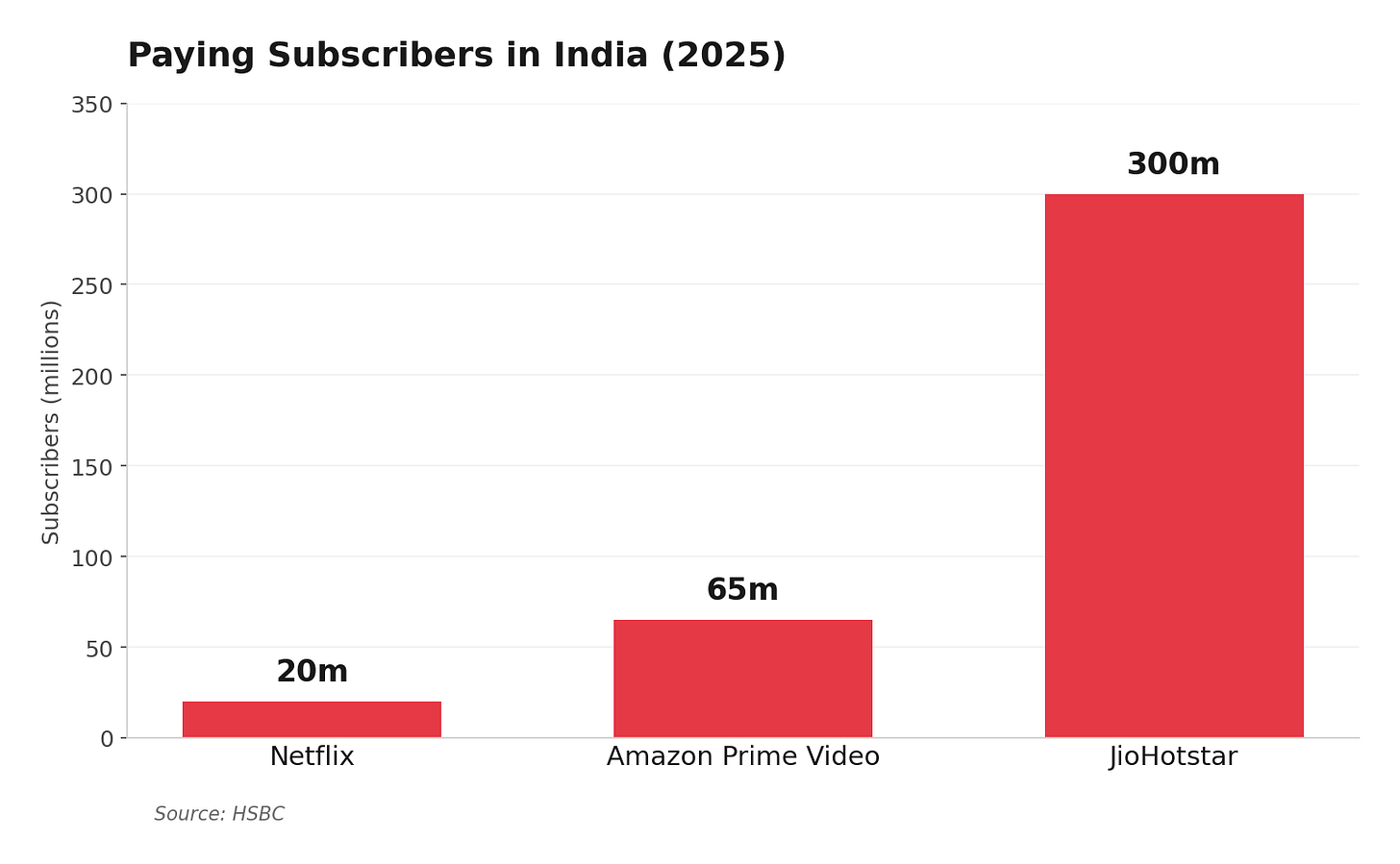

Netflix Said To Have 20 Million Paying Subscribers in India

And more than $900 million in annual revenue in India.

Amazon Prime Video has more than three times the subscribers as Netflix in India, according to HSBC.

Prime Video, which also comes bundled with Amazon's e-commerce Prime subscription, has roughly 65 million paying subscribers in India, compared to Netflix's roughly 20 million, the bank wrote in a note to clients.

JioHotstar, the market leader formed as a result of the merger between Disney and Mukesh Ambani-controlled Viacom18, leads the Indian market with over 300 million subscribers.

Only 24% of OTT users in India pay for their content, HSBC estimates. To win customers in the country, all major streaming services have lowered their prices drastically. Netflix, which entered India in 2016, charges as little as $19.5 a year for an entry-level subscription tier in the country. Amazon Prime and JioHotstar both charge $16.40 annually. Up to 90% of video consumption in India happens on mobile devices.

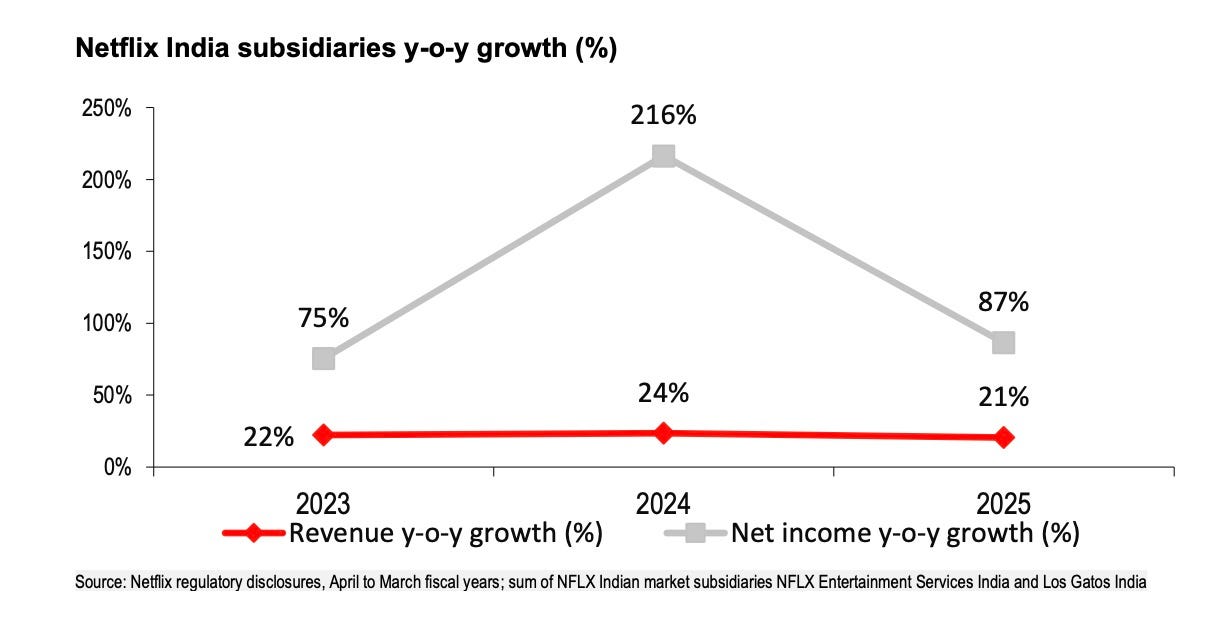

Netflix India's revenue reached $905 million in 2025, HSBC projects, representing about 2% of the company's global total. Its India subsidiaries posted a 22% revenue CAGR from 2022 to 2025 and a 118% net profit CAGR over the same period. Pretax margin sits in the low single digits.

JioHotstar's local content library spans 320,000 hours, roughly six times the size of Netflix's Indian catalogue. JioHotstar holds exclusive streaming rights for IPL cricket and for Warner Bros./HBO and Disney content in India. When JioHotstar shifted IPL viewers from a freemium model to paid subscriptions in early 2025, its subscriber base jumped from around 50 million to nearly 300 million within four months.

India's OTT market has topped 600 million users and is projected to grow revenues at a 16% CAGR through 2029. Netflix management has said the company is on the "right track" in India while acknowledging there is "a long way to go."

Video content companies in India don’t make profits. Netflix shows profits because it parks most of it’s content costs in another company registered in India :)