India's Market Suffers Longest Losing Streak Since September 2001

India's Nifty 50 index has fallen for four consecutive months, matching a pattern of decline not seen since the aftermath of September 2001.

The benchmark's sustained drop stands out amid otherwise rising global markets, with the MSCI World index up 3.5% in January. While major markets from Brazil to Europe posted significant gains - with Brazil's index jumping 12.4% and European stocks rising 7.1% - India's market declined 4.8%.

Small investors appear to be losing confidence. The cancellation rate of systematic investment plans - a popular form of regular stock investing among retail traders - reached 83.3% in December, approaching levels last seen during India's general elections in May 2024.

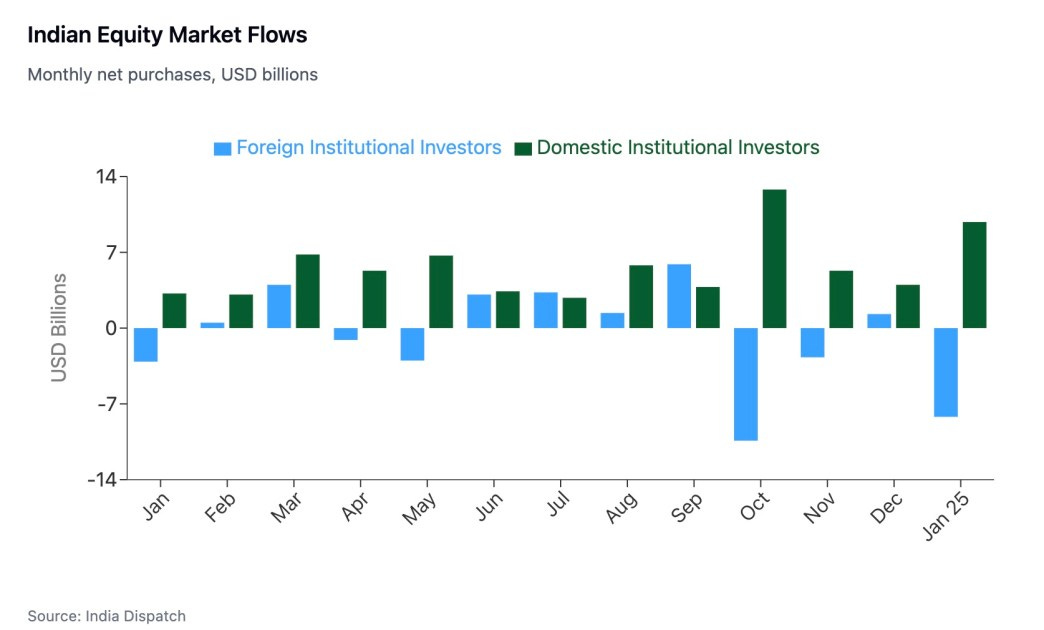

Foreign investors accelerated the decline, pulling $8.2 billion from Indian stocks in January - their second-largest monthly withdrawal on record. Domestic institutions tried to counter this exodus by purchasing $9.8 billion worth of shares, but the market's continued slide suggests their buying power may be insufficient to halt the downturn.

The last time Indian stocks fell for this long, markets worldwide were grappling with the aftermath of the September 11 attacks. The current streak, while matching that period in length, still falls short of the market's longest-ever decline, which lasted from September 1994 to April 1995.