India Investment Banking, 2024 Full Review

India’s equity capital markets hit an all-time high of $72.3 billion in 2024, more than doubling from the previous year, while mergers and acquisitions activity slumped to its lowest level since 2020, underscoring a stark divergence in the country’s investment banking landscape. The data was provided to India Dispatch by LSEG.

Equity Capital Markets Boom

Record $72.3 billion in equity capital markets activity, up 112.4% year-on-year

IPO proceeds surged 176% to $20.5 billion

Follow-on offerings reached $51.6 billion, up 94%

Number of new listings increased 40% year-on-year

M&A Slowdown

Deal values fell 11.4% to $80.5 billion, lowest in four years

Number of transactions rose 3.3% to 2,756 deals

Domestic M&A declined 27.5% to $41.9 billion

Inbound M&A grew 18.7% to $29.6 billion

U.S. emerged as most active cross-border partner

Sector Performance

Industrials led M&A activity with $10.9 billion (13.5% market share)

Healthcare deals up 51.5% to $9.8 billion

Financial sector M&A down 69% to $9.44 billion

Private equity-backed M&A fell 9% to $11.3 billion

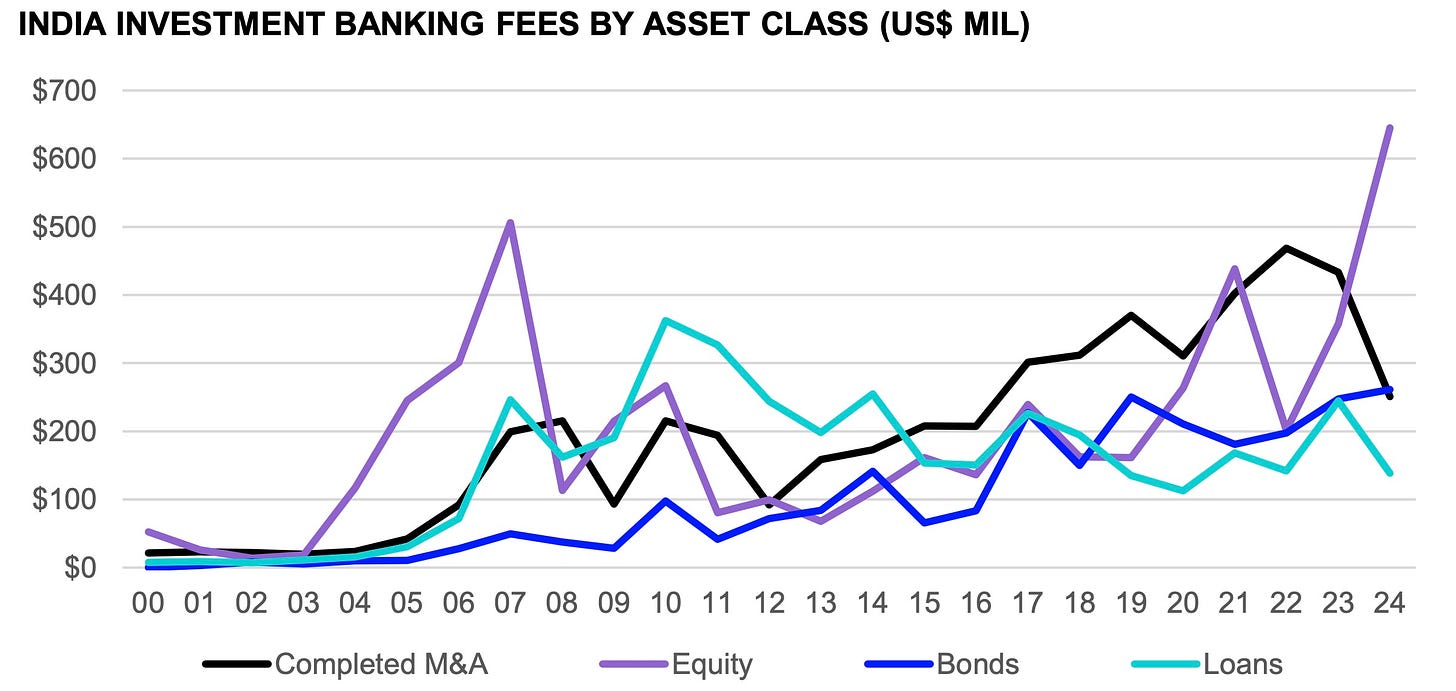

Investment Banking Fees

Total fees up 1% to $1.3bn

ECM underwriting fees surged 80% to $645.2m

M&A advisory fees dropped 42% to $250.7m

Syndicated lending fees fell 43% to $138.3m

League Table Leaders

Kotak Mahindra Bank topped overall fee rankings with $92.8 million

Ernst & Young led M&A advisory with $11.8 billion in deal value

Axis Bank dominated bond underwriting with $11.9 billion