Quick Commerce's Transformation From 'Good To Have' To 'Indispensable' Use Case

Speaking of Flipkart’s quick-commerce ambitions, a new note from UBS:

While quick-commerce or q-com (with a focus on grocery and FMCG) took off globaly during COVID, we have seen significant slowdown in growth post COVID globaly. As a result, several q-com start-ups have either closed, scaled down or made changes in their business models. India – interestingly – has been an exception to this trend. In this note, we aim to understand why and how the q-com space in India wil shape up in the coming years.

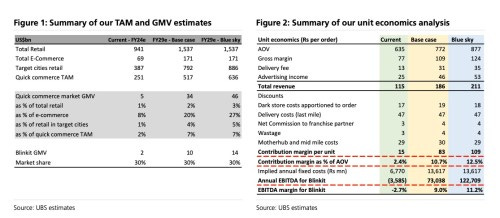

We start by sizing up the total addressable market (TAM) for q-com in India. We look at factors that are unique to the Indian retail / e-retail landscape and demography that make this a viable business. We look at categories that could drive bulk of q-com GMV and whether this can evolve in the coming years. We compare q-com platforms’ offering with other forms of e-commerce in India to understand unique problems these platforms are solving. We estimate a TAM of US$520bn for q-com with sector GMV reaching US$34bn by FY29e or 7% penetration of TAM. This would imply a CAGR of 45% over FY24-29e vs the FY24e estimated market size of US$5bn. In our bul case, we estimate GMV can reach as high as US$46bn.

We then look at unit-economics to estimate long-term margin potential for q-com. We estimate an ideal basket size or AOV required for the business to be viable. We leverage the current unit economics of food delivery segment (both in India and globaly) as reference but note the unique factors that could make q-com unit economics different from food delivery. Leveraging our expert cals with dark store franchisees and middle mile experts, we simulate the unit economics of dark stores at varying levels of scale. We estimate contribution margin (CM) of 10-11% and EBITDA margin of 9-10% by FY29e, which is higher than our estimate for food delivery.

Finaly, we look at competitive dynamics in Indian q-com space by comparing Blinkit, Instamart and Zepto on various parameters such as SKU mix, geographical footprint, pricing and monetization strategies etc. We consider the possibility of other e-commerce platforms such as Flipkart, Amazon and BigBasket entering the space as q-com evolves beyond grocery.

We believe the three large q-com platforms currently have comfortable advantage on the core infrastructure needed – rolout of dark stores and logistics infrastructure – although a more fragmented market structure over the medium term cannot be ruled out. We also look at select case studies of global q-com platforms to identify chalenges faced by them and the parameters for success.