India's Grid Cannot Keep Up With Its Ambitions

The digital economy is arriving faster than the physical grid can adapt to handle its demands.

India’s economic expansion and accelerating digitalisation are creating a surge in electricity demand that is exposing deep vulnerabilities in the existing power grid. The South Asian nation has committed to 500 gigawatts of non-fossil capacity by 2030, but the grid cannot yet reliably deliver clean power when and where it is needed. Supply will have to grow faster, be firmer and be more flexible than the system has ever delivered. If India captures a larger share of global data center investment driven by AI, this challenge will arrive precisely when the grid is least equipped to handle it.

Goldman Sachs estimates that power required from utilities now needs roughly 7.2% annual growth between fiscal years 2025 and 2035, up from a prior 5.6%. The ratio of power growth to economic growth has been revised to roughly 1.06, versus roughly 0.85 before. Rising appliance ownership, electric vehicle charging and green-hydrogen pilots are pushing demand higher across the economy.

The compute infrastructure supporting the digital economy is migrating from traditional IT rooms to industrial-scale data centres, creating a new and concentrated source of load that operates on a different scale than anything the grid has handled before. Hyperscalers say power is the first or second question in every investment decision when they evaluate potential data center locations.

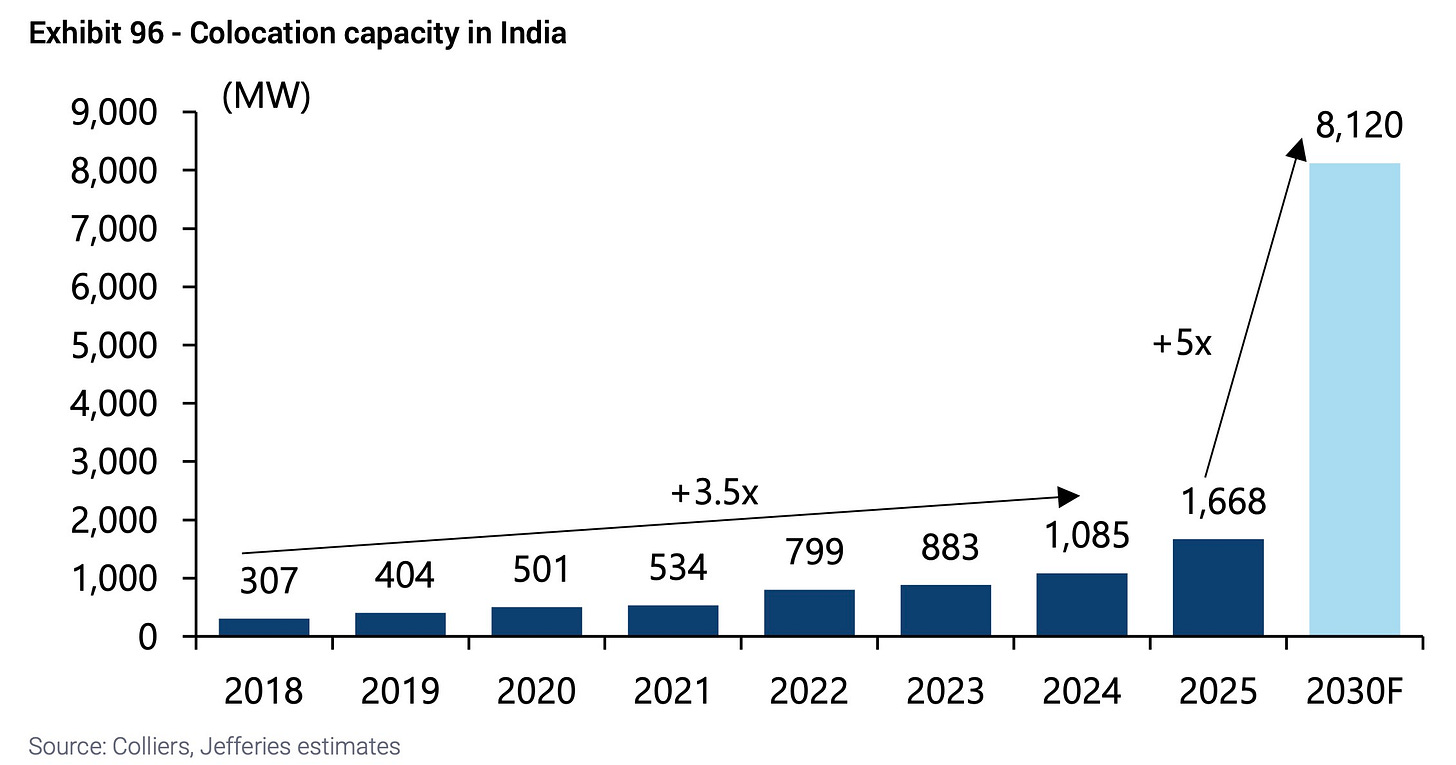

India’s data-centre base is still in the low single-gigawatts today, but Bernstein forecasts cluster around 5 to 6 gigawatts by 2030, provided interconnects and land clear on time. Jefferies’ top-end view reaches roughly 8 gigawatts, which at typical costs of 4 to 5 million dollars per megawatt implies 32 to 40 billion dollars of capital expenditure by decade-end.

AI servers draw five to seven times the power of a legacy server rack, according to HSBC, creating disproportionate pressure on the grid. At scale, a 1 gigawatt campus needs roughly 1.3 to 1.5 gigawatts of constant supply depending on how efficiently the facility uses power, per Morgan Stanley. Power availability and connection queues now drive site selection as much as land price does, fundamentally altering the economics of where these facilities can be built.

Data centres use only a sliver of India’s power today, but their share plausibly rises into the low single digits by fiscal year 2030 even in Nomura’s base case scenario. In a more aggressive scenario, consumption reaches 80 terawatt-hours, creating demand that would rival entire industrial sectors. Silicon wants electrons on a firm schedule that the current grid cannot reliably provide.

India can construct utility-scale solar farms in 12 to 24 months (Mohit Bhargava, Senior Advisor to India Energy and Climate Center at UC Berkeley and former CEO of NTPC Green Energy said at a recent conference), which makes the renewable buildout look deceptively simple on paper. Reconciling that speed with the physics of electricity demand is proving harder in practice. Solar panels flood the grid when daytime demand is comparatively low, then fade precisely as households and commercial loads climb after 5 PM.

On Goldman’s full-year models, the system runs a 1% to 4% energy deficit by fiscal years 2034 through 2035. Five-minute modelling of the peak week under adverse weather produces a deficit nearer 9%. This is not a morality tale about dirty versus clean energy sources but a timing problem that no amount of solar capacity alone can solve, no matter how many panels are installed or how quickly they are brought online.

Coal plants can run around the clock and can ramp up production during the evening hours to meet surging demand. Legacy flexibility in the existing fleet complicates this seemingly straightforward solution in ways that limit how much solar the grid can absorb. Many Indian units struggle to operate at levels much below 60% to 70% of capacity, according to data shared by federal grid operator POSOCO.

Operating at these minimum levels is crucial to keep the grid’s frequency stable, yet this makes it harder to absorb midday solar or respond to clouds passing overhead. Flexibility retrofits and revised operating norms matter as much as new megawatts in addressing this constraint, but the scale of the upgrades required is substantial.

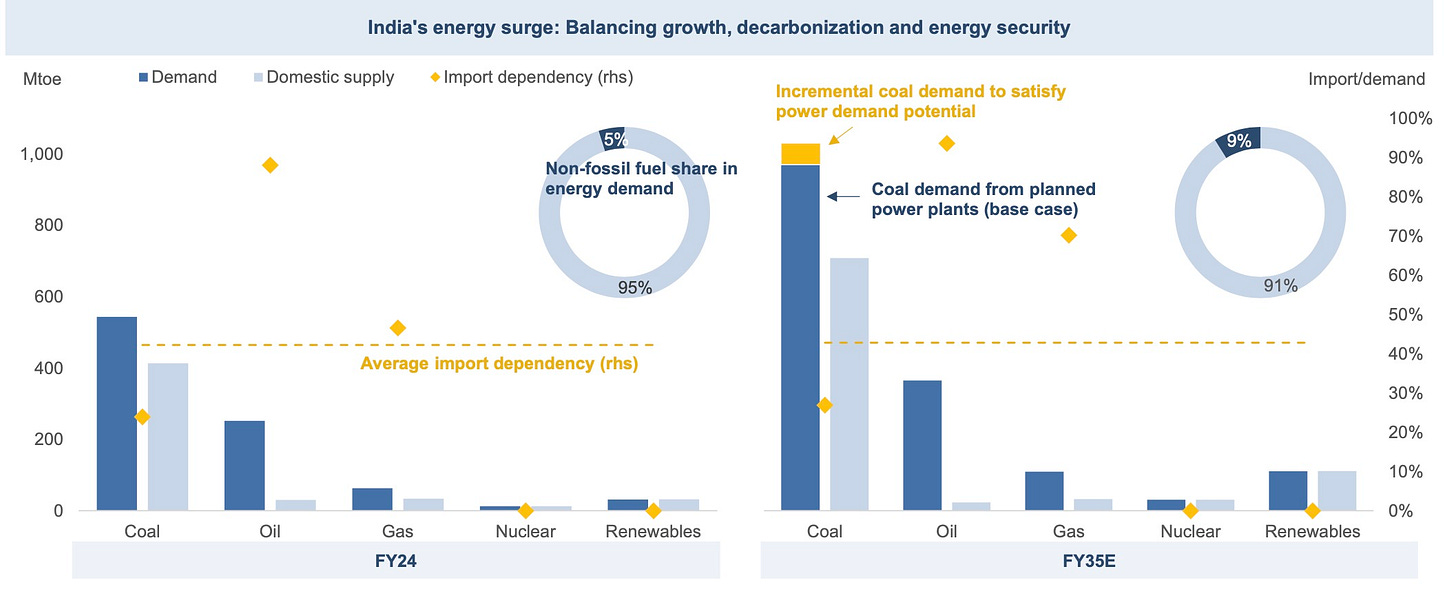

Assessments suggest India may need roughly 140 gigawatts of additional coal capacity by fiscal year 2035 versus 2023 levels. The government’s current target is roughly 87 gigawatts by fiscal year 2032. Some of this coal is bridge capacity to stabilise a faster-greening grid, not a repudiation of renewables, but the scale required exceeds what policymakers have publicly acknowledged or what most analysts expected even two years ago.

Transmission infrastructure is the rate-limiter on the entire system, constraining how quickly renewable capacity can be added even when the generation itself can be built rapidly. The National Electricity Plan allocates about $110 billion for transmission through 2032, expanding the network from roughly 485,000 to roughly 648,000 circuit-kilometres and adding nine long-haul high-voltage direct current links totalling roughly 33 gigawatts.

Typical interstate lines take 30 to 36 months to complete, and that timeline arrives before accounting for right-of-way fights and land acquisition disputes that routinely add years to the process. India’s present ability to move power through the system at high voltages is nowhere near what a continent-scale renewables-plus-data-centre system needs to function efficiently.

Moving bulk power efficiently across regions will demand more substations, more support for maintaining stable voltage and more high-voltage direct current backbones than are currently funded or planned. The investment exists on paper, but the physical infrastructure lags years behind where it needs to be to support the generation capacity that is either already built or under construction.

The constraints are already affecting major renewable developers in concrete ways. Reliance has land banks suitable for well over 100 gigawatts of solar capacity, but the ability to connect to the grid is the choke point affecting actual deployment of these projects. Its first 690 megawatt application at Khavda, a village in Bhuj Taluka of Kutch district, was granted connection capacity only by 2030, three years later than requested and larger blocks open from 2032 onward.

Data-centre developers cannot sit in a transmission queue for years waiting for grid connectivity to materialize. They will gravitate toward firm electrons and existing infrastructure, not promises of future capacity that may or may not arrive on schedule.

Energy storage is attempting to fill the gap between when solar generates and when demand peaks, but the scale required is enormous. Peak-week modelling suggests India could require roughly 530 gigawatt-hours of energy storage by fiscal year 2032, with about 420 gigawatt-hours plausibly delivered by batteries on current pipelines versus roughly 240 gigawatt-hours in government guidance.

Battery pack prices have fallen roughly a third over the last two years, making solar-plus-storage economically viable for shifting midday power to early evening hours and covering short peaks that were uneconomic before. At multi-hundred-gigawatt-hour scale, supply chains, financing and siting still constrain deployment speed in ways that make it difficult to build fast enough. Storage is a powerful complement to transmission and flexibility, not a replacement for either, and it cannot by itself solve the problem of evening demand.

Natural gas looks like a textbook bridge fuel on paper, offering the flexibility and reliability that the system needs. Except that cost and availability work against it in practice in the Indian context. Even under prospective liquefied natural gas gluts on global markets, gas-fired generation sits higher on India’s merit order than coal because of fuel pricing dynamics that have persisted for years.

Gas will find a role as peaking capacity and locational reliability, especially where transmission infrastructure and urban substations are running at their limits, but it will not underwrite the nation’s evening ramp at scale on current economics. The math simply does not work at the volumes required to make a meaningful difference in the overall power balance.

Time-of-day tariffs, interruptible contracts for large users and automated demand response can shave the peak and reduce the need for new generation capacity if deployed aggressively. These tools should be pursued because they can deliver results faster than building new plants or transmission lines and at a fraction of the capital cost.

The political economy resists change in ways that make widespread deployment difficult. Distribution company finances are fragile, tariff reform is jagged and politically contentious, and enforcing sharp evening prices on voters is rarely a career-enhancing move for state governments that depend on those votes. Without that price signal, smart loads remain a pilot program rather than a resource at scale that can materially affect the peak demand problem.

Institutions will decide the pace as much as technology does, determining which solutions can be deployed and how quickly they can scale. The Central Electricity Authority and Central Electricity Regulatory Commission set operating norms that determine how low coal plants can be run, how quickly they must ramp and what flexibility investments can be recovered through tariffs.

State distribution companies control connection timelines and local capital expenditure decisions that affect every project. They also ration pain through load-shedding rather than pay for upgrades that stress their balance sheets and require politically difficult tariff increases.

Land acquisition and right-of-way rules for the interstate transmission system pit national priorities against local politics and immediate constituent concerns in ways that delay projects for years. Open-access permissions, banking rules, and cross-subsidy surcharges tilt corporate buyers toward captive generation solutions instead of grid-beneficial ones that would help the broader system but offer less certainty to individual companies.

China’s solution to data-centre load has been a coal-plus-renewables tandem buttressed by ultra-high-voltage transmission lines that move power thousands of kilometres across the country. The country built firm capacity and a long-haul backbone first, then stacked wind and solar behind it once the grid could handle the variability. It is not clean by any measure, but it is stable and predictable in ways that enable industrial planning.

Texas offers a cautionary mirror on the other end of the spectrum: a torrent of wind and solar capacity, relatively light interconnections between regions, and a price-only market that invites curtailment and volatility during extreme weather events. That system is now being partly tempered by a wave of battery installations, but the integration challenges remain significant.

India cannot copy either model wholesale given its own institutional constraints and geography, but the lesson is the same everywhere. Get the transmission infrastructure and the operating rules right before promising 24-hour clean power to compute campuses that require uninterrupted supply.

Most commentary fixates on long-distance transmission lines as the primary constraint limiting renewable deployment. The near-term crunch may actually be distribution infrastructure at the local level, which receives less attention but creates immediate bottlenecks.

Data-centre parks and peaking plants need substations at various voltage levels, high-capacity feeders, and fault-level upgrades inside cities already operating at thermal and political limits. Who pays becomes key in determining what gets built and when: developers via hefty connection charges, or distribution companies via capital expenditure they can barely finance given their debt loads and tariff constraints.

Connection queues and local reinforcement requirements may add as much delay as the interstate lines that dominate public discussion, creating a two-tier bottleneck that affects different projects in different ways.

Avoiding a false binary choice is essential when considering how much coal versus everything else the system needs to manage the transition. A plausible fiscal year 2035 mix that manages the evening peak includes several components working together in ways that complement rather than substitute for each other.

A large block of new coal capacity operating flexibly during the 6 PM to 11 PM hours when demand surges past what renewables can provide. An upgraded legacy fleet with lower minimum operating levels to absorb midday solar without destabilising the grid’s frequency or forcing curtailment.

Hundreds of gigawatt-hours of batteries shaving intraday swings and covering the first hour of the peak before other sources take over. A modest wedge of gas for location-specific reliability and fast start capability where transmission constraints prevent coal from serving certain areas. A growing contribution from time-of-day tariffs and demand response as state politics allow and distribution companies become more financially stable.

The exact shares will move with prices, weather patterns and policy choices as the decade progresses, but the direction is clear regardless of which specific path policymakers choose. India will add coal to buy time for transmission, storage and demand-side tools to catch up with the modern economy’s arrival, even as it continues building renewable capacity at record rates.

The digital economy is arriving faster than the physical grid can adapt to handle its demands. Transmission lines take years to plan, approve, and construct under the best circumstances. Solar panels go dark at the worst moment for system reliability, creating precisely the gap that needs to be filled.

Batteries are powerful tools but not yet cheap enough at the scale required to make evening peaks disappear entirely, despite the dramatic cost declines of recent years. Hydroelectric plants and nuclear reactors face long lead times and public resistance that delay their contribution to the grid mix, often by a decade or more from initial proposal to operation.

Given these timelines, the dependence on high-carbon baseload power will rise before it falls, creating a period where emissions may increase even as renewable capacity expands. Policymakers cannot pretend otherwise or deny the contradiction between clean energy goals and near-term infrastructure realities.

Really interesting post. Do you see the big tech companies in India taking any role in driving this forward? Feels like big tech is pushing a lot of the improvements in the US.