India’s Domestic Investors Are Running Low On Ammo as Foreigners Bolt

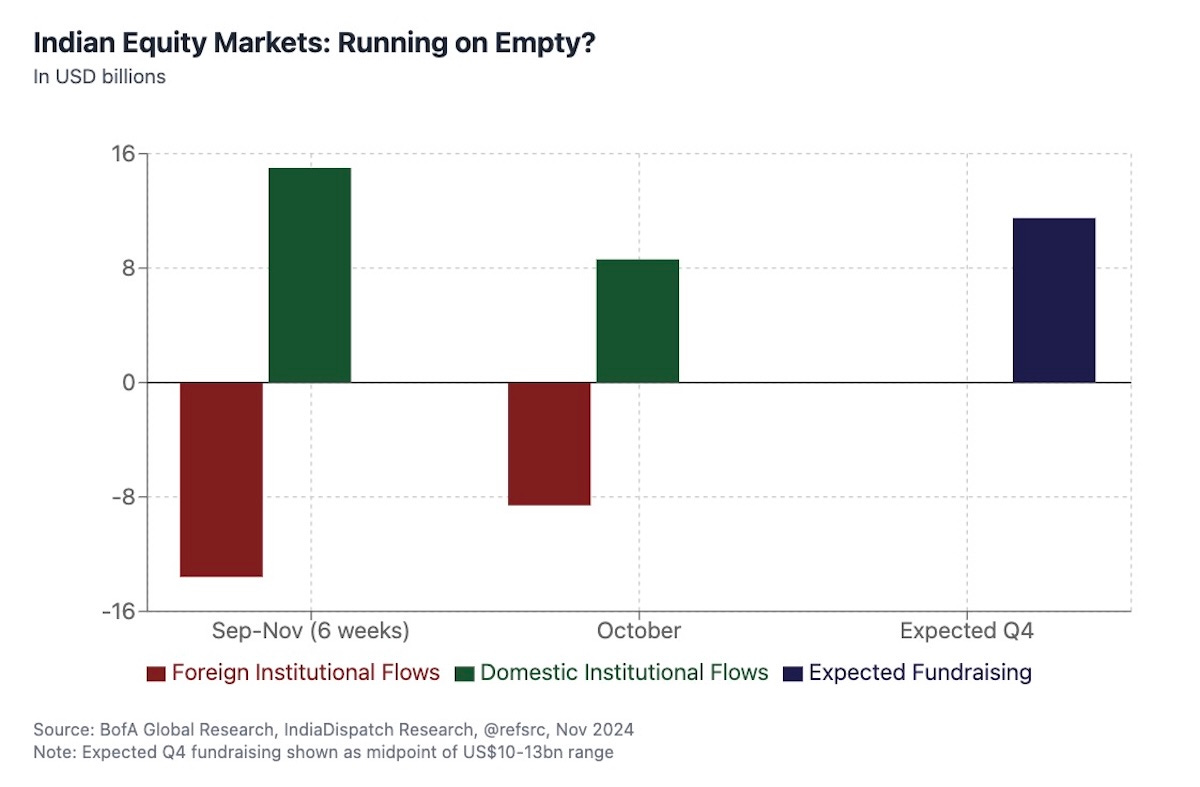

India’s domestic institutional investors have been valiantly absorbing a record $13.6 billion of foreign selling over the past six weeks, but Bank of America reckons their firepower for future rescues is getting dangerously depleted.

Foreign institutional investors have dumped 1.6% of their assets under management since Indian markets peaked in September, with financials, consumer discretionary and energy stocks bearing the brunt.

The selling intensified after China’s stimulus announcements and was further fueled by flat year-on-year earnings in the second quarter.

Enter the domestic cavalry. Local institutional investors matched the foreign exodus with $15 billion of buying, including a record $8.6 billion in October alone.

But here’s the rub: BofA’s calculations suggest their cash reserves have likely dropped from $22 billion (4% of AUM) to about $16 billion (2.8%) – what the bank describes as “a bare minimum” in its view.

The timing couldn’t be more precarious. There’s $10-13 billion of equity fundraising planned for the fourth quarter of 2024. Meanwhile, Indian markets are still trading at a 10% premium to long-term averages, and BofA warns that potential US policy shifts – including tariffs and immigration restrictions – could trigger even more foreign outflows.

The domestic bid has been the only factor supporting Indian equities. With cash reserves running low and foreign investors heading for the exits, that support is looking increasingly wobbly.