India’s Retail Disruption That Wasn’t

Every few years, someone proclaims the imminent death of India’s mom-and-pop stores. First came modern retail chains in the 2000s, then e-commerce in the 2010s, and now quick commerce in the 2020s — each promising to finally “modernize” India’s fragmented retail market.

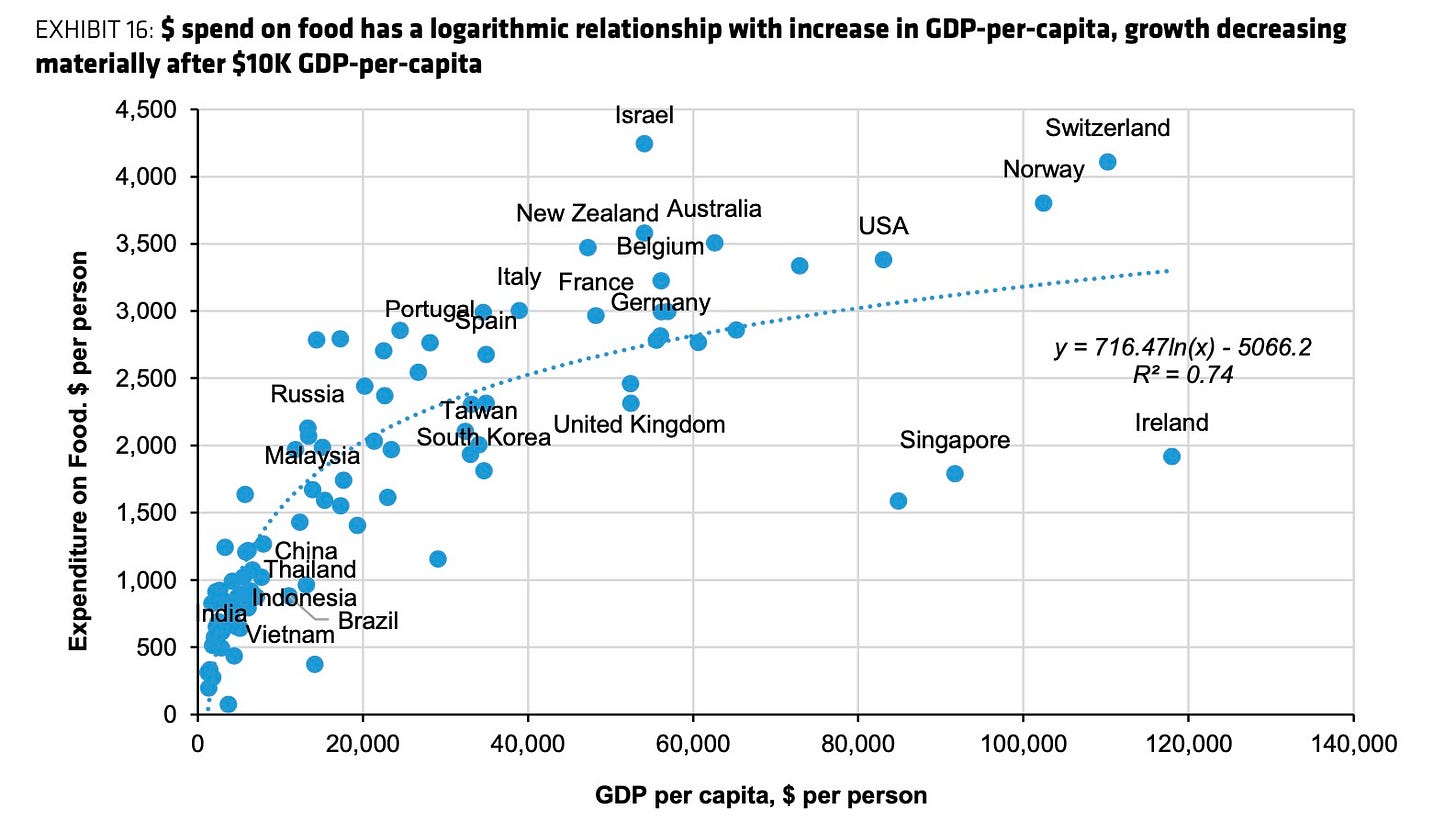

On paper, it’s a disruption waiting to happen. A $570+ billion market growing at 9% annually, with 12 million traditional stores holding a 90% market share, screams inefficiency.

Yet after 25 years of predicted disruption, traditional retail remains remarkably resilient, with organized retail’s penetration still notably low across India.

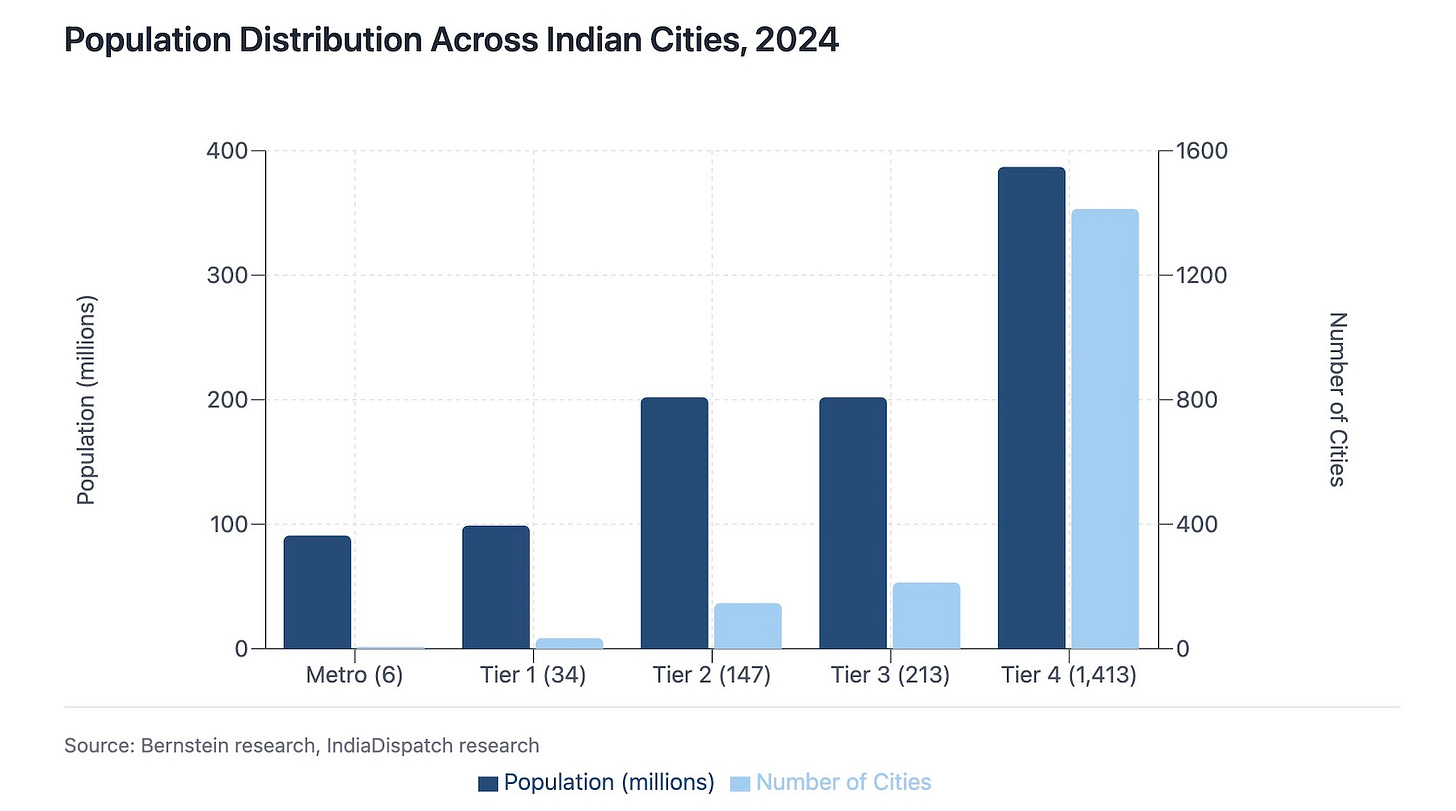

While surface comparisons to China or the U.S. suggest inevitable modernization, India’s unique structural characteristics tell a different story. Unlike China and the US, where population density, wealth, and numbers conveniently align in coastal regions, India’s high-income populations cluster in the West/South while its dense populations concentrate in the poorer North/East.

This spatial mismatch means retail models that work in wealthy urban centers struggle to scale across India’s vast middle.

But here’s the real kicker: India’s female labor force participation rate sits at just 37% — among the lowest in G20 countries. Counter-intuitively, it actually decreases as households get wealthier in urban areas.

When women spend more time on household work, Bernstein analysts argued in a recent report, families prioritize cost savings over convenience, making premium retail formats less attractive. Even in the “affluent” top 40% of households, 42-66% rely on irregular income streams, making neighborhood store credit an essential service rather than a quaint relic.

None of this means modern retail won’t gain share in wealthy urban pockets targeting the top 50-100 million consumers. But for investors betting on widespread retail disruption, it might be worth considering whether demographics will continue to trump disruption.