences of too much activity while Southeast Asia grapples with too little.

“Although more listings improve the overall depth of the market, the increase in supply last year [in India] squeezed some liquidity out of the secondary market,” said Herald van der Linde, Head of Equity Strategy for Asia Pacific at HSBC.

Indonesia’s fundraising has been “muted,” with primary market action virtually nonexistent across much of the region, but Malaysia stands alone as a surprising bright spot, having “strengthened [its IPO activity] last year, with 50 IPOs” while maintaining a pipeline of “7 with issue size of $420 million” planned for the coming month, according to HSBC.

Indian retail investors initially emerged as central protagonists fueling the market’s ascent through early 2024, channeling record sums into both direct equities and systematic investment plans, but have subsequently withdrawn from equities for three consecutive months when excluding systematic investment plans (SIPs).

Simultaneously, SIP inflows reached record highs last month, revealing how investor preferences have pivoted decisively toward structured recurring investments over one-time commitments to individual companies. The ecosystem’s resilience now depends increasingly on the steady accumulation of automated investment rather than the enthusiasm of discretionary stock pickers, HSBC cautions.

Southeast Asian investors, by contrast, have largely withdrawn from both primary and secondary market engagement altogether, creating an environment where neither retail nor institutional capital provides sufficient foundation for robust IPO activity.

“For most of ASEAN, the story is one of retrenchment and missed opportunity,” said HSBC, contrasting with India’s increasingly selective but still dynamic market where activity continues despite growing constraints.

Evidence of adjustment already appears in India’s 2025 IPO activity where, despite a substantial pipeline. Issuers and underwriters now face a more discerning public, with market participants increasingly questioning whether the market can continue absorbing additional supply without disruption, while most ASEAN markets (excluding Malaysia) show virtually no signs of escaping their prolonged fundraising winter.

These mirrored challenges represent opposite sides of the same fundamental question facing Asia’s evolving capital markets — how to achieve sustainable development that balances growth with stability, access with governance, and innovation with reliability.