Indian Life Insurers Poised To Outperform Asset Managers, Bernstein Says

Investment research firm Bernstein has come out with a contrarian take on India’s financial services sector, arguing that insurance stocks are poised to outperform asset management.

Bernstein’s analysts are betting that India’s private insurers can maintain their impressive 15% growth clip – a pace they’ve sustained for the better part of a decade – while suggesting that asset managers might be in for a rougher ride.

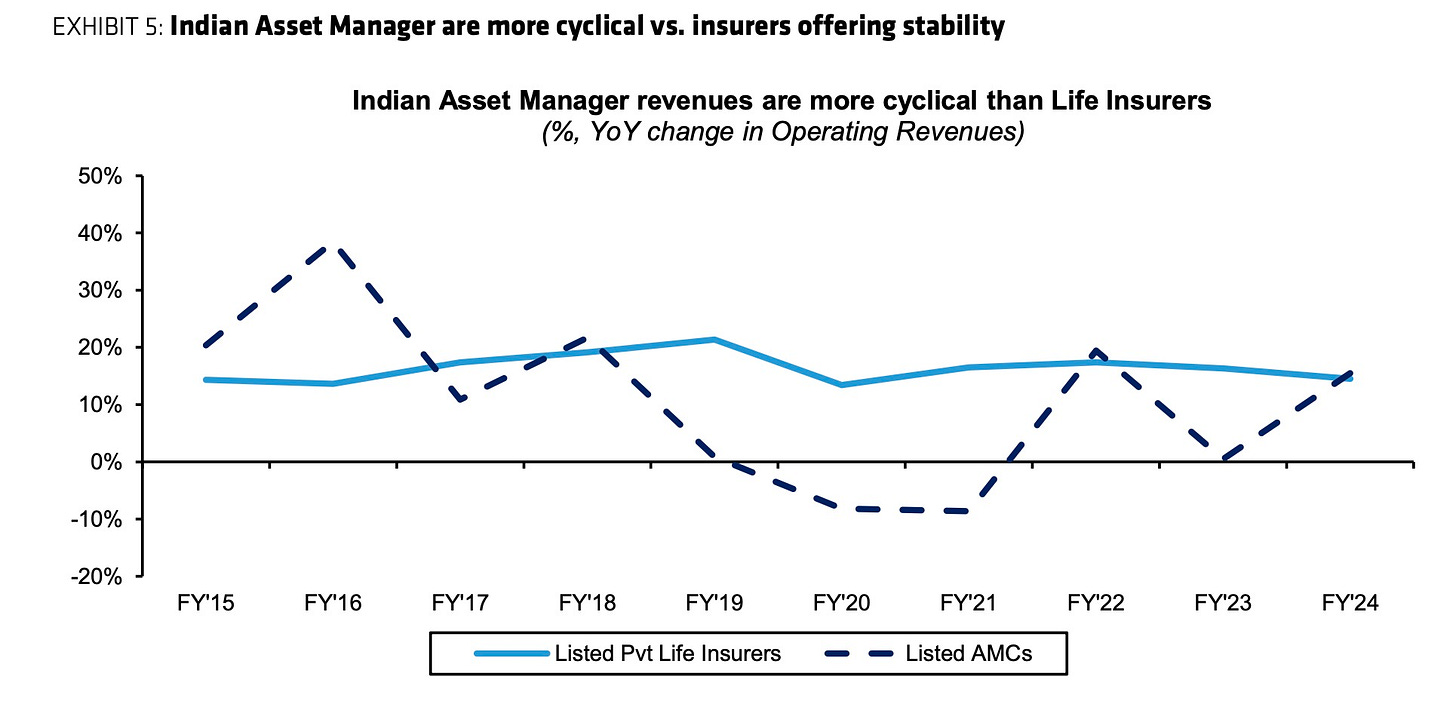

The crux of their argument? It’s all about the cycles. Bernstein reckons that Indian equity valuations are looking a bit rich, and when the inevitable market hiccup comes, asset managers could find themselves on the sharp end of the stick.

The idea that Indian equity is overpriced isn’t surprising. In fact, a venture capitalist told me this week that many of her friends who run shops trading public market are apprehensive of the Indian market because valuations are just out of whack.

Insurance, on the other hand, is being touted as the steady Eddie of the Indian financial landscape. With penetration rates still stubbornly low, insurers have a long runway for growth.

But here’s where it gets really interesting: this isn’t just a play on market cycles. Bernstein is essentially making a long-term bet on the changing face of Indian savings. As the country’s middle class swells and financial literacy improves, both sectors stand to benefit from a shift away from traditional savings vehicles like gold and real estate.

Bernstein, however, is wagering that insurance has more room to run in this particular race. In most developed markets, asset managers are the darlings of the financial world, their scalable business models and juicy fee income making investors weak at the knees. Insurance, by contrast, is often viewed as the boring-but-necessary cousin – hardly the stuff of investment excitement. But India, as we all know, has a habit of confounding expectations.