India’s Value Retailers: $3.5 T-shirts, Triple-Digit Multiples

When companies selling Rs 300 ($3.54) t-shirts trade at higher earnings multiples than global luxury leaders, questions need asking.

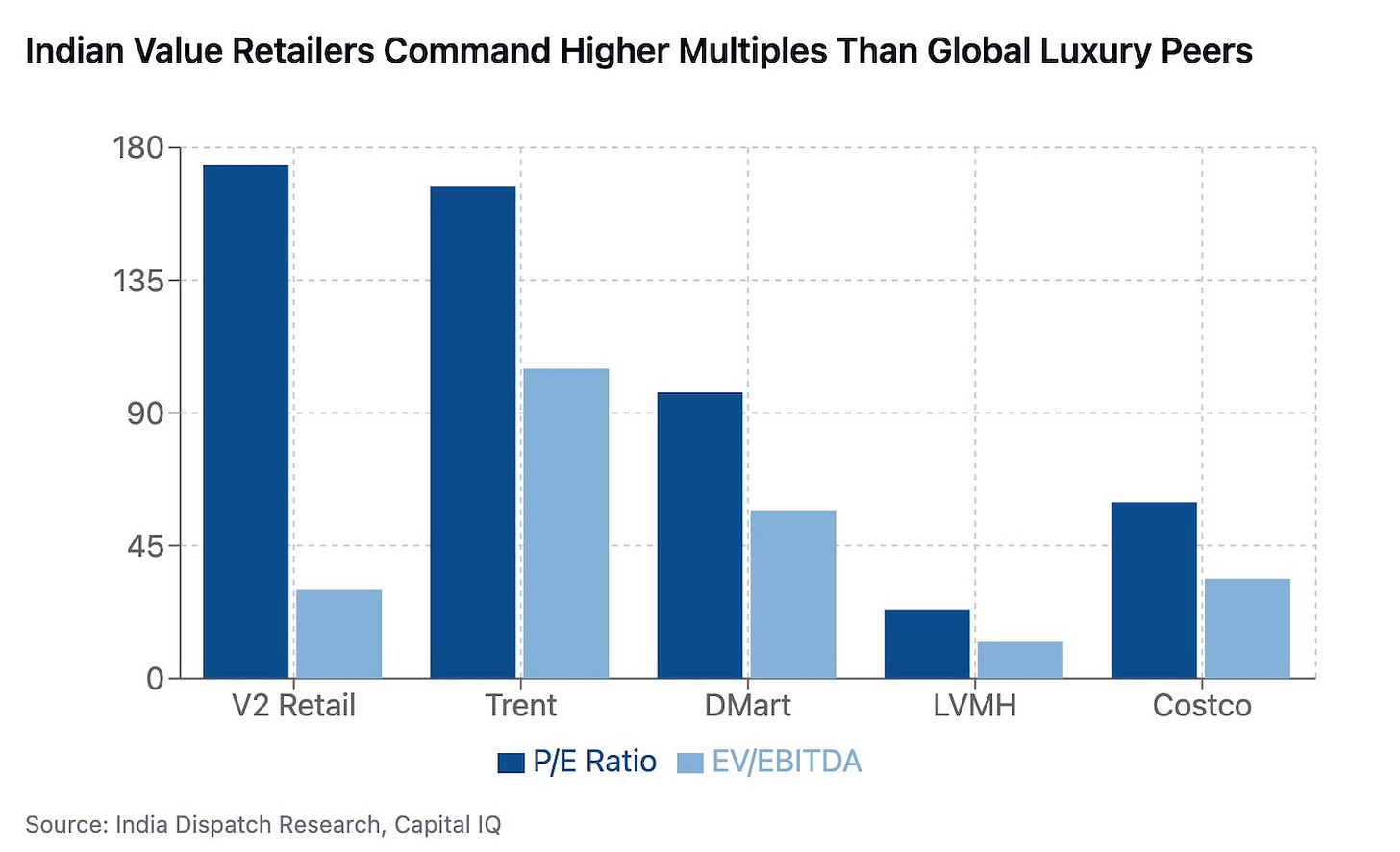

V2 Retail, targeting value-conscious consumers in India’s Tier 2 and 3 cities, trades at 174x trailing earnings. Trent commands 167x, while DMart sits at 97x. For context, LVMH trades at 23.4x earnings, while Costco trades at 59.7x.

The upcoming Vishal Mega Mart IPO extends this premium valuation trend. Its proposed pricing implies a 75-79x trailing P/E multiple, despite reporting lower revenue density than peers and having 45% of stores in Tier 3+ cities.

The bull case rests on India’s “Next-30%” income pyramid growth story. But the numbers raise questions:

Style Baazar: 244 days of inventory versus DMart’s 33 days

VMart’s advertising costs at 5%+ of revenues

Most players showing sub-15% EBITDA margins

Yet the market appears unfazed. V2 Retail has surged 35% year-to-date, while the Nifty 50 index is up just 3%.

The valuation disconnect becomes starker when examining EV/EBITDA multiples:

Trent: 105x

DMart: 57x

VMart: 32x

V2 Retail: 30x

For reference, LVMH trades at 12.4x EV/EBITDA and Costco at 33.8x.

With significant geographical overlap between players (over 2,000 value retail stores across India) and margins constrained by the very nature of value retail, the market appears to be pricing in perfect execution of India’s retail transformation story.

Vishal Mega Mart’s target customer “is value focused and not necessarily aspirational.” The same cannot be said about their earnings multiples.

Follow India Dispatch on WhatsApp Channel.