India’s EV Paradox: Highest Subsidies, Lowest Uptake

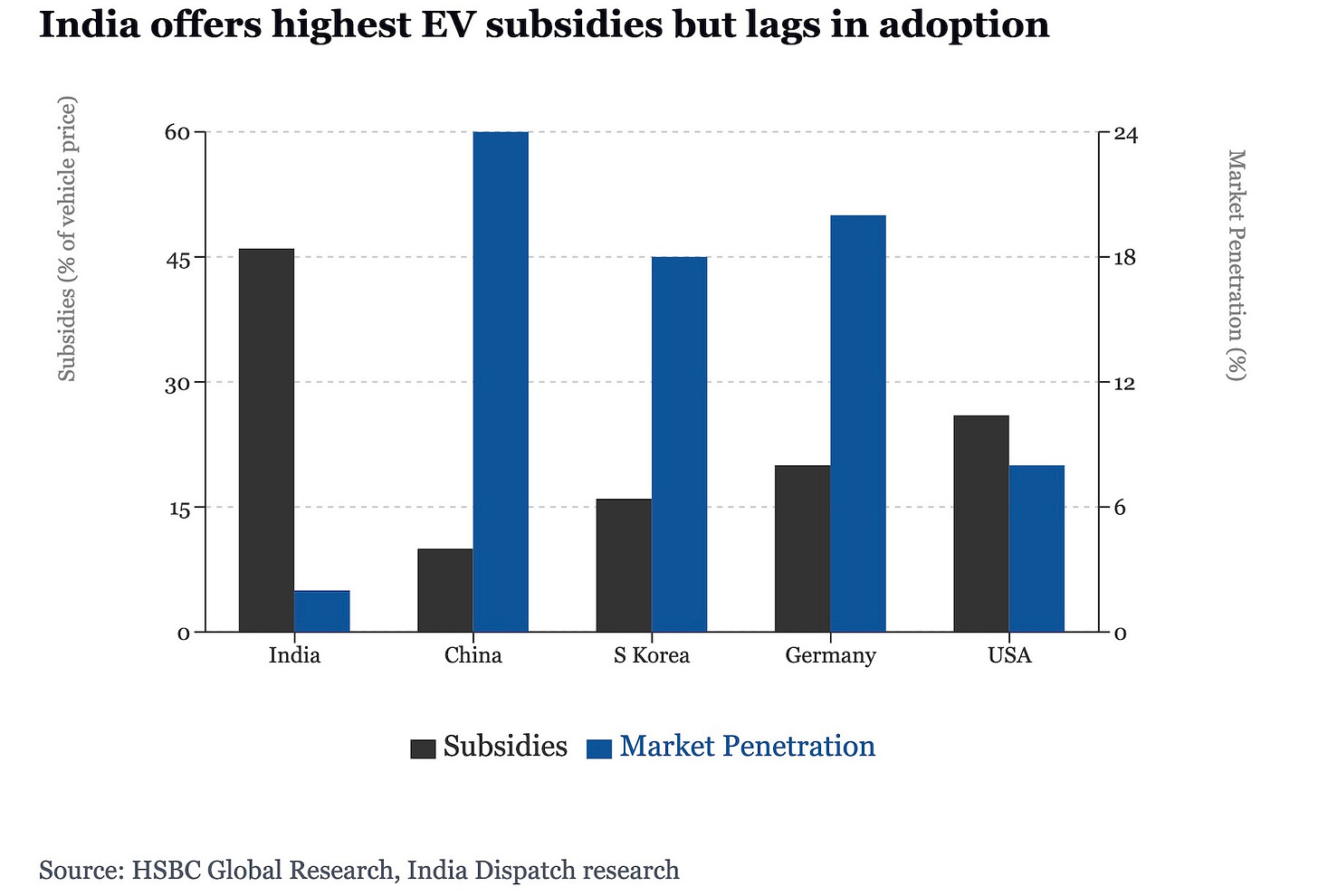

India, the world’s fifth-largest economy, is offering the heftiest electric vehicle subsidies globally — yet has achieved just 2% market penetration so far.

India’s total EV subsidies amount to 40-50% of vehicle prices when accounting for GST (goods and services tax), road tax benefits, state subsidies and production-linked incentives. For larger vehicles like the Grand Vitara, the effective subsidy reaches 61%.

This dwarfs incentives in other major markets. China’s subsidies represent about 10% of EV prices, while South Korea and Germany offer around 16-20%. The US provides roughly 26% through various federal and state programs.

Yet India’s EV penetration significantly lags these markets. China has reached 24% penetration, South Korea 18%, Germany 20%, and the US 8%. India’s 2 percent looks particularly stark in comparison.

The disparity raises questions about the efficiency of India’s subsidy regime. Despite manufacturers receiving substantial government support, HSBC notes they are “making much lower margins on EVs” compared to conventional vehicles. Consumer uncertainty around range anxiety and resale values also persists.

This is creating a troubling scenario where neither manufacturers nor consumers are fully convinced by EVs despite unprecedented government support.

HSBC projects that even if India achieves 30% EV penetration in new sales by 2030, the total EV fleet share would remain below 10%. This suggests the current subsidy structure may need rethinking if India hopes to make meaningful progress in vehicle electrification while maintaining fiscal sustainability.

Follow India Dispatch on WhatsApp.