Amazon, Flipkart and Meesho Are Driving Logistics Shakeout in India

Amazon, Flipkart and Meesho control 82% of India parcel volumes

India’s express parcel delivery ecosystem — the vast network of logistics operations that handles business-to-consumer shipments from e-commerce platforms to end customers’ doorsteps — is experiencing major transformation and consolidation.

This critical infrastructure, which managed over 2 billion shipments in the financial year ending March and forms the backbone of India’s digital commerce scale, includes everything from warehousing and sorting centers to last-mile delivery networks. This entire system is being reshaped by the outsized influence of the country’s three dominant e-commerce platforms: Amazon, Flipkart and Meesho.

These so-called “Big Three” now control approximately 82% of India’s express parcel shipment volumes, according to ICICI Securities. “This is indicative of the disproportionate power exercised by the Big 3 horizontal platforms,” said Abhisek Banerjee, equity analyst at ICICI Securities. “Their dominance has forced a structural reorganization of the entire logistics ecosystem.”

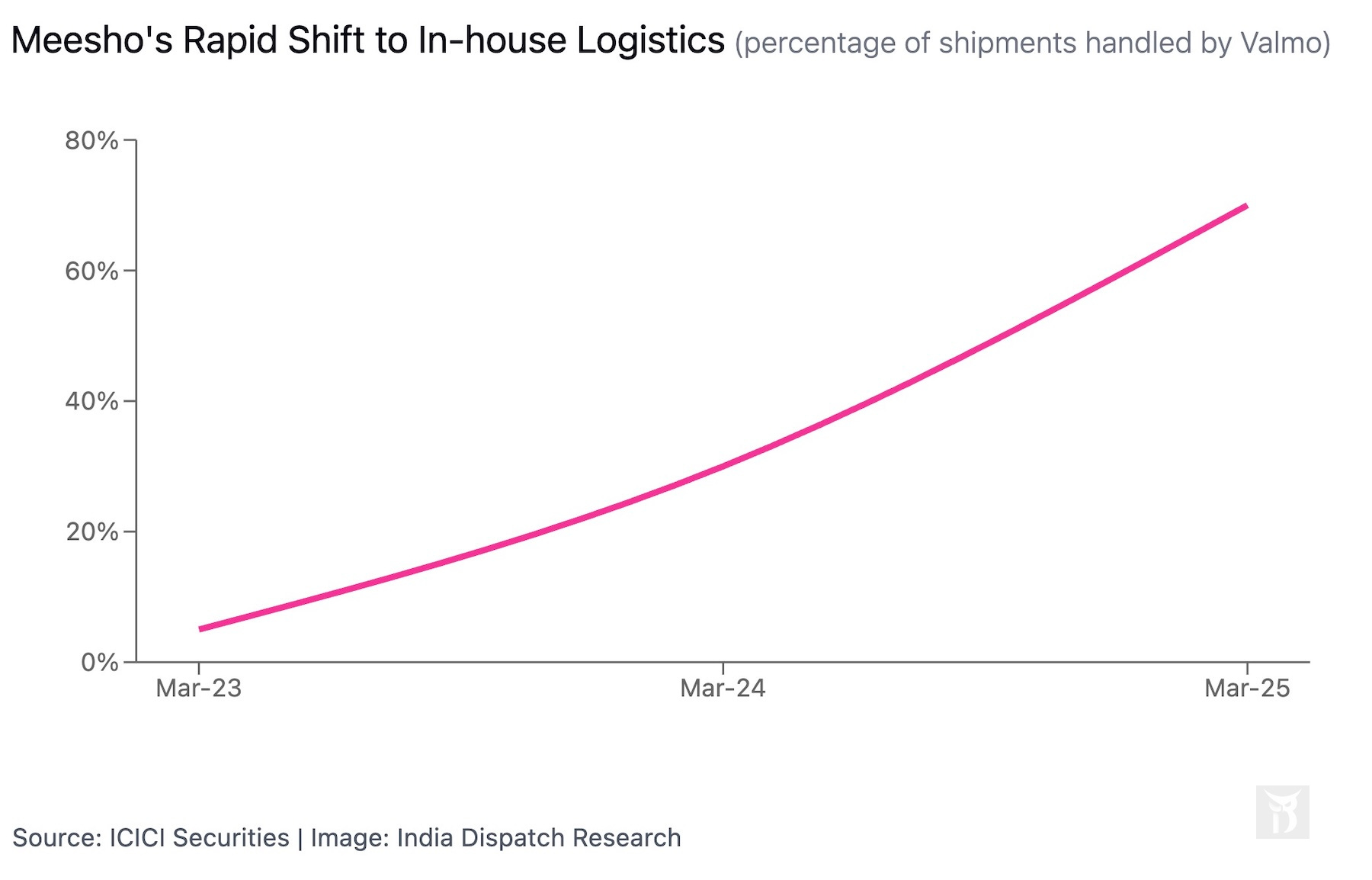

The most dramatic shift has come from SoftBank-backed Meesho, which launched its own logistics arm Valmo two years ago. Meesho has aggressively increased its in-house shipment handling from just 5% in March 2023 to approximately 30% by March 2024, and further to 70% by March this year, the bank said.

The share of captive shipments — deliveries handled by the platforms’ own in-house logistics arms rather than independent third-party logistics providers (3PL) — across all e-commerce platforms has grown from 52% in the financial year ending March 2023 to 61% in the fiscal year that ended this March and is projected to reach 67% by FY26, according to ICICI.

This represents a significant power shift away from independent logistics providers toward platform-controlled operations.

The dominance of the Big Three has forced smaller 3PL providers — many of which previously relied heavily on these platforms for volume — into a difficult position. The 3PL segment saw overall volume decline by approximately 3% year-over-year in FY25, with shipments from the top three e-commerce players falling by 13%.

In response, the market is moving toward consolidation. Delhivery recently announced its acquisition of Ecom Express for about $165 million, accounting for a price-to-sales ratio of just 0.5x based on FY24 revenue. This deal is “one of the first steps towards consolidation” in the industry, Morgan Stanley said.

The companies that have best weathered this transformation are those that have found ways to reduce dependence on the Big Three or carved out specialized niches.

Delhivery managed to grow its express parcel volumes by 2% YoY in the fiscal year ending this March despite the overall market contraction, gaining 190 basis points in market share. Its resilience stems from its diversified client base with a stronger focus on vertical e-commerce platforms and direct-to-consumer brands — segments less dominated by the Big Three.

Shadowfax, a Bengaluru-headquartered startup that intends to go public in the next two to three quarters, has repositioned itself by concentrating on specialized services such as return logistics, next-day delivery, and same-day delivery — segments where the Big Three have not yet fully extended their reach.

The Big Three’s dominance has created significant financial pressures on 3PL providers. Morgan Stanley’s analysis shows service-level EBITDA margins for express delivery declining from 14% in FY22 to 5.9% in FY23 before recovering to 11.6% in FY24 for Delhivery.

“With tight PE/VC funding in this sector and consolidation on the 3PL side, we see room for right-sizing capacity and driving better unit economics for 3PL companies in the medium term,” Morgan Stanley wrote in a recent note.

The concentration of power raises questions about market competition, ICICI cautions. While regulators have approved Delhivery’s acquisition of Ecom Express, the continued dominance of the Big Three e-commerce platforms may eventually attract regulatory scrutiny regarding potential oligopolistic market structures that could disadvantage smaller players and consumers.