In India, Direct Mutual Funds Are Actually Working

A new Bernstein report examines India’s mutual fund industry, where fintech startups are driving a significant shift in distribution channels – with an unusual beneficiary: the end investor.

Indian regulators introduced “direct” mutual fund plans in 2013, allowing investors to bypass traditional distributors and their associated commissions. These direct plans carry lower expense ratios than “regular” plans, which include distribution fees.

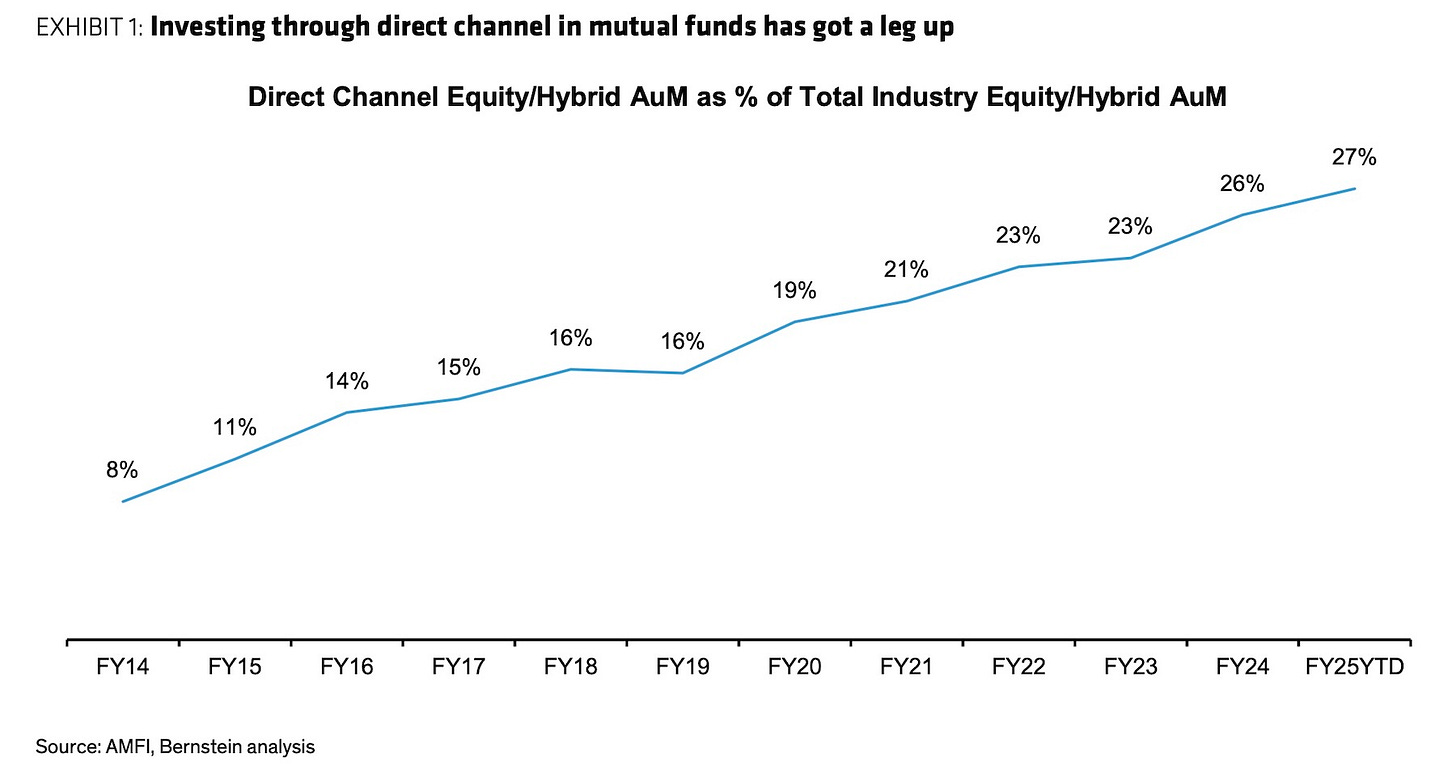

The impact is now visible. Direct channels account for 27% of equity and hybrid fund assets, up from 8% in 2014, driven by platforms including Zerodha and Groww offering commission-free funds. These digital broking apps use mutual funds as a customer acquisition tool.

The numbers are significant. Traditional distributors typically extract 56% of total expense ratios as commissions on the largest active equity and hybrid funds. In direct plans, these savings flow to investors.

Yet, there are important caveats. Bernstein’s channel checks indicate direct platform flows are more performance-sensitive than traditional channels, which demonstrate “relatively more patience and nuanced fund selection.” The stickiness of these investments remains untested.

Asset managers see no direct benefit – they earn identical management fees regardless of distribution channel. While HDFC AMC and Nippon have “selectively rationalized commissions on popular schemes,” Bernstein argues the direct channel lacks scale to meaningfully alter distributor dynamics.

Traditional distributors retain significant market share, particularly given that flows to mutual funds now trend towards more than 15% of household savings. The rise of family offices adds to direct channel growth.

The key point: unlike typical fintech disruption where new intermediaries capture economics from incumbents, India’s direct mutual fund system is functioning as intended. The regulatory intervention, amplified by fintech platforms, has created genuine cost savings for investors.