The Great Indian IT Squeeze

When everyone wants their own Bangalore

The Indian IT sector has operated for decades under the dominance of major firms TCS, Infosys, Wipro, and HCLT. The historical growth of these companies was tightly coupled with the U.S. economy through a strong “multiplier effect,” where Indian IT export growth significantly outpaced US GDP growth. This reliable growth model is now under pressure.

The multiplier has weakened considerably, falling from a peak of 4.1x to a projected 1.6x. This is contributing to a prolonged slowdown period for India IT exports, with analysts anticipating a recovery — of some kind — that will be more “gradual” than the sharp rebounds seen after the global financial crisis and the COVID-19 pandemic.

In the most recent quarter, four out of the five largest Indian IT companies reported a quarter-over-quarter revenue decline. Three out of the five largest firms reported a year-over-year revenue decline.

A primary factor in this slowdown is a clear shift in client spending priorities. While overall enterprise technology spending remains strong, clients are now allocating a larger portion of their budgets to core digital infrastructure, such as cloud platforms and SaaS platforms, over traditional IT services.

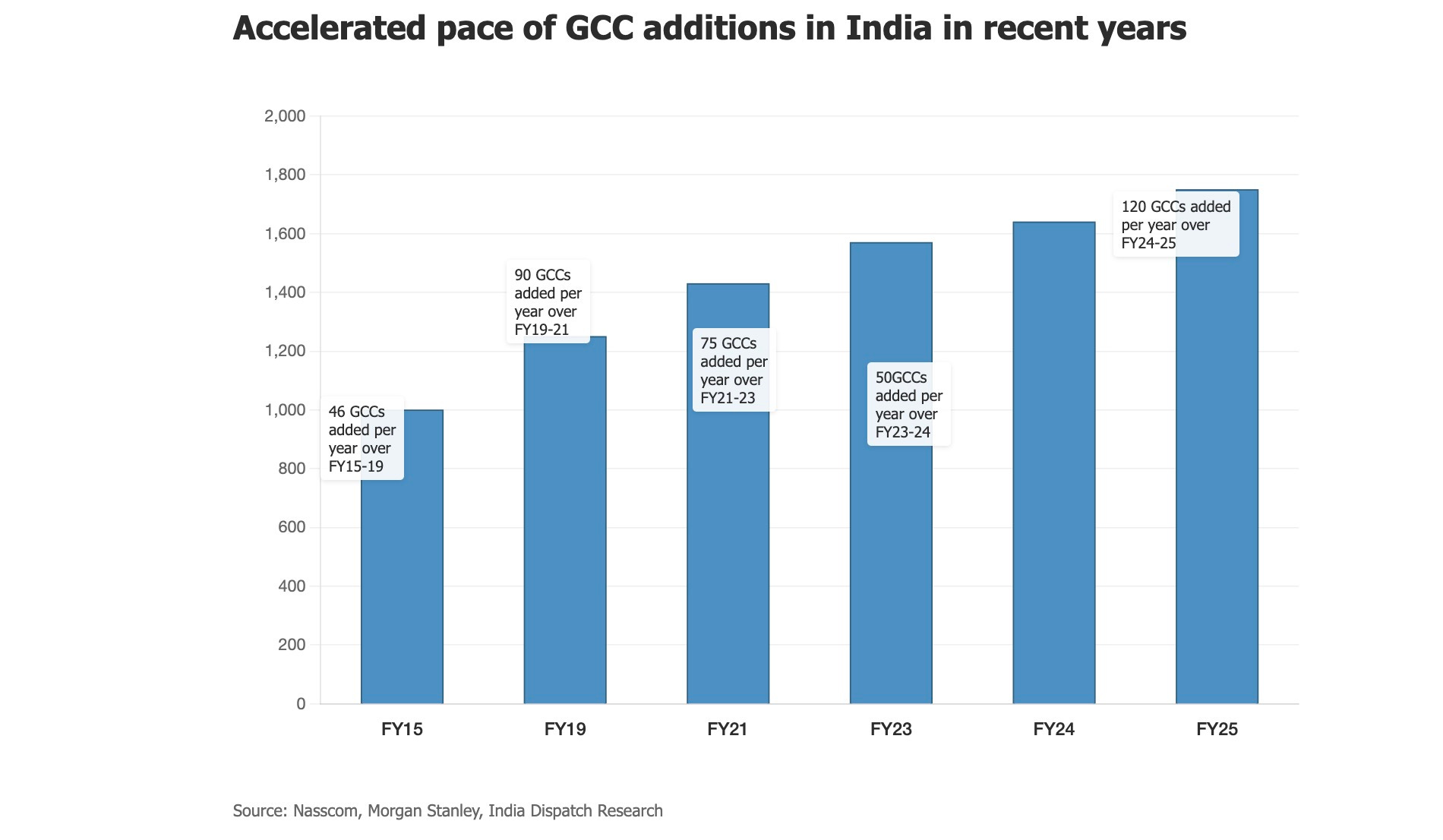

The firms are facing challenges on multiple fronts. Global corporations are increasingly establishing their own global capability centers in India, with projections indicating an accelerated pace of 120 new centers being added annually in fiscal years 2024 and 2025, up from some 40 six years ago. This insourcing trend diverts revenue from traditional IT vendors and creates direct competition for skilled technology talent.

The pressure on profitability is acute because the industry’s traditional defensive measures against downturns are failing. The levers used to protect margins — such as efficiency gains and deferring wage hikes — are now “largely exhausted after nearly three years of subdued demand,” Kotak wrote on Tuesday.

Global competitors are also reasserting themselves. US-based Cognizant, after losing ground in prior years, is now gaining market share, reporting strong TTM order bookings (up 6% YoY) and raising its revenue growth guidance for the year. The company’s BFSI vertical grew by a strong 6% YoY in constant currency, signaling heightened competition in a key sector for Indian firms.

The IT sector is also experiencing significant internal fragmentation and varied performance among the major players. As deal sizes have come down, nimbler mid-cap firms are achieving higher 5-year compound annual growth rates than their large-cap counterparts. Even among the large firms, fortunes have diverged. TCS, the industry’s largest player, has lost market share in its core industry verticals, and its stock has fallen the most among peers year-to-date in 2025 (a decline of 25.14%).

In response to margin pressure, TCS reported last week that it was pruning 2% of its workforce, mostly at the mid-senior level, to maintain its aspirational 26-28% EBIT margin band. In contrast, Wipro has announced two major deals — $500 million telecom contract and a $650 million BFSI deal — after a multi-year gap without wins of that magnitude.

However, the recent wave of strong deal announcements are masking a challenging reality. Many of these deals are not new to the industry but are vendor consolidations that involve replacing one firm with another, making them inherently margin-dilutive. The client ends up being the beneficiary, not the industry.

AI presents a complex, double-edged challenge. While creating new project opportunities, it is also exerting immediate deflationary pressure on existing revenue streams. Clients are now actively renegotiating contracts to build in AI-driven productivity gains. Infosys, for example, reports achieving productivity improvements of 5-15% from AI in various service lines, but these benefits are often being shared with clients, which can limit the net revenue impact. This trend threatens the traditional effort-based services model that has long been the financial foundation of the industry.

Investor sentiment is reflecting these mounting challenges and the uncertain outlook. The Nifty IT index now trades at parity with the broader Nifty 50 index, a valuation level historically associated with crisis periods. The index is also trading at a significant 20-22% discount to the tech-heavy Nasdaq, a level of pessimism last seen during the Silicon Valley Bank crisis. Consensus earnings-per-share estimates for fiscal year 2026 have been revised downwards for most firms since the start of 2025, with cuts as high as 11.9% for LTIMindtree.