Private Indian Insurers Undervalued Despite Growth Outlook

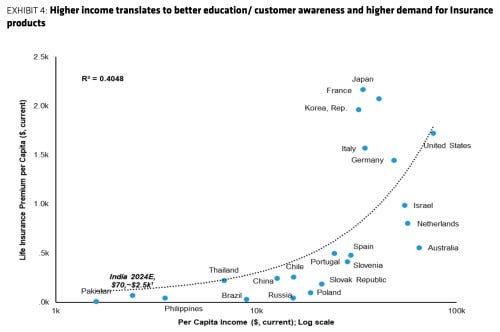

India’s private life insurance sector is set for robust expansion, with growth rates outpacing the broader industry, even as valuations remain surprisingly modest, according to a new analysis.

The analysis, by Bernstein, projects a 15% growth rate for private insurers over the next five years, surpassing the 12% growth expected for the overall industry. This bullish outlook is underpinned by significant untapped market potential, with private insurers currently serving only about 30 million of India’s 300+ million households.

Despite these strong growth prospects, the market appears to be undervaluing the sector. SBI Life and Max Financial, two leading private insurers, are trading at implied long-term growth rates of just 11% and 2% respectively, markedly lower than other sectors targeting India’s affluent consumers.

Bernstein highlights the sector’s resilience, noting that private insurers have maintained a consistent 15-16% growth in gross written premiums over the past decade. This stability is complemented by healthy returns, with major private insurers reporting returns on embedded value (RoEV) ranging from 14% to 23%.

A key growth driver identified is the current low level of coverage. The average sum assured per policy stands at a mere 0.6 million rupees ($7,500), suggesting substantial room for increasing protection levels as India’s economy continues to expand.

The post Private Indian Insurers Undervalued Despite Growth Outlook appeared first on INDIA DISPATCH.