Inside India's Semiconductor Push

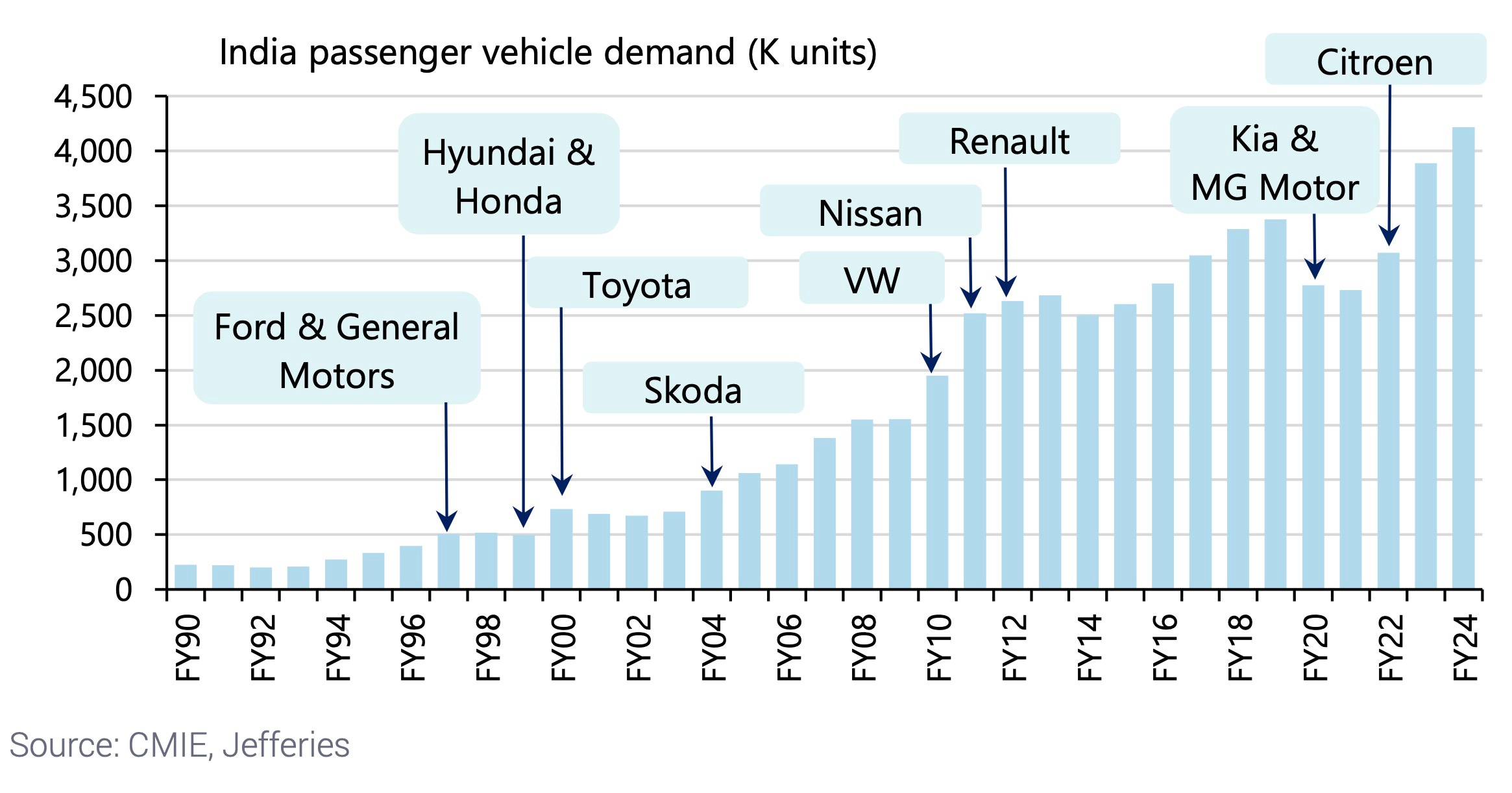

The journey of auto industry in India provides a remarkable case study on how the country, with prudent policies and rising demand, could establish manufacturing ecosystem

India is investing more than $18 billion in five semiconductor projects that rely heavily on state support, with combined federal and state subsidies covering approximately 70% of project costs.

Central government policy provides fiscal support for 50% of approved project costs on a pari-passu basis, while several states including Gujarat offer additional incentives of about 20%, creating one of the world’s most generous semiconductor subsidy regimes. Gujarat, in particular, has emerged as a key hub, attracting four of the five semiconductor projects, amounting to ~$15 billion of the total investment.

The approach comes as India struggles to increase domestic value addition in its electronics industry. Despite growing electronics production at a 15% compound annual growth rate over 2016-24 to reach $115 billion, the country’s domestic value addition has remained stubbornly low at 18-20%, according to an analysis by Jefferies. The government aims to increase this to ~35% by 2030, as most critical components — including semiconductor chips — are still imported.

India’s semiconductor push is part of a global subsidy race that has accelerated since the chip shortages of 2021-22. The US has committed $39 billion for chip manufacturing and $13 billion for semiconductor research through its CHIPS Act. The European Union is mobilizing more than €43 billion in public and private investments, while Japan has pledged over $65 billion and South Korea has unveiled an ambitious $250 billion funding plan.

Tata Electronics, which is developing India’s first chip fabrication plant with an investment of $11 billion in partnership with Taiwan’s PSMC, will focus on mature technology nodes between 28-110nm. The facility, expected to start production in 2026, represents a technological compromise compared to global leaders like TSMC, which operates at 3-5nm.

“India’s manufacturing success, at least for now, may not lie in competing at the technology frontier, but in leveraging proven technologies and creating effective solutions, aligned with the nation’s rising demand and economic priorities,” Jefferies analysts wrote.

While India is not aiming to compete at the cutting edge of semiconductor fabrication, Jefferies draws a strong parallel with the country’s success in automobile manufacturing.

India struggled to develop an auto sector in the early 1980s, but with sustained policy support and rising domestic demand, it is now the world’s fourth-largest producer of passenger vehicles, exporting more than $8 billion worth in the financial year that ended in March 2024..

Government efforts extend beyond fabrication, with a clear focus on building the entire semiconductor supply chain, including chemicals, gases, equipment, and packaging. The India Semiconductor Mission (ISM) is actively working to develop local semiconductor design expertise, with financial incentives under the Design-Linked Incentive (DLI) Scheme.

India already has a strong chip design workforce, with ~20% of the world’s semiconductor design engineers. Companies such as Intel, AMD, Nvidia, and Qualcomm have significant R&D operations in India, and the government is working with Cadence, Synopsys, and Siemens to integrate advanced chip design tools into 104 universities.

Though India certainly has a significant policy momentum, it’s also grappling with many challenges: an undeveloped supply chain, a limited talent pool in semiconductor fabrication, and rapid technology shifts that could outpace India’s current strategy.

“We believe India possesses several key ingredients for success in semis such as large fiscal incentives, policy support, rising demand, participation of large corporates, low manufacturing cost, strong design talent, and strategic goodwill with the West,” the analysts concluded, while cautioning that India must address its weak semiconductor supply chain and global competition to fully capitalize on the opportunity.