Indian Consumers Show Signs of Fatigue Amid Market Rally

India’s consumer sector is displaying clear signs of slowdown, particularly in urban mass markets, even as the country’s equities trade at record premiums to emerging market peers.

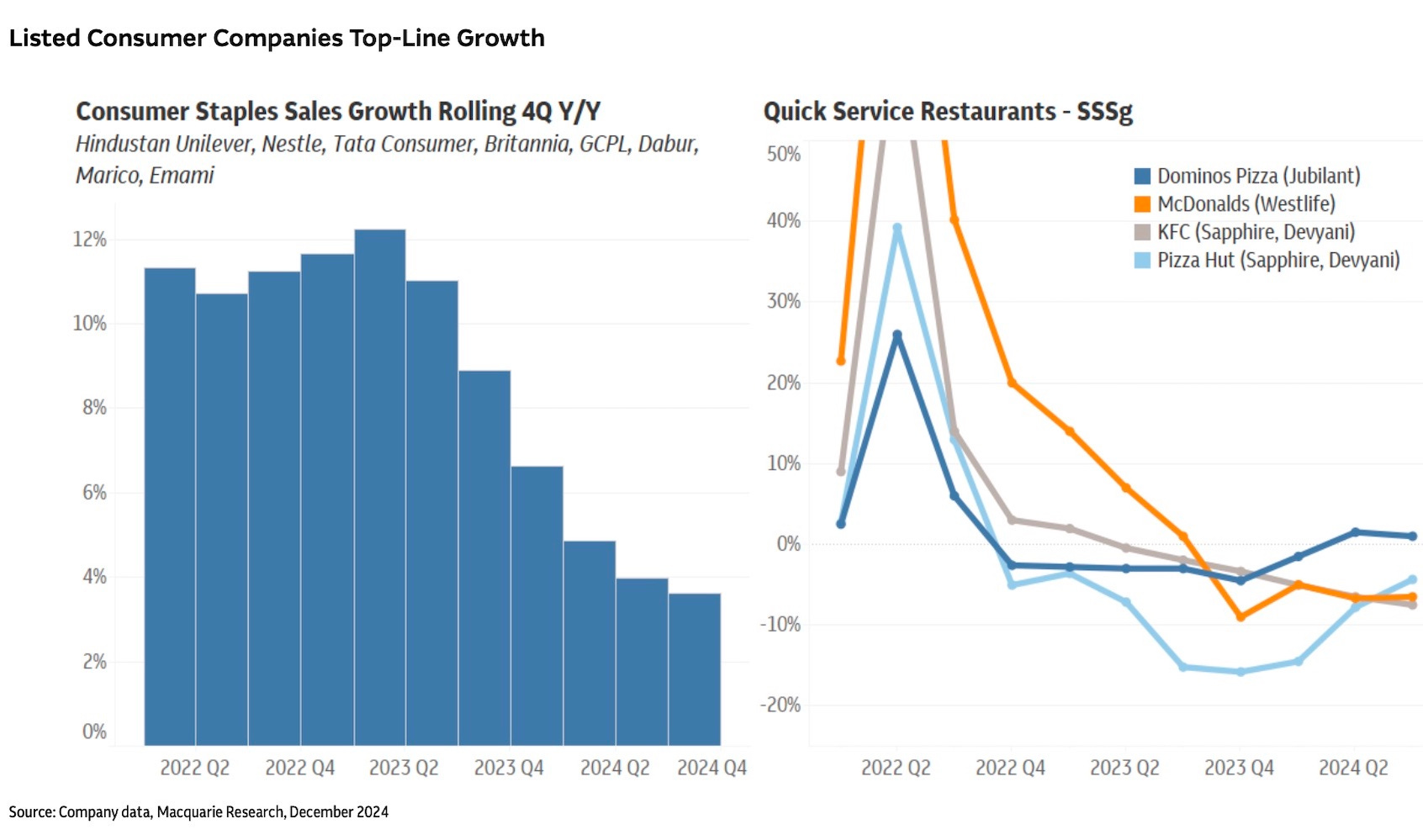

Consumer staples sales growth for major listed companies including Hindustan Unilever, Nestle, and Britannia has fallen below 4% on a rolling four-quarter basis. Quick-service restaurants are reporting negative same-store sales growth, affecting major chains including Dominos Pizza (Jubilant), McDonalds (Westlife), and KFC.

This consumption fatigue comes as Indian equities trade at 20.7 times forward earnings, an 89% premium to emerging markets.

The slowdown shows a distinct pattern across market segments. While mass market consumption weakens, premium segments remain resilient. Jewelry retailers such as Titan, Kalyan, and Senco continue to report solid sales growth around 20%.

Credit metrics suggest broader stress. Bank credit growth in personal loans has “meaningfully softened” in the past four months, while credit card non-performing assets are rising. Consumer confidence surveys also indicate weakening sentiment.

Rural markets offer some contrast, with positive indicators in two-wheeler sales and tractor demand. This aligns with early signs of rural wage growth recovery.

The consumption slowdown comes amid cumulative food and beverage inflation of 36% since 2020, particularly affecting urban mass-market segments.

Follow India Dispatch on WhatsApp Channel.