The Mystery of Reliance's Quick Commerce Growth

The rest of the industry is not feeling it.

India’s largest retail chain is reporting impressive growth in quick commerce, but the industry is not buying it.

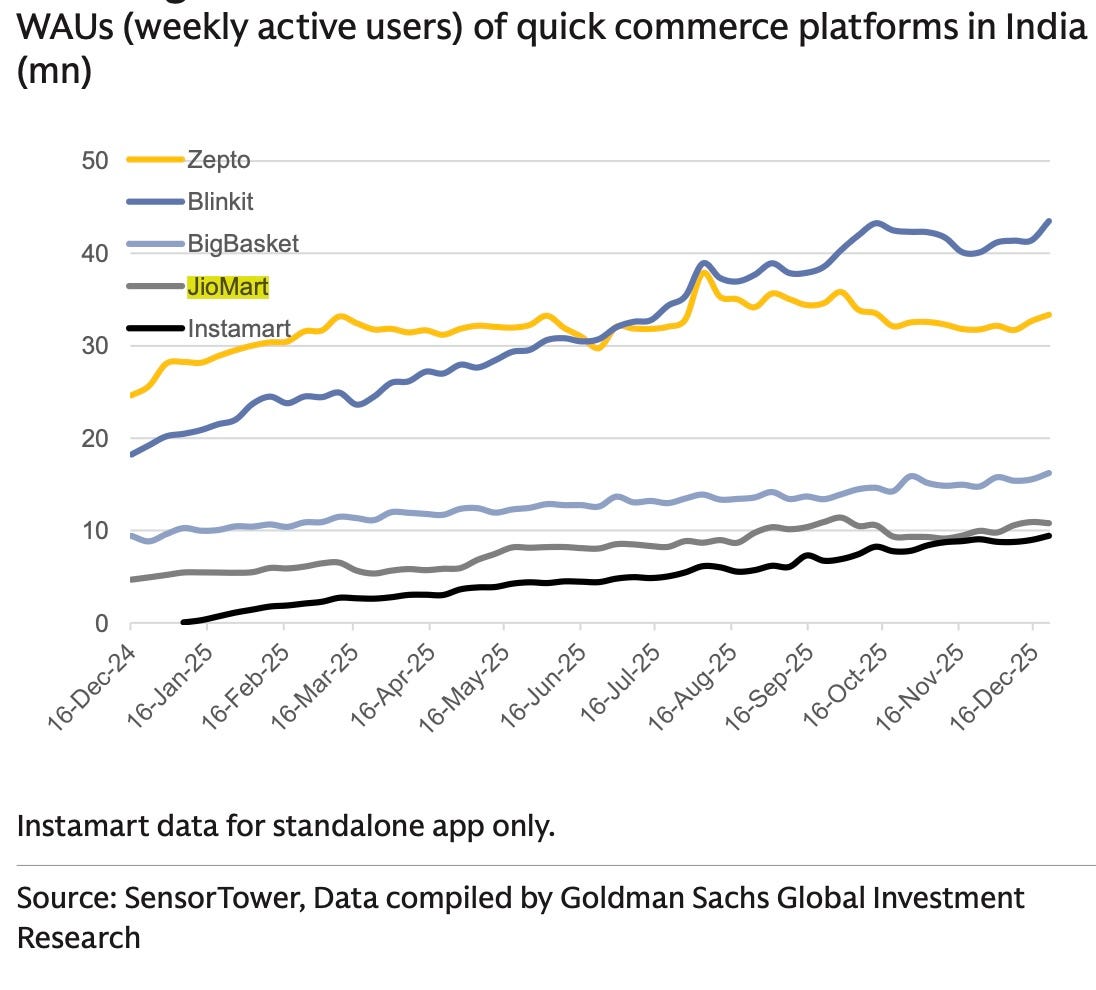

Reliance, the most valuable company in India, said on Friday that daily orders on its hyper-local commerce service hit 1.6 million at peak during the quarter ending December. This is a peak figure, not a daily average. Compared to Blinkit’s 2.4 million daily orders in the quarter ending September, it’s still something. The company, management said on an earnings call, aims to become the second largest quick commerce player in the category.

These are tall claims from the country’s largest retail chain that raised capital at $100 billion valuation in 2023. But curiously, public market institutional investors, analysts and leadership at the current top three quick commerce players are not worried about Reliance or its claims. It’s not arrogance. They are simply not seeing much of Reliance on the battleground.

Reliance Retail, whose quarterly revenue is larger than the annual GMV of all Indian quick commerce players combined, prefers to avoid the “quick commerce” label. It goes with “hyper-local commerce” instead. Its version of quick commerce promises delivery in 30 minutes, or thereabouts. The Big Three (Blinkit, Zepto, Instamart), in comparison, focus on delivering most orders within 15 minutes.

Quick commerce is important to Reliance. Growth has been slow at Reliance Retail and the unit has struggled to make inroads with traditional e-commerce despite many gimmicky partnerships.

Reliance wants to own the narrative that it is beginning to move the needle meaningfully in quick commerce. This would help, the company believes, puncture the prospects of traditional e-commerce giants that have barely scratched the overall retail surface and are suddenly nowhere to be found in the quick commerce race.

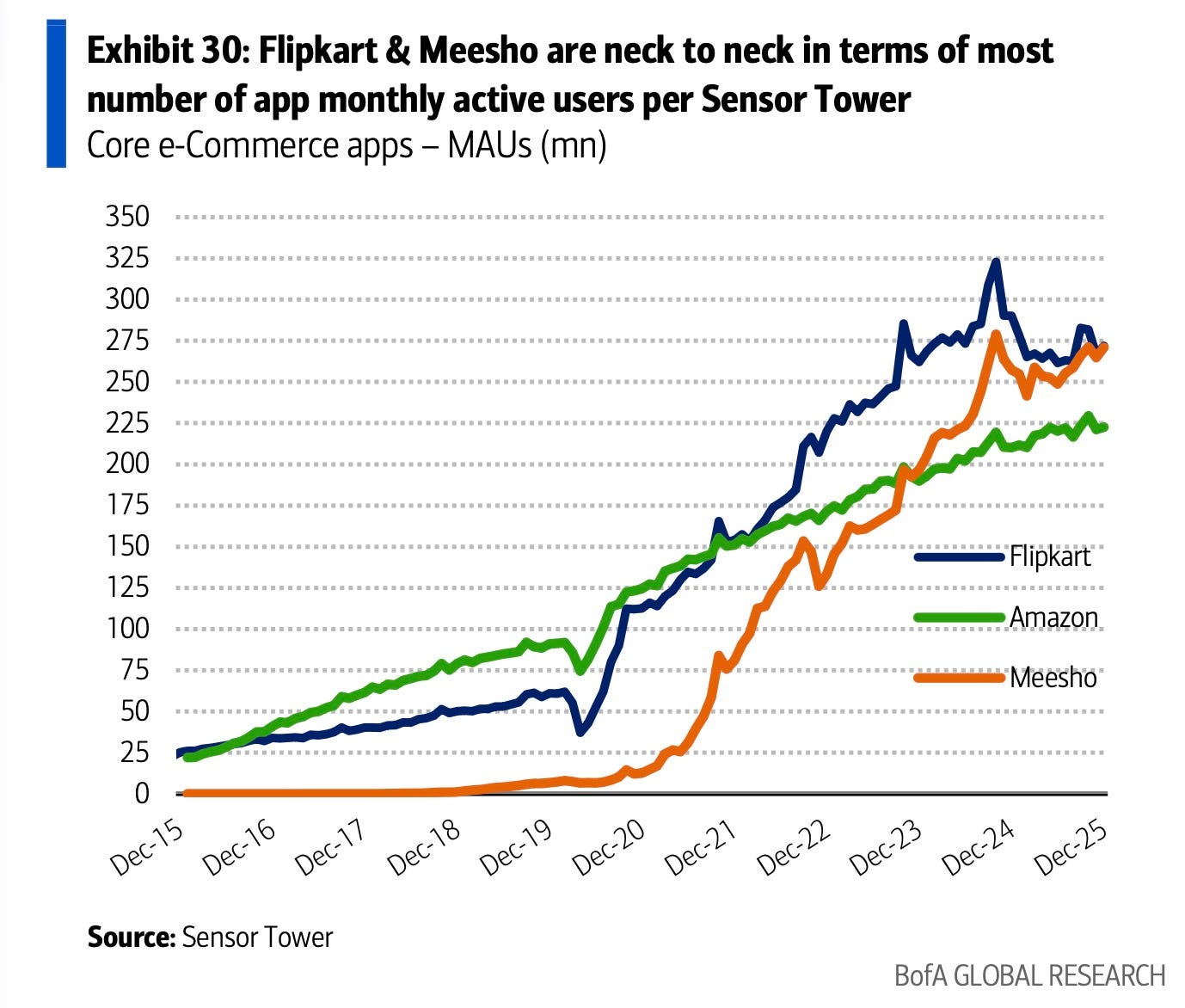

So why is nobody taking Reliance’s claims at face value? In tier 1 India, JioMart, Reliance’s digital commerce app, is rarely ever part of any conversation. But that’s fine, a majority of people in tier 1 are also not customers of Meesho. But unlike Meesho’s value commerce play, quick commerce is not yet a tier 2 and beyond story, so who precisely is using JioMart and placing quick commerce orders there?

The thing with Meesho is that even those who are not Meesho customers know for a fact that Meesho has many customers.

JioMart, in comparison, is far behind Blinkit and Zepto.

I don’t doubt Reliance’s figures. But either its metrics measure something different from what the Big Three report, or the market is wrong to discount it. Either way, some correction is due.