The Indian Retailer Beating Zara and H&M at Their Own Game

Zudio, the Tata-owned retail chain, generated $1 billion in sales across 765 stores — three times Zara India's $330 million in revenue.

As Zara and H&M deepen their presence globally and expand e-commerce efforts, they are both struggling to answer a fast-growing local rival in India that has built the country’s largest fashion retail business by making customers queue at checkout counters staffed by actual humans.

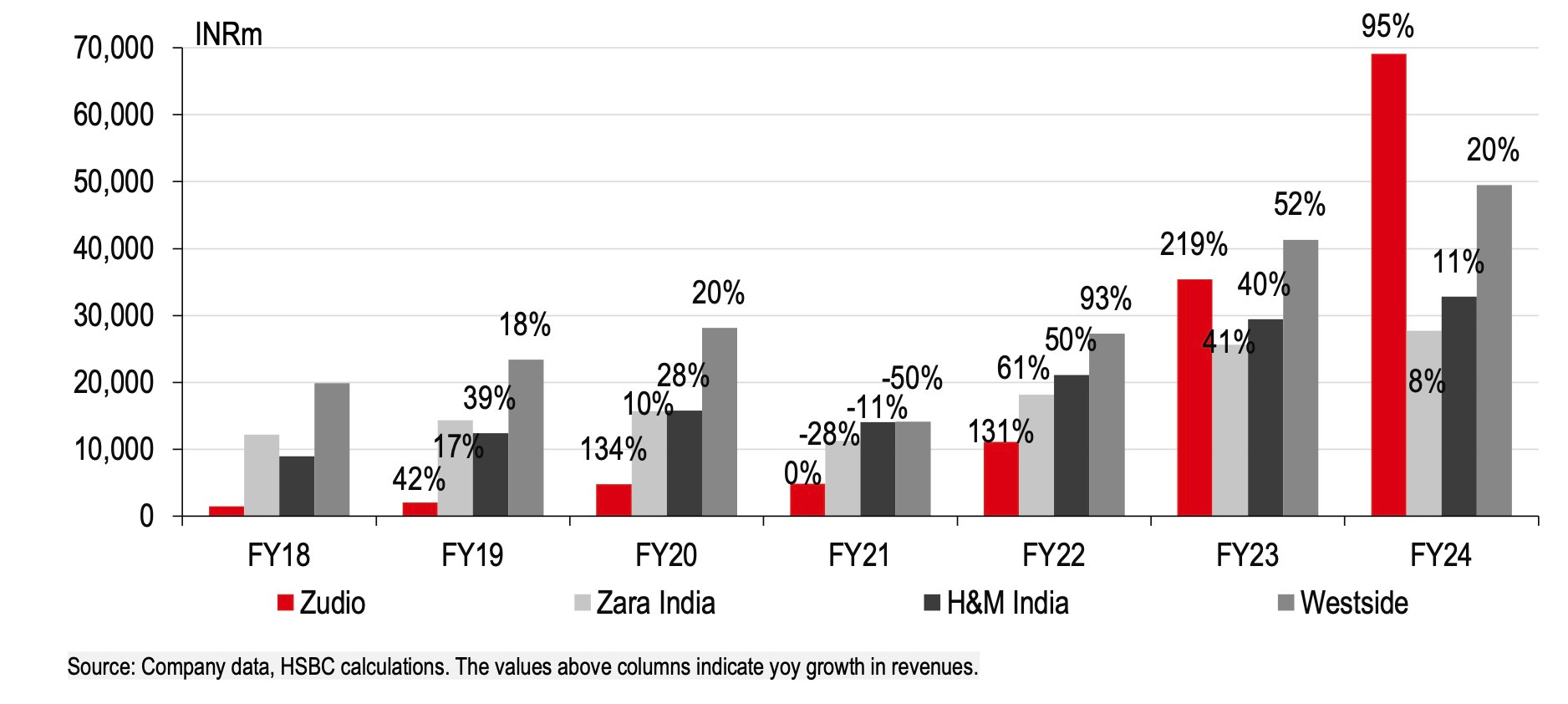

Zudio, the Tata-owned retail chain, generated $1 billion in sales across 765 stores — three times Zara India’s $330 million in revenue and is making H&M’s Indian operations look like a rounding error.

Zudio added 220 stores in fiscal 2025, a 40% year-on-year expansion that coincided with crossing the billion-dollar revenue milestone, while simultaneously expanding internationally with two stores in Dubai generating $3 million in revenues.

Zara India’s store count has remained relatively stable in India while its revenues have plateaued around the same levels for several years, despite the Spanish chain’s reputation for sophisticated global supply chains that move runway trends into stores within weeks. H&M’s Indian operations, in comparison, have posted negative growth in recent years, unable to establish a clear position between Zara’s premium pricing and local alternatives that better understand Indian consumer capacity.

Zudio has not only outperformed its global rivals, but also its sister property, Trent’s other retail format Westside, which consolidated 24 stores in fiscal 2025, representing 10% of its network compared to the historical 3-5% consolidation rate. (Fun fact: It was Tata that played a pivotal role in bringing Zara to India.)

Zudio stores require investment of $360,000-480,000 per location compared to Westside’s $960,000-1.08 million, creating capital efficiency advantages that international chains have struggled to match while maintaining their global brand standards. Zara stores occupy prime mall locations with carefully designed interiors that emphasize premium positioning, while Zudio operates stores where customers queue at traditional checkouts and browse by walking through aisles rather than using digital interfaces or contactless payment systems.

The fundamental business model differences extend to pricing strategies that reflect different understandings of Indian consumer reality. Zudio management said at an investment bank conference recently that “disposable incomes are not growing as far as the aspirations,” a market condition that the firm addresses by offering clothing at price points accessible to middle-class consumers in smaller cities, while Zara maintains premium positioning with items often priced above $50 even in the Indian market. Zudio captured the price segment up to 300 Indian rupees ($3.50) that was previously “dominated by the unorganized segment, with very few brands present,” creating a white space opportunity that international brands largely ignored.

Zudio drops new collections every Friday and sources 90% of its products domestically, creating a localized fashion cycle that responds to Indian preferences rather than global trends. This approach contrasts with Zara’s global network that optimizes for speed and trend replication across markets, and H&M’s reliance on global sourcing that prioritizes cost efficiency over local customization and market-specific consumer behavior.

The company’s focus on physical retail execution has produced measurable advantages in customer satisfaction and operational efficiency. Trent achieves “one of the lowest return ratios in online fashion” and maintains 80-85% full-price sales compared to industry averages, indicating that customers who experience Zudio’s physical retail environment are more satisfied with their purchases than those shopping through digital channels or other retail formats.

Zudio now holds 13.8% of India’s organized value fashion market compared to Westside’s 3.8% share of the organized mid-premium segment, underscoring how the value segment offers greater scale opportunities than the premium positioning that international chains typically pursue. Zudio targets tier-2 and tier-3 cities that international chains largely bypassed, serving consumers who were previously underserved by organized retail, while Zara and H&M concentrated on metro markets and affluent consumers who already had access to international brands.

Zudio has expanded beyond clothing into beauty products, footwear and innerwear, creating what management describes as an “aspirational set-up” for customers who prefer physical shopping experiences over digital alternatives. The chain’s beauty business represents a long-term bet consistent with what Trent calls its playbook of 100% own brands delivered through quality retail environments that prioritize customer engagement over operational efficiency metrics.

Zudio’s expansion continues with plans to enter new cities and product categories, having demonstrated that understanding local consumer behavior and delivering value through traditional retail formats can outperform both sophisticated international strategies designed for different markets and e-commerce platforms that assume digital-first consumer preferences across all demographic and geographic segments.