Shein Faces Uphill Battle in India's Digital Fashion Race

Chinese fast-fashion sensation Shein's return to India through Reliance Retail faces a vastly different competitive landscape from the one it left in 2020.

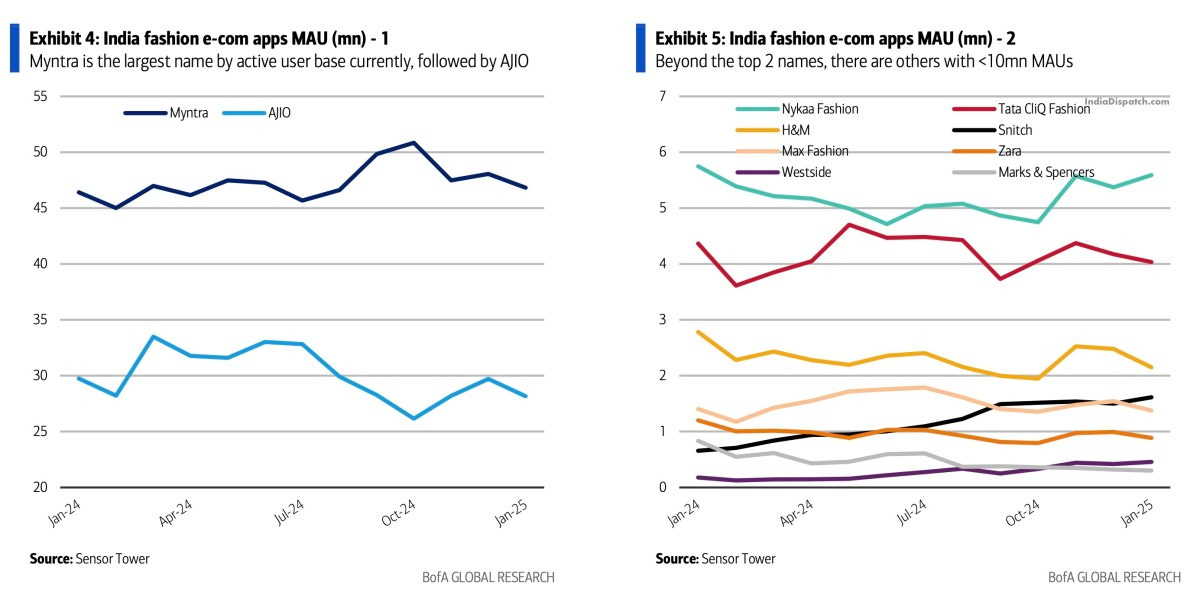

Flipkart-owned Myntra has since tightened its grip on India's digital fashion shoppers, drawing nearly 50 million monthly active users. Reliance's own fashion app Ajio has carved out a strong second place with about 30 million users.

The market then drops off sharply. Nykaa Fashion and Tata CLiQ Fashion each attract roughly 4-5million monthly users, while global brands H&M and Zara maintain modest digital footholds with 2-3 million users.

Traditional retailers have struggled to win online shoppers, with Max Fashion, Westside and Marks & Spencer each drawing barely 1-2 million monthly users. (Worth noting that these firms sell their offerings through other channels, including Myntra and Ajio.) In its previous avatar before being banned in 2020, Shein had built an impressive base of 36 million monthly users. Its return through Reliance, launching first in Delhi and Mumbai, comes as Indian shoppers are spending less per order - down from Rs996 in 2019 to Rs645 in 2024, according to Bank of America.

But this time is different: all products will be made in India, with Reliance controlling both operations and data - a stark shift from Shein's earlier direct-to-consumer model that had worried regulators.