Airtel-Tata DTH Merger Would Create Dominant Player in Shrinking Indian Pay TV Market

Bharti Airtel has confirmed it is in bilateral discussions with Tata Group to combine their direct-to-home television businesses, a move that would create a dominant player controlling over 61% of India’s pay TV market.

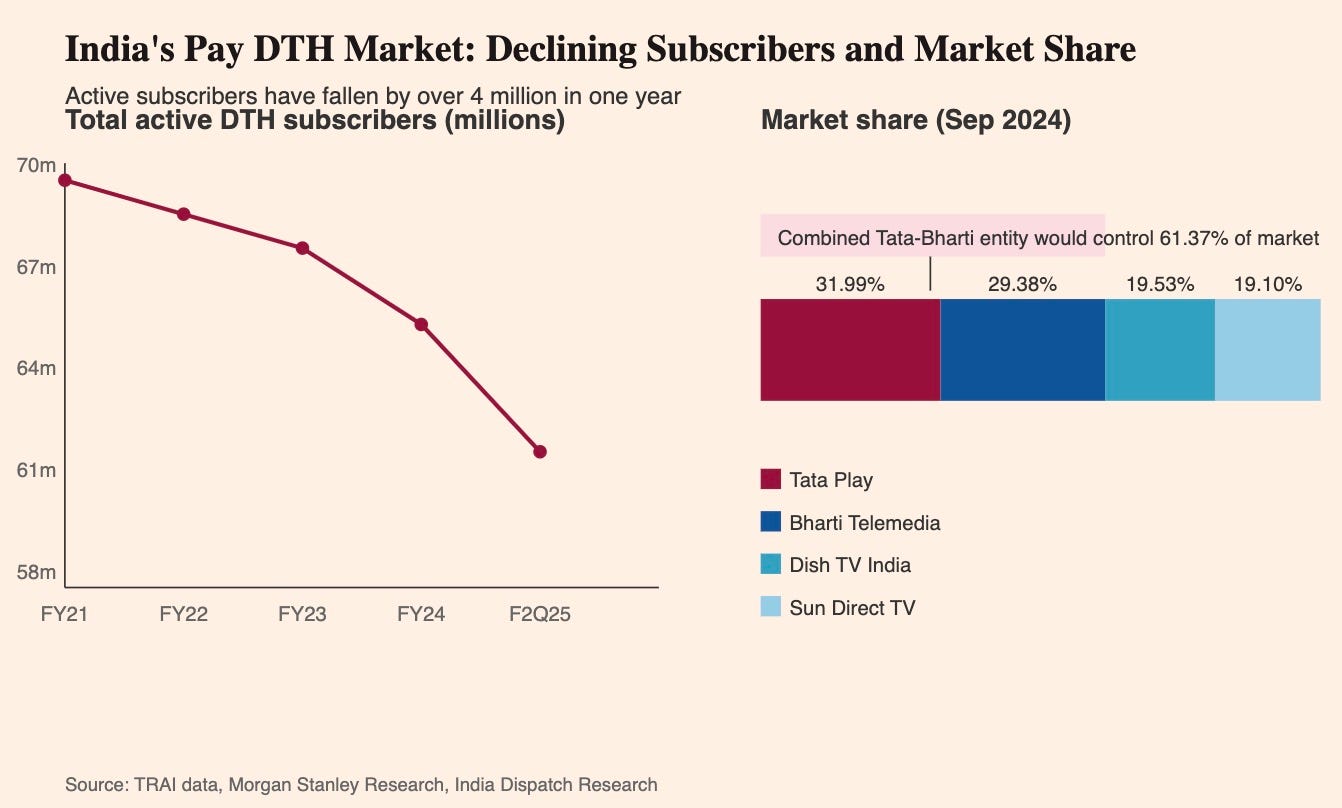

The proposed merger comes as India's DTH industry faces significant subscriber losses, with active customers falling by over 4 million in the year to September 2024, according to telecom regulator TRAI. Total subscribers across the four pay DTH operators now stand at 59.9 million, down from 66.6 million in December 2022.

Tata Play currently leads the market with a 31.99% share, followed by Bharti Telemedia at 29.38%, while Dish TV India and Sun Direct TV hold 19.53% and 19.1% respectively.

Bharti's DTH business generated revenue of Rs30.4 billion in fiscal year 2024 with EBITDA of Rs17.2 billion and a 56.3% margin. Meanwhile, Tata Play's revenue declined 4.3% to Rs43 billion in FY24, with the company reporting a net loss of Rs3.5 billion, widening from a Rs1.1 billion loss the previous year.

For Bharti Airtel, which has seen its DTH subscriber base increase modestly to 16.1 million (up 1.3% year-on-year), the merger would strengthen its strategy of creating service bundles. The company reported that 43% of all broadband customer additions in Q4 FY24 came through converged plans.

"We believe consolidation is positive, especially in an industry that is going through its own challenges in terms of subscriber loss, competition from free Dish from the government, disruption from broadband players in bundling TV services with broadband and OTT services," Morgan Stanley analysts noted in a note Thursday.

The deal, reportedly structured as a share swap with Bharti taking a 52-55% stake, would help the company "accelerate its journey of bundling more customers with multiple services and increase reach of its broadband services," the analysts wrote.