Reliance Retail's 'Forgettable' Year

The digital transformation of India’s largest retailer has hit some speedbumps.

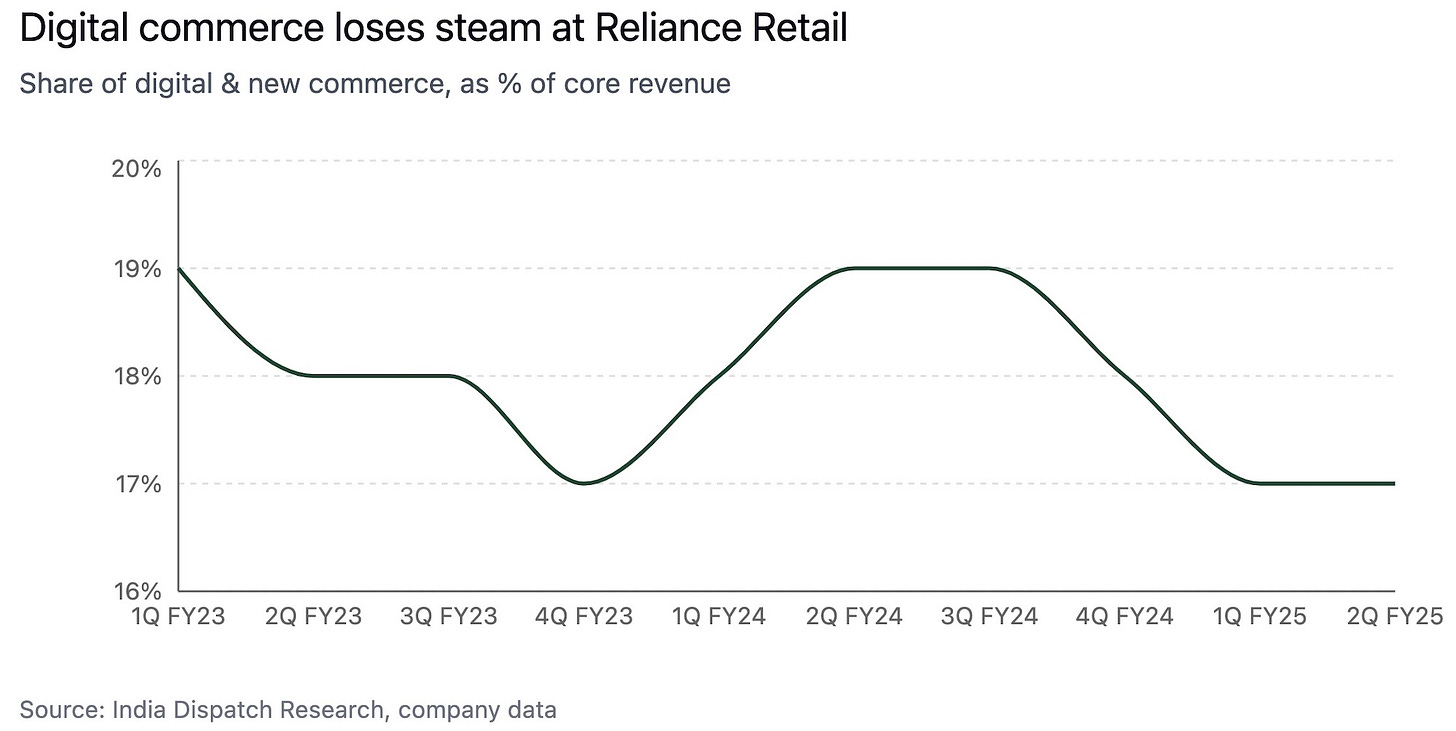

Reliance Retail, the retail arm of Mukesh Ambani’s sprawling conglomerate, has seen its share of digital and new commerce decline to 17% of revenues in its latest quarter, down from 18-19% previously. This comes after years of ambitious digital expansion and a string of acquisitions meant to position the company as India’s answer to Amazon.

The pullback appears particularly pronounced in e-B2B operations, which have seen “sharp declines” according to Jefferies.

The company’s quick commerce ventures have faced an even rougher road: Its JioMart Express service shut down after two years, while its 26% stake in rapid delivery startup Dunzo has gone sideways as that company finds itself “marginalised.”

Yet rather than admit defeat, Reliance is preparing to try quick commerce for a third time. The difference? It’s planning 30-minute deliveries rather than the 10-15 minute offerings trumpeted by competitors.

All this while the core retail business faces its own challenges. The company closed 1,185 stores in the first nine months of 2024 and saw its first-ever sequential decline in retail space, down 2.4% in the latest quarter.

Reliance Retail’s experience suggests that even with virtually unlimited capital and unmatched scale, the path from physical to digital retail remains far from straightforward.

Perhaps most telling is Jefferies’ call for “improved disclosures/transparency to allow for better appreciation of business strategy and performance.” In other words: What’s really going on under the hood?

Jefferies says 2024 was a “forgettable” year for Reliance Retail.

Follow India Dispatch on WhatsApp Channel.