Indian and Foreign Mutual Funds Diverge on Indian Equities

Indian domestic equity funds are seeing cash levels grow while shifting their sector exposures, according to a Goldman Sachs report analyzing over $200 billion in holdings from the top 100 domestic equity mutual funds as of August-end.

The report reveals that domestic institutions have experienced record buying of equities this year, with $38 billion in inflows year-to-date, pushing mutual funds’ ownership in Indian equities to a multi-year high of 9%.

Funds have been supported by robust inflows, with $4.6 billion entering in August alone, up 3% month-on-month. Cash levels in the funds are healthy and growing, with the sample of 200 equity mutual funds holding $11 billion in cash as of August-end, compared to $9 billion a month ago and $7 billion a year ago.

At 4.4% of assets under management, cash allocations are slightly above the historical average of 4.2%, suggesting funds could continue to support equity markets in the near term.

In terms of sector positioning, domestic funds are overweight consumer cyclicals by approximately 400 basis points, while maintaining neutral allocations in investment cyclicals and exporters, and underweight positions in commodity cyclicals, defensives, and financials.

Notable shifts in exposure over the past three months include increased allocations to private banks and IT sectors, while reducing exposure to industrials. This marks a departure from the consistently strong overweight exposure to industrials maintained through the last few years.

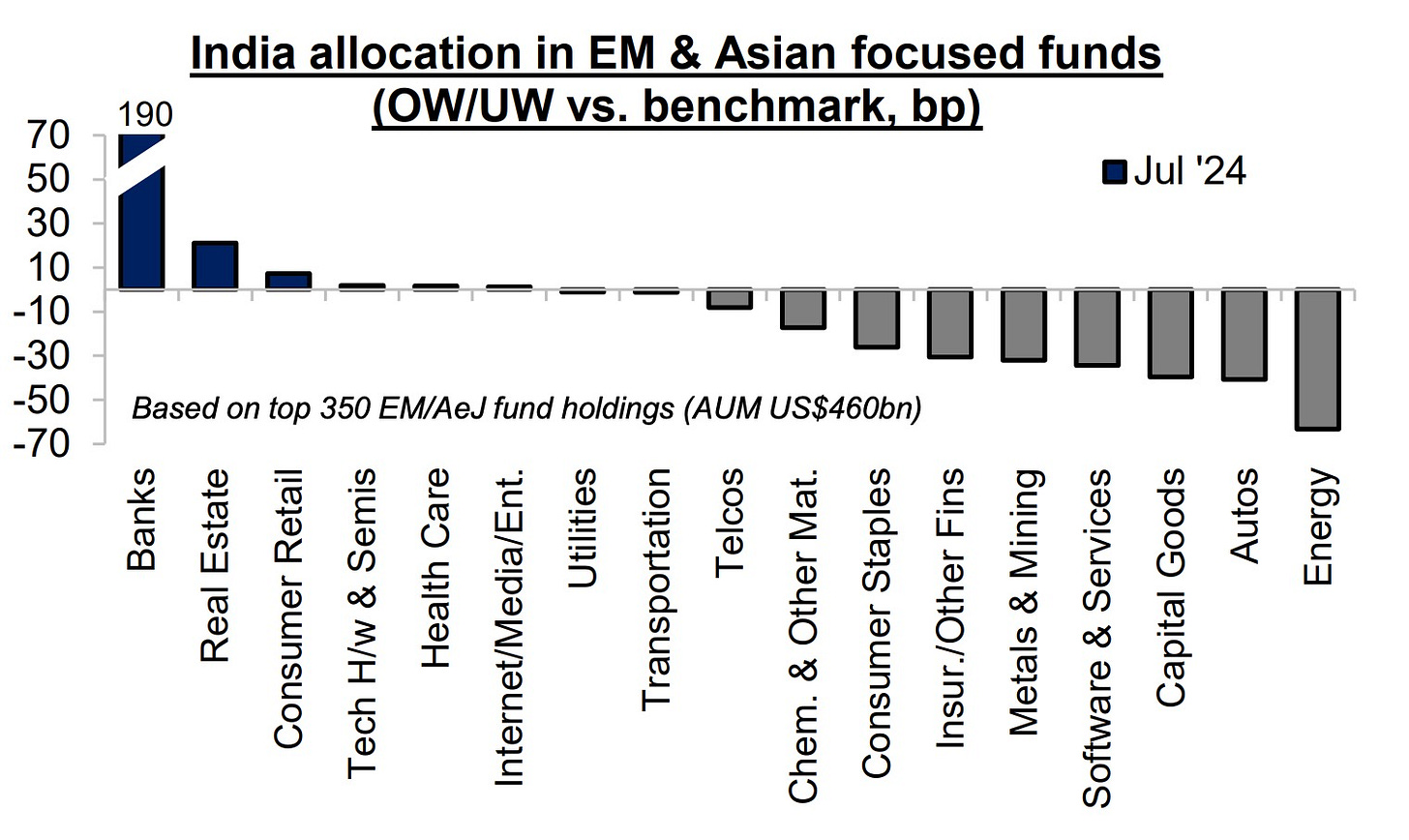

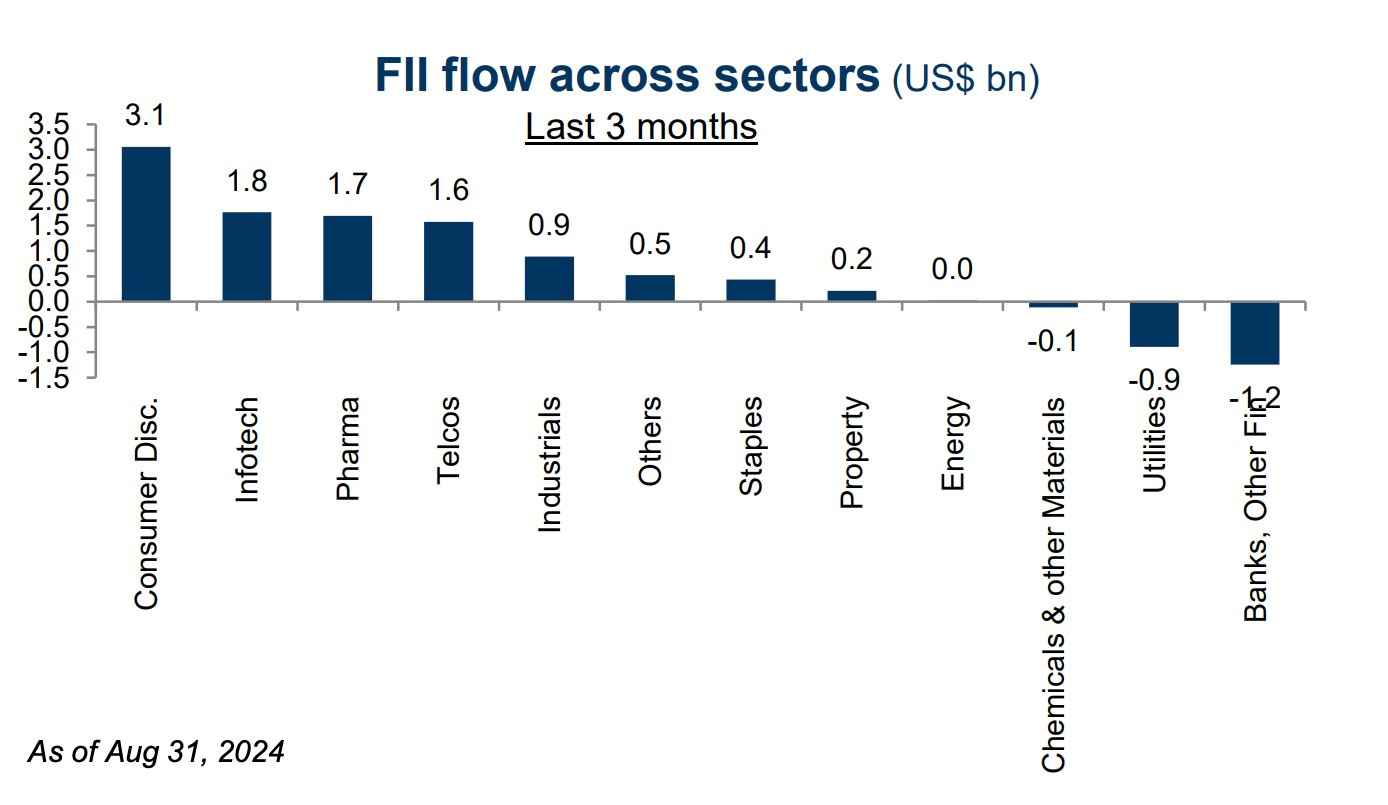

The report also highlights a divergence between domestic and foreign fund preferences in certain sectors. While domestic funds are underexposed to banks and have been increasing their holdings in recent months, foreign (emerging market/Asia) funds maintain strong overweight allocations in banks but have been net sellers of the sector.