The Collapse of Mid-Range Smartphones

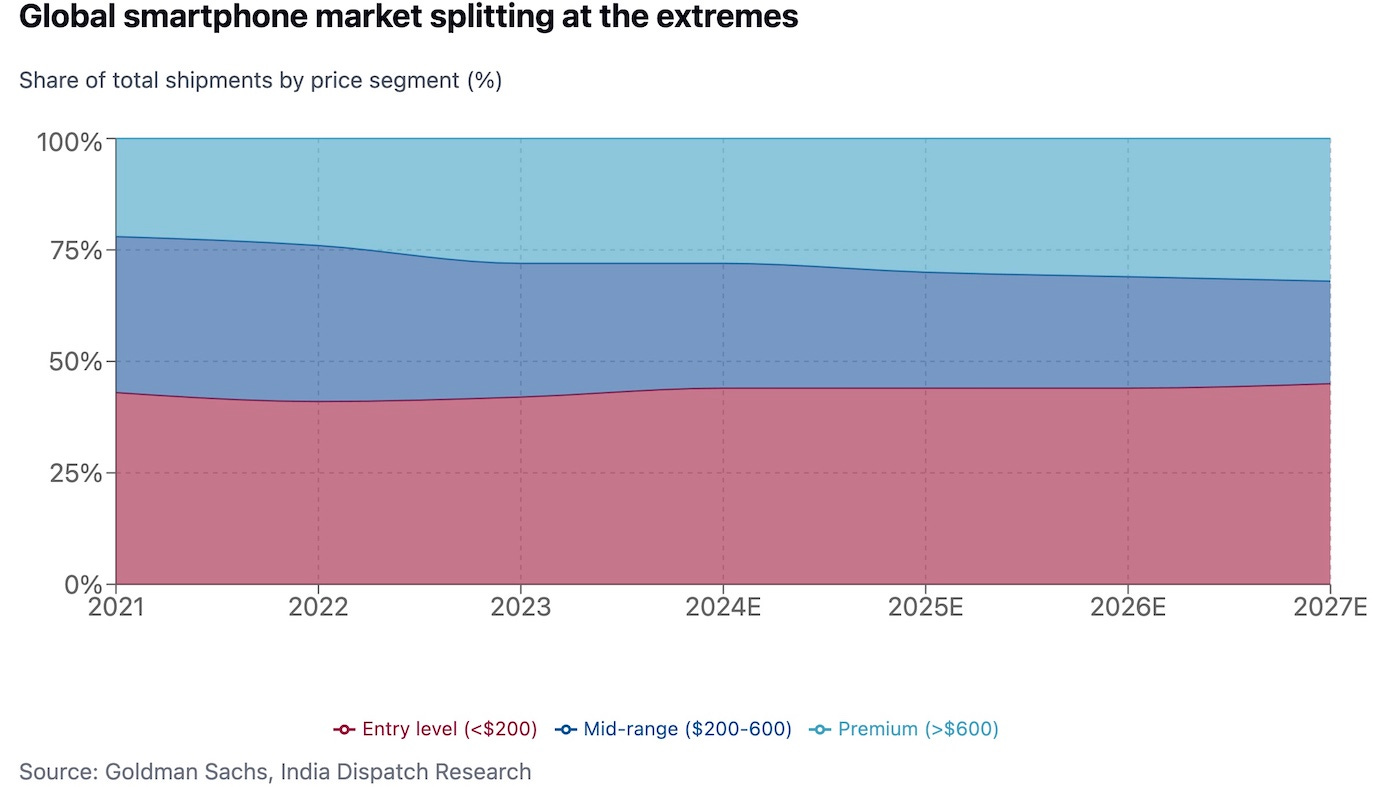

The global smartphone market is splitting into two distinct segments, with the mid-range segment seeing its market share plummet from 35% in 2021 to a projected 23% by 2027, according to an analysis of data compiled by Goldman Sachs.

The collapse of the mid-range segment — $200-600 — marks a stark reversal from 2021-22, when it held a steady 35% market share.

“While mid-end segment used to provide balance between outstanding specifications and high performance-cost ratio, the demand has been declining due to the lack of revolutionary technology upgrades and a more conservative consumption of middle class amid macro challenges,” the analysts wrote in a note reviewed by India Dispatch.

Premium phones — above $600 — have seen their share steadily rise from 22% in 2021 to 28% in 2023, and are projected to reach 32% by 2027. By value, premium devices are expected to account for 74% of industry revenues by 2027, up from 56% in 2021.

Entry-level smartphones — below $200 — have shown remarkable resilience, maintaining a 41-45% market share throughout the period. The segment’s stability is attributed to “4G to 5G migrations in developing markets, as well as consumers toward cheaper models under macro challenges.”

Navkendar Singh, an analyst at IDC, added in a response to the story: “Another major unseen under-appreciated reason is the growth of used phone or refurbished market across major geos.”

The broader market outlook remains conservative, with Goldman projecting volume growth of just +3%/+2%/+1% in 2025-27E, citing “lack of innovation and prolonged replacement cycle” as key constraints.

India’s smartphone shipments are projected to grow at 3% in 2025E, matching the global smartphone market’s expected growth rate that year. India’s share of global smartphone shipments is expected to reach 13% by 2025-27E (159m-164m units), higher than more mature markets like the USA (10%) and Western Europe (8%).

Follow India Dispatch on WhatsApp Channel.