Indian Electronics Manufacturers’ Stocks Soar Despite Shallow Manufacturing Base

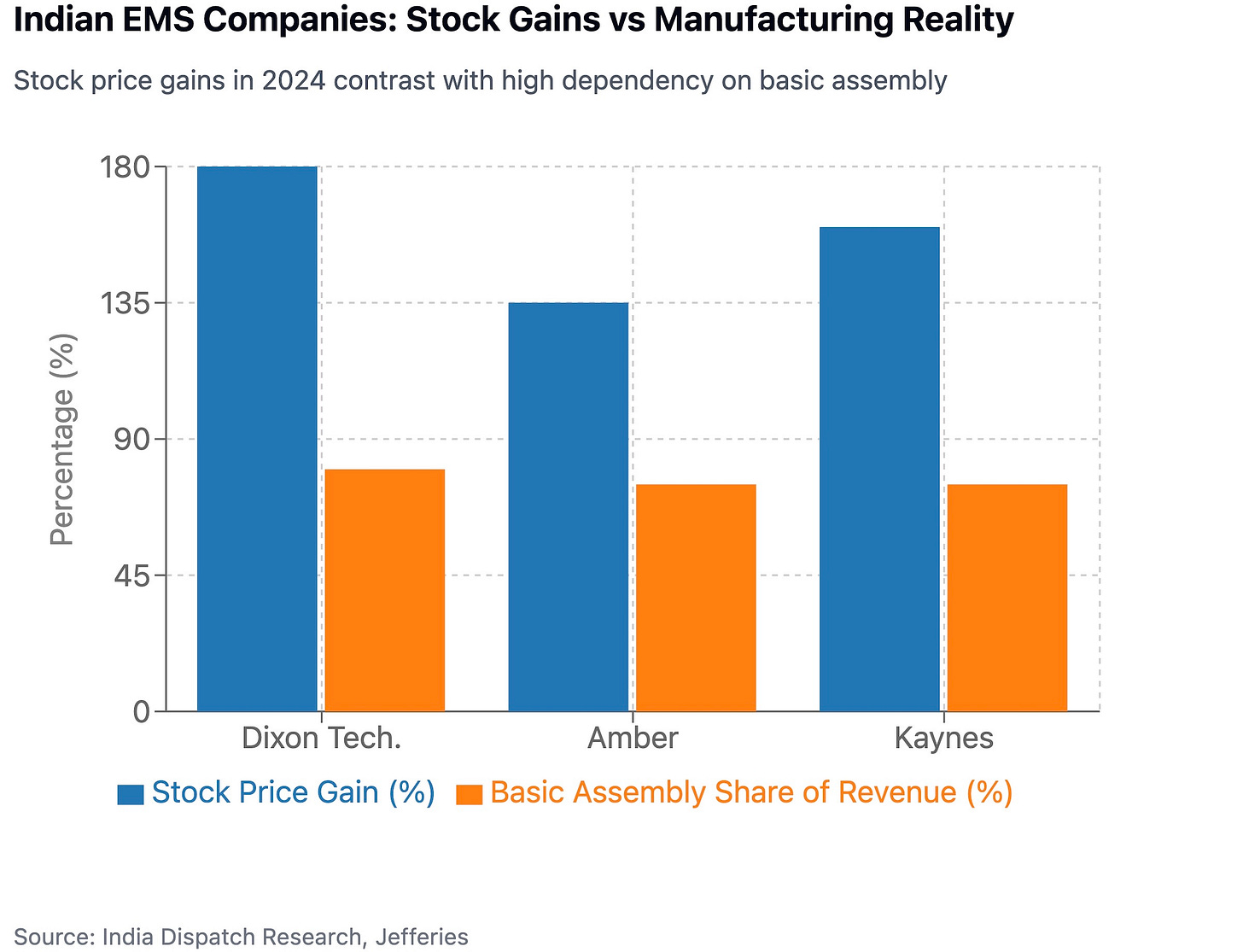

Indian electronics manufacturing stocks surged by up to 180% in 2024, far outpacing the broader market’s 23% gain, even as the country’s much-touted manufacturing capabilities remain largely limited to final assembly operations.

An analysis of shares of Amber, Kaynes and Dixon shows they rallied between 135-180% last year. Dixon, the largest of these contract manufacturers, now trades at a forward price-to-earnings multiple of about 113 times its projected FY26 earnings.

The analysis underscores a stark disconnect between stock market enthusiasm and manufacturing reality.

India remains highly import dependent for core electronic components across most product categories. Even in mobile phones, where India claims significant manufacturing success, only about 25% of components are locally sourced.

A Jefferies analysis found that in laptops and servers, more than 80% of units consumed domestically are imported. In televisions, critical components like open cells, which constitute about 60% of the bill of materials, continue to be imported.

The research also highlights how India’s electronics manufacturing services (EMS) sector remains predominantly focused on basic assembly. Dixon Technologies, despite its market success, derives 75-80% of its sales from OEM operations, with operating margins of 3.5-4%.

Electronics represent a key import category for India, accounting for 14% of total imports in FY24, according to the report.

Indian manufacturers are attempting to move up the value chain, with companies like Kaynes venturing into semiconductor assembly and testing. However, these efforts remain heavily dependent on government support, with about 75% of their approximately Rs38bn capex expected to be funded by the government.