India’s Manufacturing Push Tests Limits of China Comparison

India’s rapid economic growth and favourable demographics have reignited discussions about its potential to become a manufacturing powerhouse, with some analysts drawing comparisons to China’s ascent two decades ago. However, a new UBS report suggests that while India possesses some advantages, it faces significant hurdles in replicating China’s manufacturing dominance.

At first glance, the numbers seem daunting. India’s manufacturing sector accounts for a mere 3% of global manufacturing value-added, a drop in the ocean compared to China’s commanding 30% share. Yet beneath these stark figures lies a more nuanced story of potential and pitfalls.

India’s trump card is its demographic dividend – a vast, young workforce that’s both cheap and increasingly skilled. This labour pool, combined with improving infrastructure and a government keen on attracting foreign investment, creates a potent mix for manufacturing growth. The country’s large domestic market, now on par with China’s in 2006-2007, provides a solid foundation for expansion that could eventually lead to increased global market share.

The path to manufacturing dominance is far from clear-cut, however. India’s economic structure differs markedly from China’s at a similar stage of development. Services, not manufacturing, have long been India’s forte. This services-heavy model may prove an advantage in an increasingly digital world, but it also means India is unlikely to follow China’s heavily industrial growth trajectory.

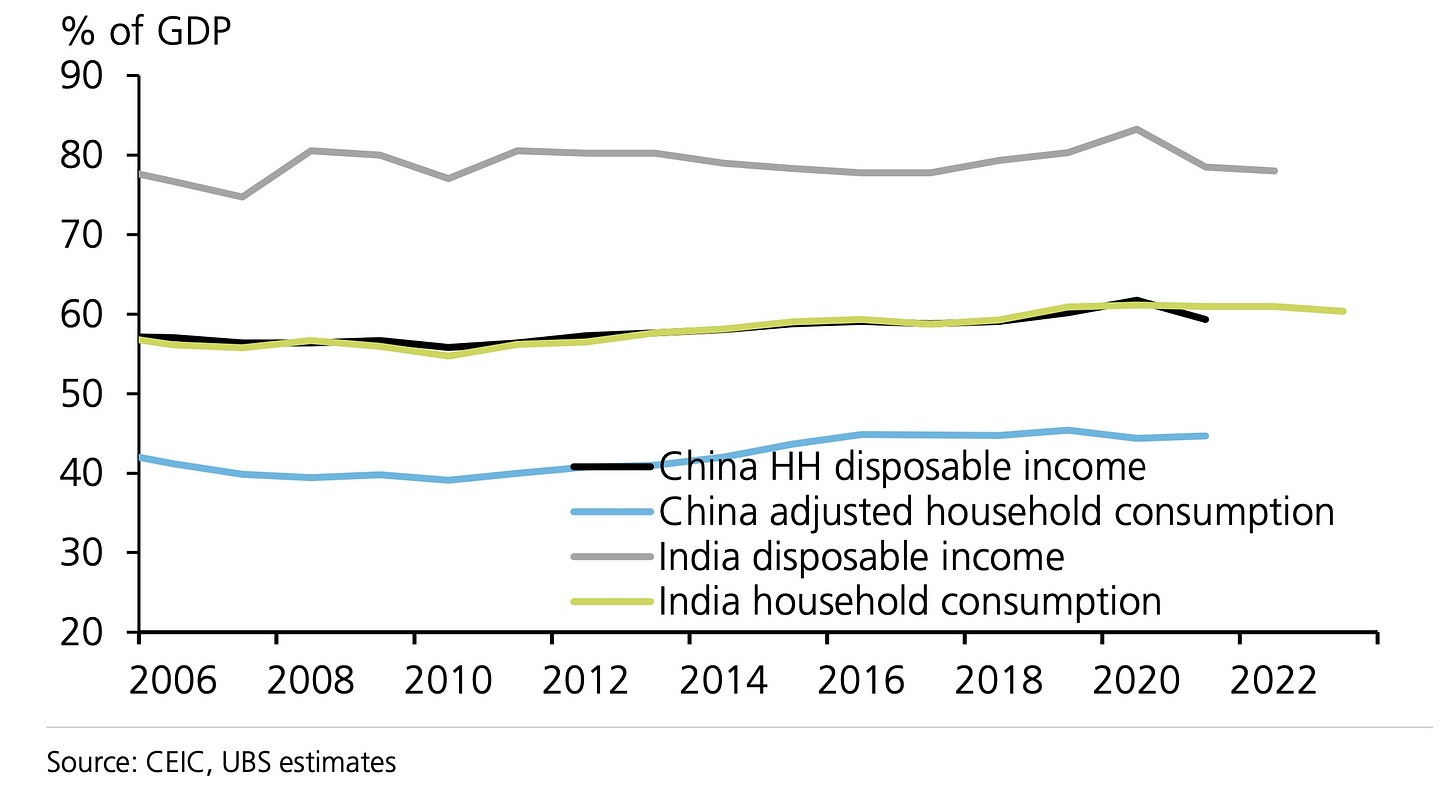

The report highlights intriguing shifts in consumption patterns as Indian incomes rise. With 119 million people now earning over $5,000 annually, demand for durable goods and automobiles is set to explode. This growing middle class could fuel a virtuous cycle of production and consumption, much as it did in China. Yet UBS economists caution that sustained consumption growth hinges on the creation of high-quality jobs – a challenge that has long bedevilled Indian policymakers.

Perhaps most surprisingly, the analysis suggests India may not have the same earth-shaking impact on global commodity markets that China did. India’s growth model appears less resource-intensive, shaped by different urbanisation patterns and a smaller share of heavy industry. This could have profound implications for global energy and materials markets that have long relied on Chinese demand.

Labour reforms emerge as a critical factor in the report. While China benefited from a flexible labour market in its manufacturing heyday, India’s complex labour laws have often been cited as a barrier to growth. Recent reforms, including the consolidation of labour codes, could mark a turning point if fully implemented. Yet political sensitivities around these changes mean progress remains uncertain.

The role of foreign direct investment (FDI) also looms large in India’s manufacturing aspirations. The country has seen a notable uptick in FDI, with manufacturing accounting for over a third of inflows in recent years. This vote of confidence from global investors could provide crucial capital and expertise to boost India’s industrial base.

Yet challenges remain. The report notes that while infrastructure has improved, it still lags behind China’s at a comparable stage of development. Land acquisition for industrial projects, a process that was relatively streamlined in China, remains a thorny issue in India despite recent reforms.

As India navigates these complex waters, the global context adds another layer of intrigue. With many multinational companies seeking to diversify their supply chains away from China, India stands to benefit. However, competition from other emerging economies means success is far from guaranteed.

In the end, the UBS report suggests that while India may not replicate China’s exact path to manufacturing supremacy, it has the potential to forge its own unique route to economic power. The country’s ability to leverage its strengths while addressing structural weaknesses will determine whether it can truly become the world’s next economic titan.