India's One-Airline State

How one airline came to control two-thirds of Indian aviation

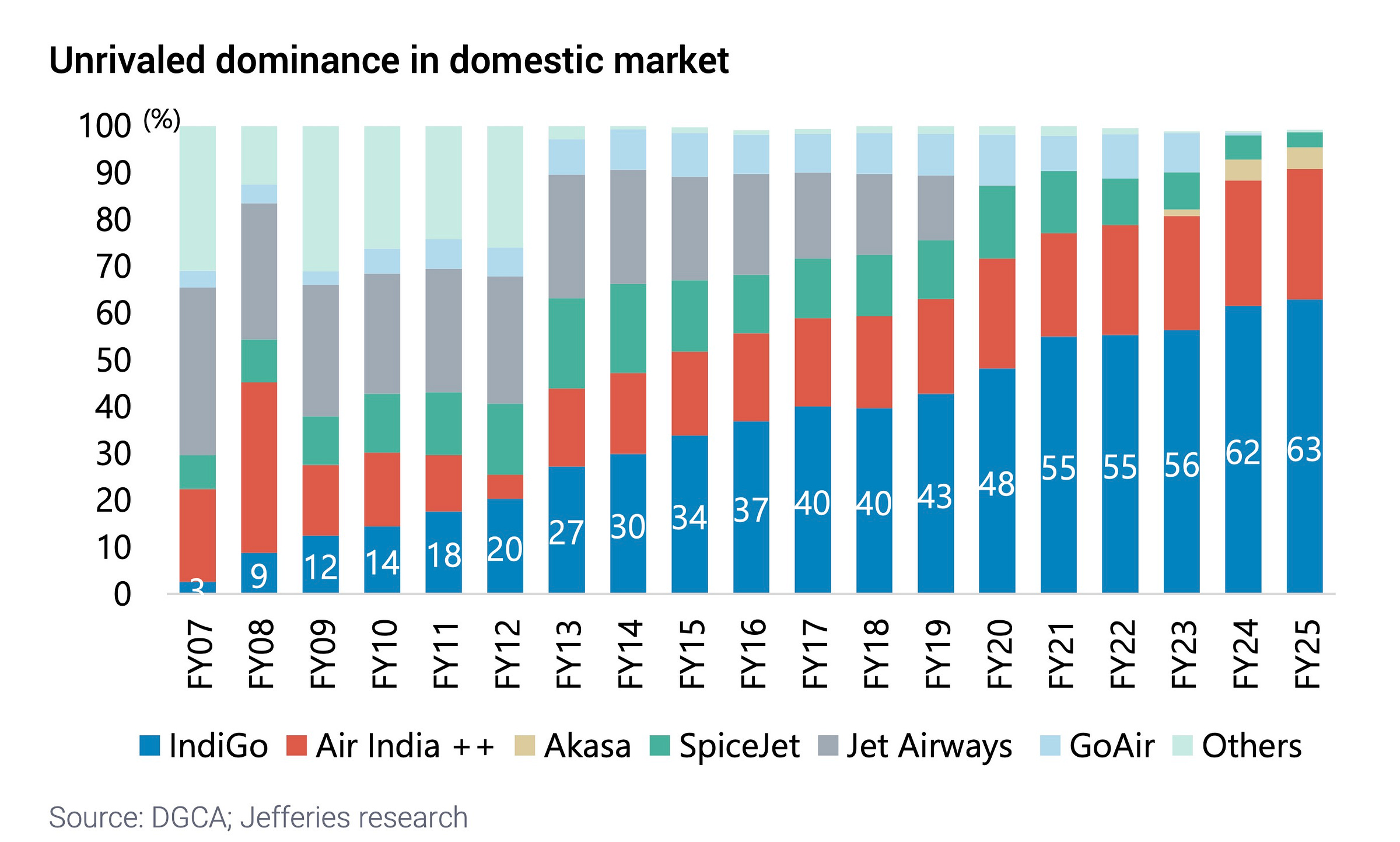

In most major aviation markets, including the U.S. and Europe, competition is an oligopolistic affair, with several large airlines competing for market share. India’s domestic sector, however, is increasingly characterized by the ascent of a single airline.

Low-cost carrier IndiGo has achieved an extraordinary concentration of the market, capturing approximately 64.4% of all passenger traffic as of May. More strikingly, the airline operates with a near-monopoly on 66% of its domestic routes, facing little to no direct competition in a significant portion of its network.

This position is the culmination of a decade-long expansion that saw the exit of rivals like Jet Airways and GoAir. Today, its remaining competitors continue to struggle; SpiceJet’s domestic market share has fallen to just 2% while it operates a reduced fleet of only 19 aircraft. Air India, despite its acquisition by the Tata Group in 2022, has been slow in its restructuring and continues to cede domestic ground, with the flag carrier remaining unprofitable.

This consolidation is occurring just as the market's post-pandemic boom shows signs of abating. High-frequency data from India's Ministry of Civil Aviation and the Directorate General of Civil Aviation points to a distinct slowdown. Year-on-year domestic passenger traffic growth moderated to 4.6% in the first quarter of fiscal year 2026, a sharp deceleration from the 10% growth recorded in the prior quarter.

This softening demand has been accompanied by considerable pricing pressure. After a strong performance in April, industry-average airfares on major domestic routes declined by up to 10% year-on-year in May and June. The operational impact is tangible, with airlines flying more empty seats; IndiGo’s own load factors have declined by approximately 200 basis points year-on-year, with Air India seeing a 400-basis-point drop.

Despite the market softness, IndiGo's competitive position appears to be paradoxically strengthening. Its success is built on formidable business moats, including a relentless focus on cost. The airline's cost per available seat-kilometre is lower than its global peers, something it has achieved through a disciplined single-fleet strategy and its ability to secure favorable terms through bulk aircraft orders. The recent challenges at Air India, including a crash on June 12, 2025, followed by regulatory findings of safety lapses, may also push safety-conscious passengers and lucrative corporate clients towards IndiGo.

Furthermore, the airline is pursuing a methodical international expansion, where profitability is believed to be "slightly better" than on domestic routes, according to its CEO. This is due to efficiencies from longer flights and lower taxes on fuel in international markets. The airline has already demonstrated its execution capability, growing its international short-haul market share from 7% in 2019 to 19% in 2025. It is now deploying a 'Fit For Purpose' strategy for its long-haul ambitions — customizing service levels while maintaining cost efficiency and adding premium offerings on select routes.

For the Indian consumer, the current dynamics have suppressed ticket prices, with inflation-adjusted airfares remaining well below 2011 levels. However, the outlook for the industry is complex. IndiGo must now navigate a period of moderating demand and diminishing pricing power from a position of near-monopolistic control.