Late-Stage Startup Deals Fetch Premium Despite Market Reset

Private market valuations are showing surprising resilience in late-stage deals globally despite a broader slowdown in venture capital activity, according to Morgan Stanley research, raising questions about whether investors are prolonging an eventual correction.

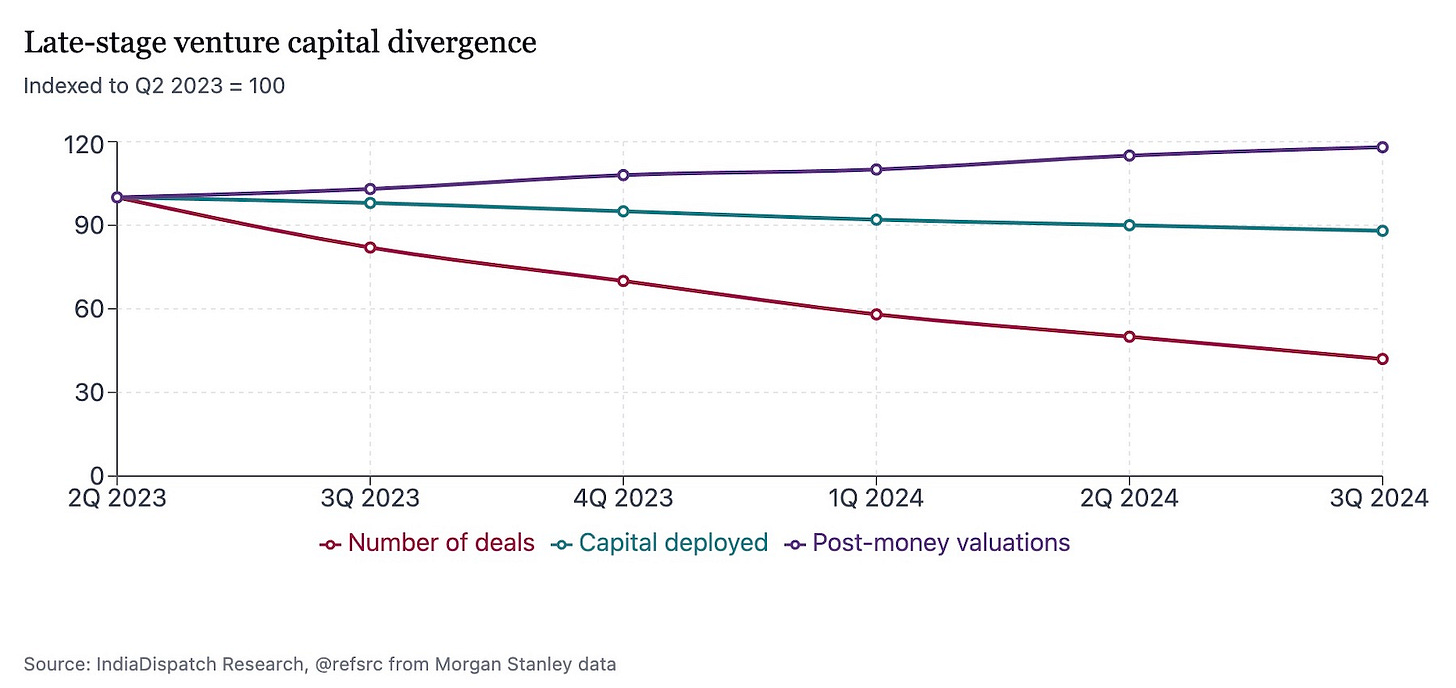

While the number of venture deals has continued to drift lower across most funding rounds in the third quarter of 2024, capital deployment has found a floor at pre-Covid levels.

The result is that fewer deals are commanding similar amounts of total investment, leading to higher post-money valuations particularly in later-stage rounds.

The disconnect is particularly notable given the challenging macro environment of higher interest rates and continued market uncertainty. Later-stage valuations are rebounding before early-stage ones, contrary to historical patterns.

Down rounds remain prevalent, having returned after a temporary dip in early 2024. Yet Morgan Stanley analysts note they are “surprised that we have not seen a more pronounced acceleration in startup shut-downs given more muted risk appetite in the ecosystem.”

The data points to a bifurcated market where higher-quality, more mature companies are maintaining their valuations while others struggle. Strategic acquirers continue to dominate exits, commanding the majority of venture and private equity-backed departures, while IPOs have lost increasing share after the spike during 2021 and early 2022.

Financial sponsors have gradually increased their share of exits from around 23% in the early 2000s to roughly 30% today, suggesting private capital is stepping in where public markets have retreated.

The resilience in late-stage valuations comes even as the ratio of Nasdaq 100 to venture capital tech multiples has recovered to its roughly 10-year average, particularly after the Nasdaq 100 re-rated into 2024.