Pizza Margins Go To Zero, and Other Tales From India's Fast Food Troubles

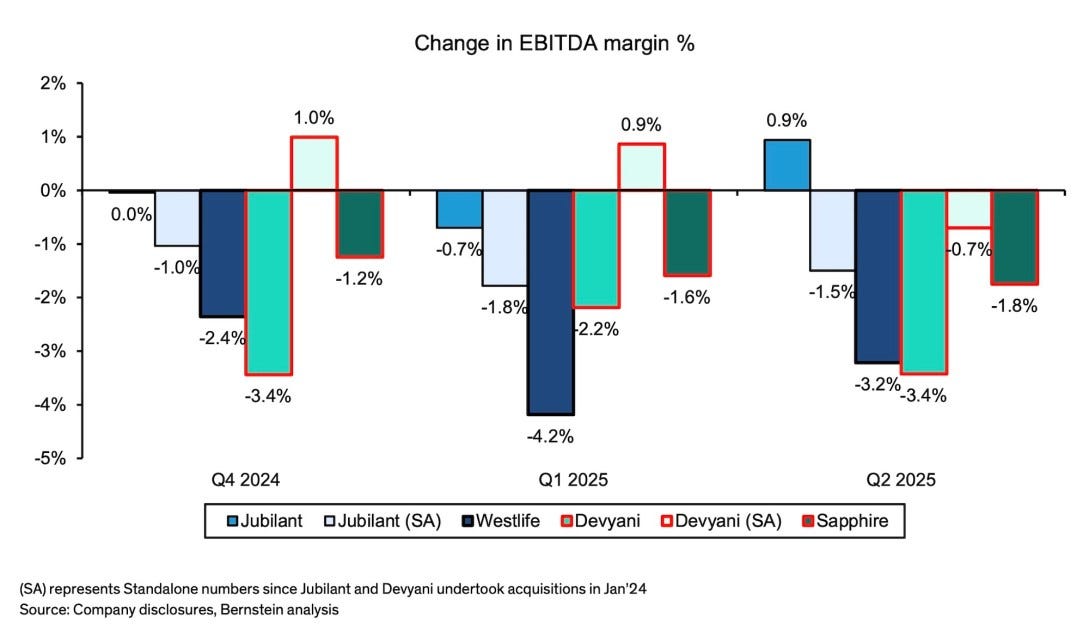

India's largest quick-service restaurant operators are confronting their first serious growth challenge as margins shrink and sales slow.

Devyani International and Sapphire Foods, which run KFC and Pizza Hut in India, have seen revenue growth fall to single digits over three quarters in 2024. This slowdown coincides with Devyani's expansion into Thailand through its KFC acquisition in January 2024.

The two companies represent different approaches to India's fast-food market. Devyani has built a diversified portfolio including coffee chain Costa and Indian brand Vaango, with KFC India now accounting for 45% of revenue after the Thailand deal. Sapphire remains heavily dependent on KFC, which generates about two-thirds of its revenue, with the rest coming from Pizza Hut and operations in Sri Lanka and Maldives.

The pressure is particularly acute in the pizza business. Sapphire's Pizza Hut unit saw restaurant margins turn negative to -2.7% in the fourth quarter of 2024.

KFC, historically the stronger performer, is also showing strain. Despite Devyani's aggressive 35% five-year store expansion rate from 2019-2024, both operators report declining average daily sales.

"The last few quarters have seen a slowdown in overall consumer demand and QSR players (representing the first line of discretionary spending) in particular, have borne the brunt of it," Bernstein analysts wrote in a note Wednesday.

The challenges stem from a fixed-cost heavy model, with approximately 95% of costs at the restaurant level. This creates significant operational leverage that amplifies the impact of sales fluctuations.

Bernstein's analysis suggests Devyani needs sustained margin improvements and continued expansion to achieve a market capitalization of 402 billion rupees ($4.64 billion) by 2030, representing a 14% compound annual growth rate from 2024. However, current market conditions complicate this path.

For Sapphire, which operates primarily in India's western and southern regions, the outlook is similarly challenging. The firm's base case projects a market cap of 118 billion rupees ($1.36 billion) by 2030, implying just a 3% growth rate from 2024.

Follow India Dispatch's WhatsApp Channel.