UBS Gives BlinkIt $15.4 Billion Valuation

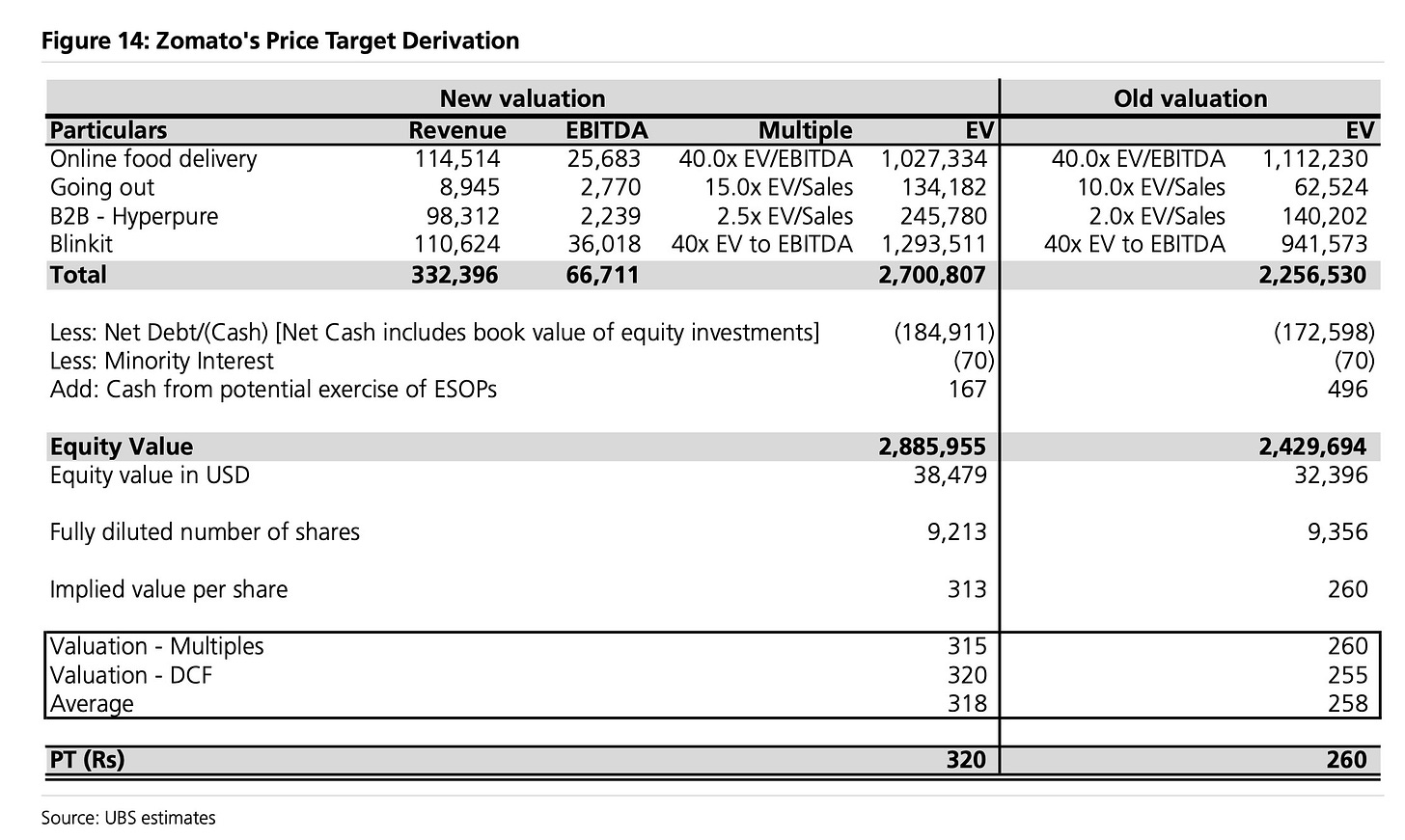

UBS has raised its price target for Indian food delivery company Zomato by 23% to 320 rupees ($3.82), citing strong growth potential in its Blinkit quick commerce business.

The bank’s valuation implies a $15.4 billion enterprise value for Blinkit alone, accounting for nearly half of Zomato’s total valuation in UBS’s model. This represents a significant premium to Zomato’s current market capitalization of about $26.9 billion. Zomato acquired BlinkIt in 2022 for less than $600 million.

UBS forecasts Blinkit’s gross merchandise value to reach over $12 billion by fiscal year 2029, implying a compound annual growth rate of 50% from FY2024 levels. The bank expects Blinkit to achieve contribution margins of 9.7% and EBITDA margins of 7.9% by FY2029.

UBS raised its gross merchandise value estimates for Blinkit by 20-30% for FY2026-28, driven by higher user numbers. The bank now expects Blinkit to double its dark store count to 2,000 by the end of 2026.

For Zomato’s core food delivery business, UBS increased revenue estimates by 2-3% but lowered EBITDA forecasts by 13-15%, expecting more gradual margin expansion.

The 320 rupee price target implies 21% upside from Zomato’s current share price. UBS says Zomato trades at 35 times FY2027 estimated EV/EBITDA, versus an average of 30 times for Indian consumer and retail peers, but argues this premium is justified by superior growth and margin expansion potential.