Keeping It In The Family Pays Off For Asia Inc

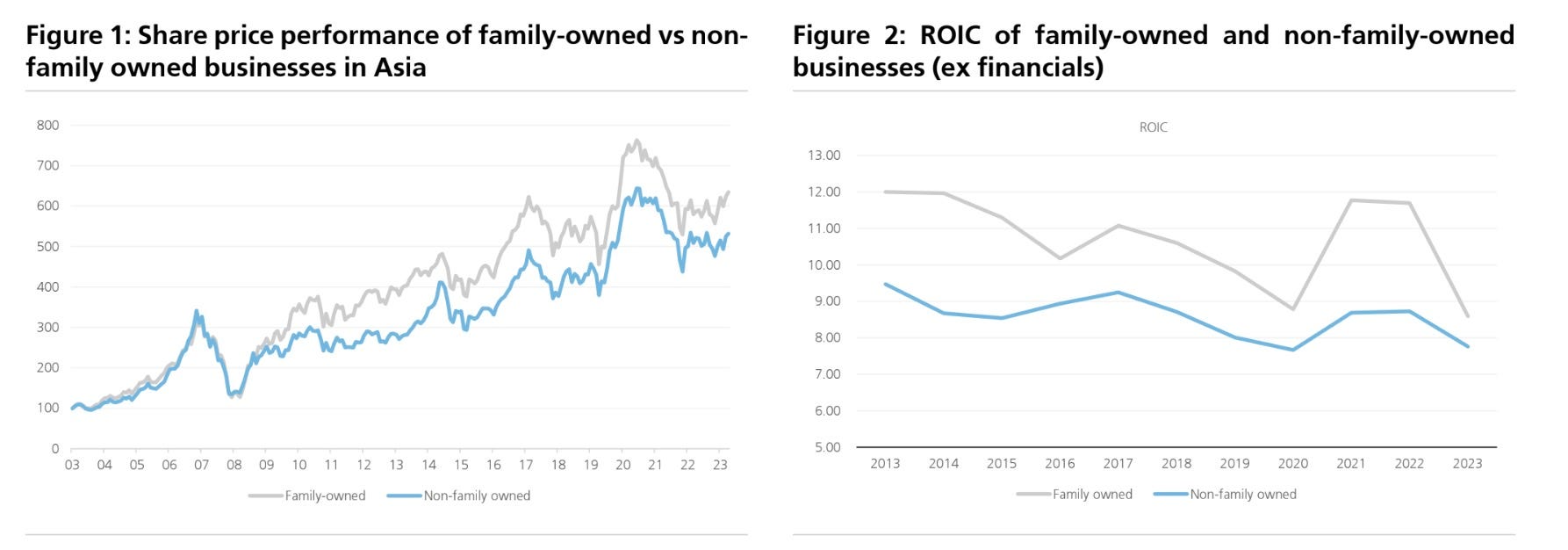

Family-owned listed businesses in Asia have outperformed non-family rivals over the past two decades, delivering superior returns and profitability, according to a UBS analysis.

The study, which analysed around 500 listed family businesses across Asia, revealed that family-controlled firms achieved an average of 212 basis points higher return on invested capital (ROIC) compared to their non-family owned counterparts.

The analysis comes at a time when nearly half of these family businesses, representing over $1 trillion in market capitalisation, are set to undergo leadership transitions to the next generation within the next five years, which could lead to near-term underperformance.

The analysis of prominent Asian business families showed that share prices typically lag behind benchmarks in the first two years after a generational transition, with the effect more pronounced when leadership passes to family members rather than external professionals.

Despite succession-related jitters, the report argues that such dips often present attractive buying opportunities for investors. Although profitability may take a short-term hit, ROICs tend to stabilise post-transition as long as the underlying strategy remains intact, with stock prices usually rebounding after the third year.

Interestingly, successions in older family businesses, those in the third generation or later, are more likely to lead to improving returns over time, possibly reflecting more robust governance frameworks and openness to outside management.