India Swings On Narrative

Foreign institutional investors have flipped from heavily overweight to underweight on India in a matter of months, revealing the market’s tendency to construct elaborate narratives to justify investment decisions rather than letting fundamentals drive market sentiment.

Based on over 100 investor meetings this quarter, Bernstein analysts Venugopal Garre and Nikhil Arela report that most foreign funds are now underweight India — a 180-degree reversal from their positioning in August/September when Indian markets peaked and these same investors were largely overweight.

“As Chinese markets almost halted last year, the focus turned to India, and sweeping narratives on India’s innovation and tech capabilities were made to rationalize investments where EM funds saw a dearth of other options,” the analysts said Tuesday.

The Nifty index has retreated 14% from its peak, with the damage worse in mid and small caps, down 20% and 24% respectively. A staggering 87% of NSE500 stocks have declined from their October 2024 values by an average of 20%.

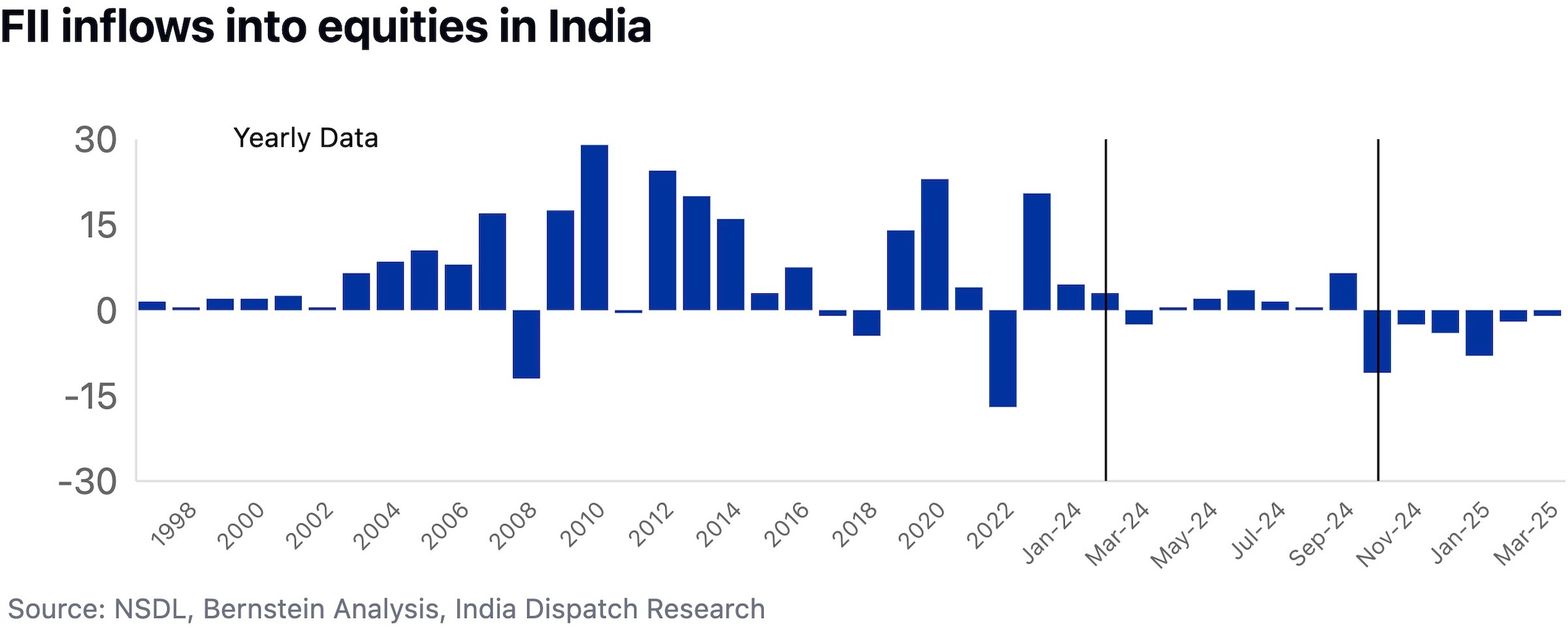

Foreign investors injected $15 billion between February and September last year but have withdrawn $28 billion since October. Meanwhile, domestic SIP (Systematic Investment Plan) flows have demonstrated remarkable resilience, declining only 1.5% month-on-month in February despite markets falling 3% in the preceding three months.

“The underweight stance reflects how narratives shape decisions,” Bernstein argues. “the India story was actually never about a break-through tech, quantum computing, humanoid robots, pioneering semiconductors or cybernetic convergence. The India story was always about the pillars of manufacturing, infrastructure and digitization, and rather ‘prosaic’ growth where it follows in the footsteps of China and other economies.”

Key investor concerns include Trump's potential tariff impact, currency stability, and macro recovery sustainability.

Perhaps most tellingly, the report highlights how commodity-driven, low-value businesses with governance issues that were “often dismissed in the past” are now attracting significant investor attention — including sectors like cables, wires, fans and appliances that were once considered mundane but now trade at valuations similar to consumer staples.

“This simply highlights that narratives can’t always be trusted, and focus should instead be on macro trends and identifying good business models — which should be the key investment strategy.”