Indian Mid-Cap IT Stocks Defy Valuation Logic

Smaller Indian IT companies are trading at unprecedented premiums to their larger rivals despite weaker fundamentals and narrowing growth advantages.

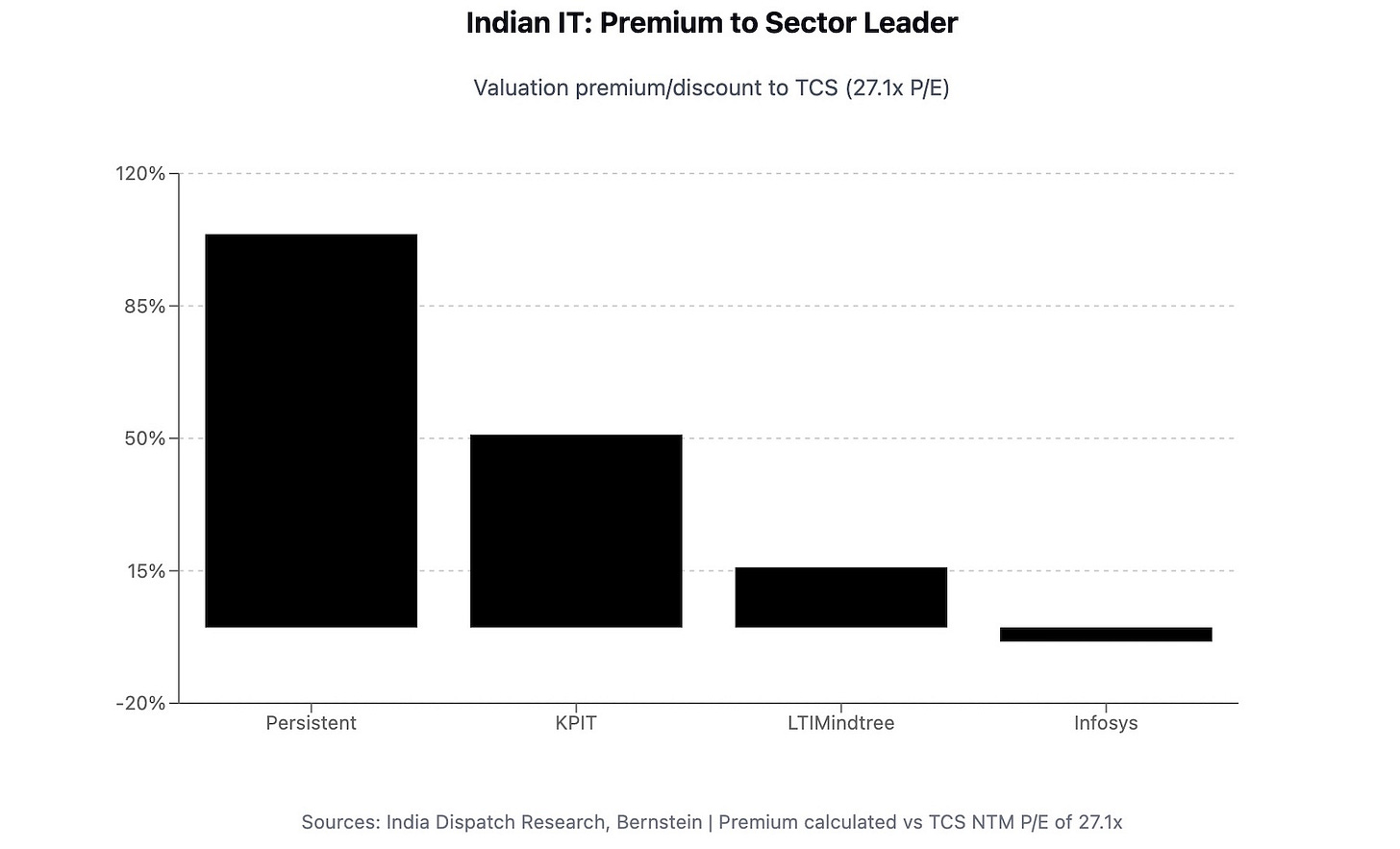

KPIT and Persistent command forward price-to-earnings ratios of 40.9 and 55.3 respectively, while sector leader TCS trades at 27.1 times, a premium that defies historical patterns.

The valuations persist despite mid-caps showing greater business risks. They derive 30-40% of revenue from their top 10 clients, compared with 20% for larger peers. Their operating margins range between 14-18%, significantly below the steady 24% at TCS and 21% at Infosys.

“Margin gap between large-cap and SMIDs has expanded to 5.1% vs 4.5-5.0% range,” Bernstein analysts wrote in a note.

The growth differential that traditionally justified higher mid-cap valuations has also narrowed. In the most recent quarter, Persistent grew 5.1% and KPIT 4.7% sequentially, compared with Infosys at 3.1%.

Using “Rule of 40” score — the sum of a company’s revenue growth (%) and EBIT margin (%) — TCS scores 33.9 and trades at 27 times earnings. KPIT scores 35.4 yet trades at 41 times, while Persistent scores 33.4 but commands 55 times earnings.

“Historically these SMIDs have traded at a valuation discount to TCS, particularly during periods of macro uncertainty,” Bernstein report added.

Follow India Dispatch on WhatsApp.