India Braces For Private Equity Investment Shake-up as Global Headwinds Loom

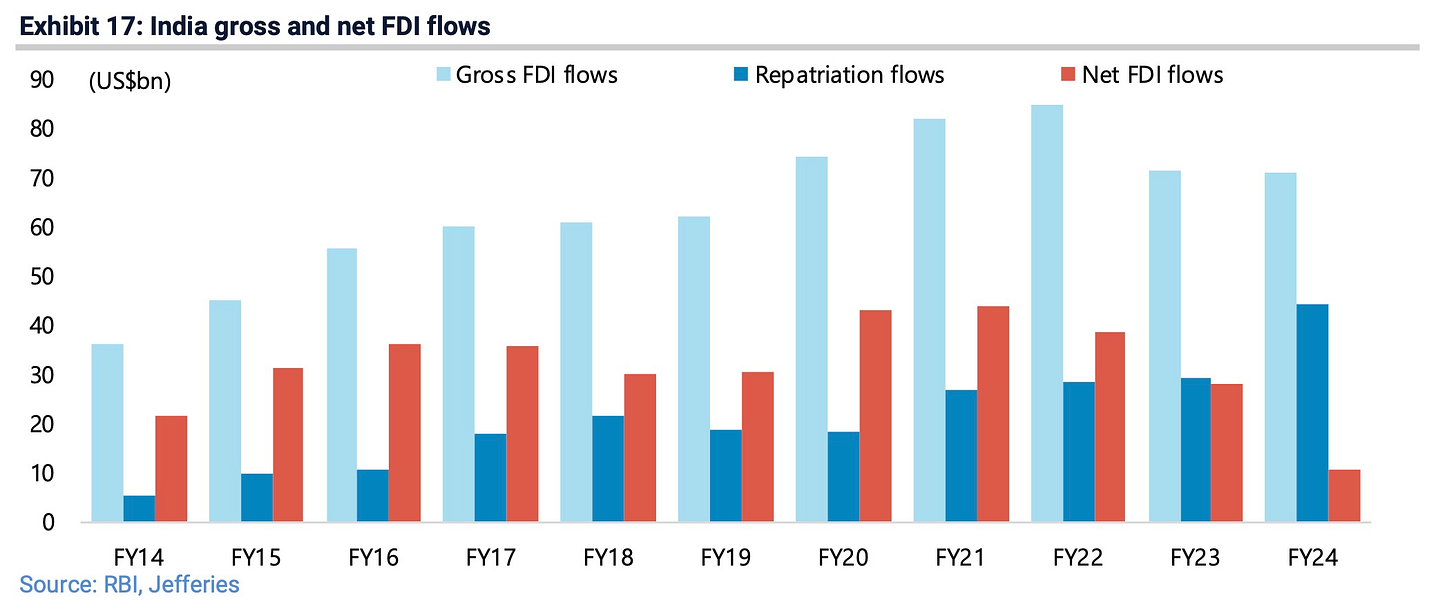

Private equity firms have dramatically reversed course on their Indian investments, with capital outflows from the country surging to unprecedented levels. In the last fiscal year, PE “repatriation” from India soared by 51% year-on-year, hitting a record $44 billion.

This massive exodus of capital has effectively nullified a significant portion of India’s gross foreign direct investment (FDI) inflows, which declined to $71 billion in 2023 from $84 billion the previous year.

The rapid acceleration of PE exits, to be sure, stems largely from India’s robust equity markets, which have presented an ideal climate for firms to cash out their investments at attractive valuations. This trend has been particularly pronounced in the technology sector, where several high-profile divestments have caught the eye of market observers.

The vigorous exit activity indicates that many PE investments in India have reached their maturation point, with firms seizing the opportunity presented by the country’s strong economic growth trajectory. But a few things continue to concern market participants.

Jefferies adds:

India is finally developing a manufacturing story. This has also been reflected in the emergence of a contract manufacturing sector in the stock market known as Electronics Manufacturing Services (EMS). These stocks trade at hefty multiples (46-132x FY25 PE based on four stocks under Jefferies coverage) reflecting hopes of strong growth from a low base despite profit margins of only 2-10%.

PE activity in India is set to undergo further transformation in response to both domestic and global factors. While the frenetic pace of exits may slow, industry experts foresee sustained interest in Indian assets from global PE players.

The country’s expansive and growing consumer market, coupled with its manufacturing push through initiatives like the production-linked incentive (PLI) schemes, is expected to draw new PE investments in sectors such as consumer goods, healthcare, and advanced manufacturing. However, PE firms are warily eyeing global economic storm clouds, particularly the looming threat of a US recession and its potential ripple effects on emerging markets.

This wariness may result in more discriminating investment strategies, with a focus on companies boasting robust fundamentals and clear routes to profitability.

The ongoing geopolitical friction between the US and China could potentially work in India’s favor, as PE firms seek to diversify their portfolios and capitalize on the “China plus one” strategy adopted by many multinational corporations.

The Indian government’s approach to foreign investment will play a pivotal role in molding future PE activity. Recent regulatory adjustments aimed at liberalizing foreign investment rules in sectors like insurance and telecom could unlock new avenues for PE firms. Conversely, any moves to tighten regulations or intensify scrutiny of foreign investments could dampen enthusiasm.