JPMorgan Says India-Assembled iPhone Within Spitting Distance of China Price

Same math slaps a $299 sticker shock on a made-in-America iPhone

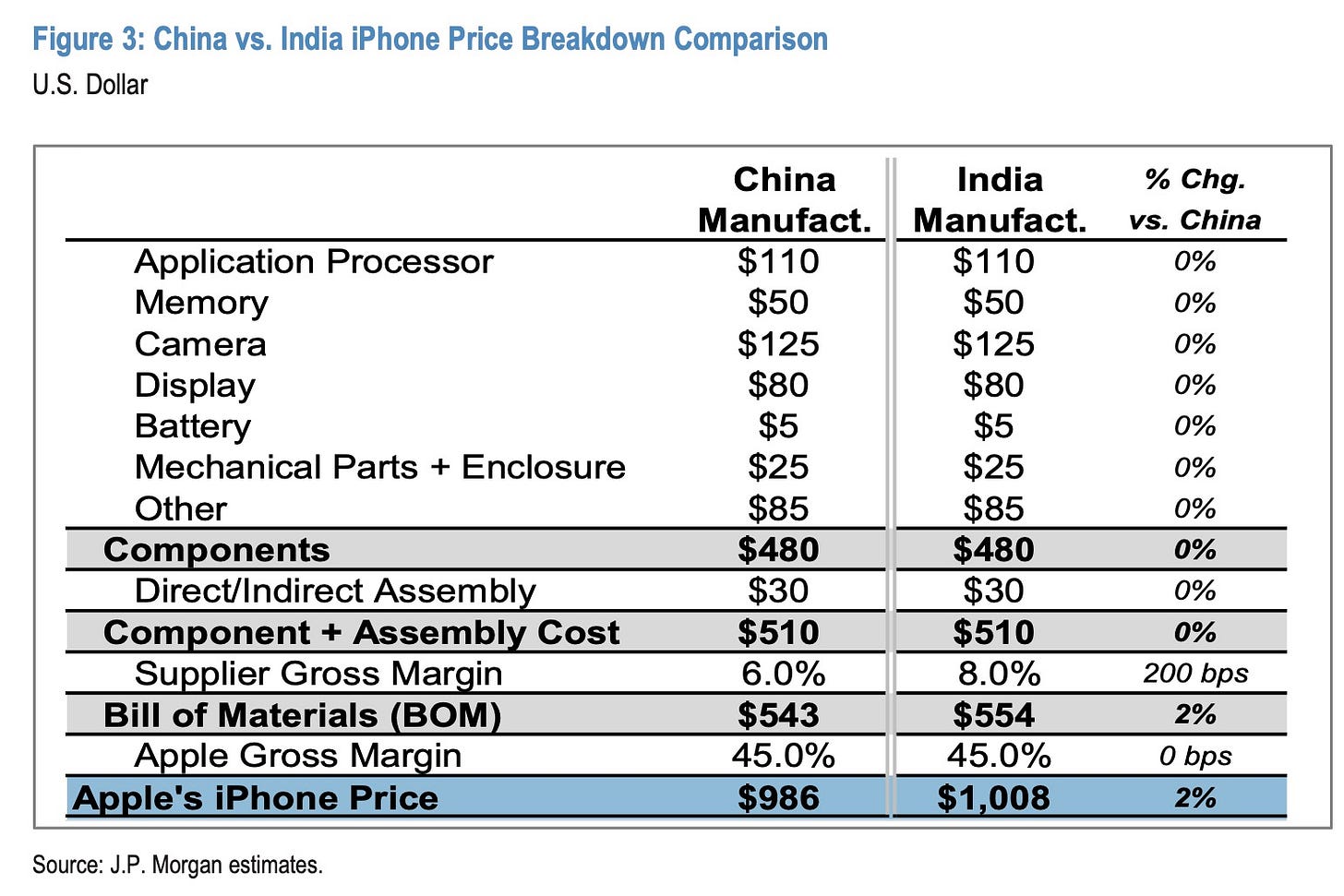

Building iPhones in India raises the handset’s retail price by little more than $20, according to JPMorgan, undercutting the roughly $300 hit consumers would face if production were repatriated to the United States. The estimates, compiled by the Wall Street bank, help explain Apple’s interest in shifting a large slice of its supply chain to India amid rising geopolitical tension.

These gaps stem from a trio of assumptions. JPMorgan posits a 20% tariff on imported components entering the United States, a doubling of assembly costs because of higher wages and overheads, and a jump in contract-manufacturer margins to 10% versus Foxconn’s 6%. The result is a retail price some 30% above a China-built phone. India, by contrast, levies negligible duties on parts, mirrors Chinese labour costs and lets suppliers earn 8%. That nudges the bill of materials to $554 and retail prices up by only 2% to $1,008.

India’s plants near Chennai and Bengaluru already produce about 3.5 million phones a month — roughly 40 million a year. Covering America’s needs would require an extra 35 million units annually, a scale analysts say the country’s labour pool and land reserves can handle. Even if New Delhi copied Washington’s 20% duty, the India-made handset would still undercut a U.S. build.

Replicating that volume at home is harder. Foxconn’s Zhengzhou “iPhone City” spans 5.6 km² and swings between 100,000 and 300,000 workers; Manhattan, though ten times larger, cannot marshal contiguous factory space or a dense industrial workforce. Under JPMorgan’s tariff-and-wage assumptions, the U.S. bill of materials climbs to $707, demanding the full 30% price hike simply to preserve Apple’s margin.

A compromise could be keeping final assembly in India while on-shoring high-value parts. Processors from TSMC’s Arizona fabs, Corning glass and Coherent sensors could shift 40-65% of component value to America. Even so, the finished phone would still cost at least 15% more than the Chinese baseline — better than 30%, but far above India’s 2%.

Vietnam and Brazil tempt with cheap labour and existing Apple lines, yet JPMorgan says their networks suit lower-volume products such as iPads and MacBooks and would struggle to add 70 million extra smartphones a year. On scale and price, India remains the only plausible rival to China.

On Thursday, Apple CEO Tim Cook said the company expected a majority of iPhones sold in the US in the June quarter to come from India and a majority of its other devices to originate in Vietnam.