India’s Corporate Earnings Falter as Economic Slowdown Deepens

Remember that report from Bernstein a couple of weeks ago, warning about visible signs of an economic slowdown in India? Well, they’re back with a sequel, and it’s not exactly a feel-good story for the bulls.

The investment bank’s latest analysis suggests that the broader economic deceleration is now seeping into corporate profits, with earnings momentum fading across sectors.

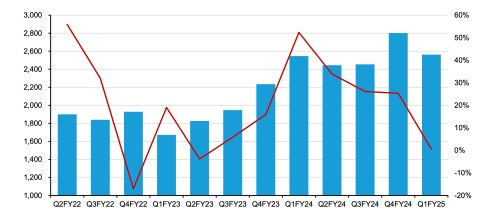

Earnings across the NSE100 index grew by a paltry 0.6% year-on-year in the first quarter of fiscal 2025. That’s quite a comedown from the 20%+ growth seen in each of the previous four quarters. And it’s not just a few stragglers bringing down the average – Bernstein points out that 31 stocks in the NSE100 missed consensus forecasts by 4% or more in the most recent quarter, the highest number since September 2022.

Now, you might think that analysts would be scrambling to revise their forecasts downward in light of this. But here’s where it gets interesting: consensus estimates are still projecting 16% earnings growth for the full fiscal year. Bernstein’s analysts seem skeptical about this optimism, suggesting that we might be in for a round of widespread earnings downgrades.

All of this aligns rather neatly with what Bernstein observed in their previous report – cooling demand across multiple sectors, from premium vehicles to gold jewelry.

Despite all this, market valuations remain stubbornly high. Bernstein’s maintaining a cautious stance, with a year-end Nifty target implying a 5% downside from current levels.

The bottom line? It looks like India’s markets are at a crossroads where the rosy outlook of recent years is colliding head-on with some harsh economic realities.