UBS Trims Smartphone, PC Forecasts While India Emerges as Production Winner

India's role in the hardware manufacturing landscape is poised to strengthen as manufacturers seek to diversify from China

Analysts at UBS and Gartner have significantly reduced their growth forecasts for global PC and smartphone markets as a result of mounting pressures from trade tariffs and broader macroeconomic uncertainties that are expected to impact consumer demand through 2026.

India’s role in the hardware manufacturing landscape is poised to strengthen as manufacturers seek to diversify from China, with PC shipments in the country forecast to increase by just 1.6% year-on-year to 186 million units in 2025 and by 0.7% to 188 million units in 2026. The smartphone market in India faces similar headwinds, though analysts note the country stands to benefit as both Apple and Samsung shift more production away from China to avoid punitive US tariffs.

In a pair of research reports sent to their clients on Wednesday, UBS and Gartner revised down their global PC shipments forecast for 2025 and 2026 from previous estimates of 5% and 4% growth to just 2% for both years, citing the potential impact of trade policy and macroeconomic headwinds. The investment bank and Gartner also cut their global smartphone shipment growth forecast for 2025 to 1% (1,235 million units) from 2%, while reducing its 2026 projection from 1% growth to flat at 1,235 million units.

The outlook is particularly grim for the US market, which accounts for 24% of global PC units and 31% of global PC value. UBS expects the region to be disproportionately affected by tariff measures, projecting US PC demand could decline by 1.1% in 2025 before registering a modest 0.8% recovery in 2026, significantly underperforming compared to the mid-single-digit growth forecasts for other regions.

“We expect the tariff burden to disrupt PC demand by H225 once tech and reciprocal tariffs move ahead,” UBS analysts wrote in a note. “A 20% average hike on the bill of materials for US PCs could see some absorbed by the supply chain and some price hike that dampens ~10% of PC demand.”

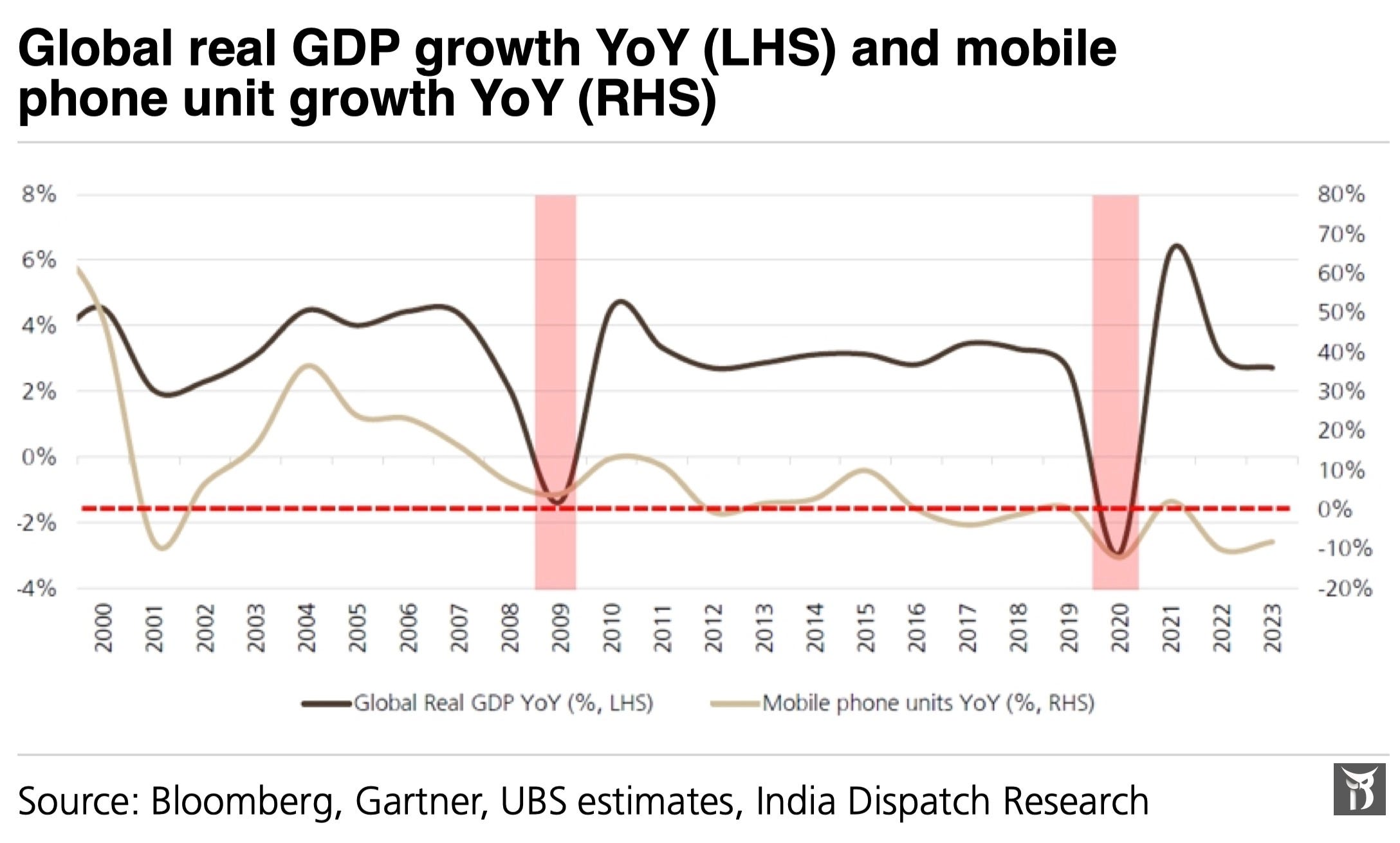

For smartphones, the recent suspension of “reciprocal” US tariffs has provided some temporary reprieve, but significant pressure points remain, including a 20% base tariff for China-manufactured devices and 10% for products from countries including India and Vietnam. The bank noted that despite these challenges, there is only a 47% correlation between GDP growth and mobile phone units over time.

The bank observed that current “rush orders” are still coming through in the near term, as channels and brands actively restock inventories ahead of tariff announcements. Global PC shipments saw a better-than-expected 4.8% year-on-year growth in the first quarter of 2025, outpacing UBS’s previous forecast of 3.1%. The top five Taiwanese notebook ODMs saw an above-seasonal minus 6% quarter-on-quarter but plus 3% year-on-year growth in notebook shipments in Q1, reflecting pull-ins ahead of tariffs and some existing build plans for Windows 10 end-of-life.

Apple, which held 56% market share in the US smartphone market in 2024 with the US representing 30% of its total iPhone units, is expected to “flex up India production as much as possible to cover a portion of the US market,” according to the analysts. India currently accounts for about 5% of iPhone units sold globally. Samsung, with its more diversified manufacturing footprint spread across Vietnam (50%), India (24%), China (15%) and Korea (10%), appears better positioned to navigate the shifting tariff landscape.

Commercial PC shipments have been cut more aggressively than consumer models in the revised forecast, with UBS lowering its projection for commercial units from 169 million/176 million (7.5%/4.3% YoY growth) to 163 million/166 million (3.5%/2.3% YoY growth) for 2025/26. The consumer PC forecast was reduced from 88 million/91 million (0.6%/3.2% YoY) to 87 million/88 million (-0.9%/2.0% YoY). The bank attributed the larger cut to commercial PCs to corporations potentially deferring upgrade cycles as business uncertainty rises amid stagflationary pressures.

Hello Manish,

I hope this communique finds you in a moment of stillness.

Have huge respect for your work.

We’ve just opened the first door of something we’ve been quietly handcrafting for years—

A work not meant for everyone or mass-markets, but for reflection and memory.

Not designed to perform, but to endure.

It’s called The Silent Treasury.

A place where conciousness, truth and judgment is kept like firewood: dry, sacred, and meant for long winters.

Where trust, vision, patience, resilience and self-stewardship are treated as capital—more rare, perhaps, than liquidity itself.

This first piece speaks to a quiet truth we’ve long sat with:

Why many modern PE, VC, Hedge, Alt funds, SPAC, and rollups fracture before they truly root.

And what it means to build something meant to be left, not merely exited.

It’s not short. Or viral.

But it’s a multi-sensory experience and built to last.

And, if it speaks to something you’ve always known but rarely seen heartily expressed,

then perhaps this work belongs in your world.

The publication link is enclosed, should you wish to experience it.

https://helloin.substack.com/p/built-to-be-left?r=5i8pez

Warmly,

The Silent Treasury

A vault where wisdom echoes in stillness, and eternity breathes.