Why India's Retail King Needs Shein

India's fast-fashion segment grew 30-40% in the year through March

Reliance is making a bold bet on Shein, the ultra-fast-fashion giant that resumed operations in India earlier this year. And the Indian conglomerate needs the gamble to pay off.

The pressure is mounting for India's largest retailer, whose retail arm posted a modest 9% EBITDA growth last year despite chairman Mukesh Ambani's public pledge to double profits within four years.

The answer may lie in India's fast-fashion segment, which surged 30-40% in the year through March, according to consultancy firm Redseer, even as the broader $82 billion apparel market limped forward at just 6% growth.

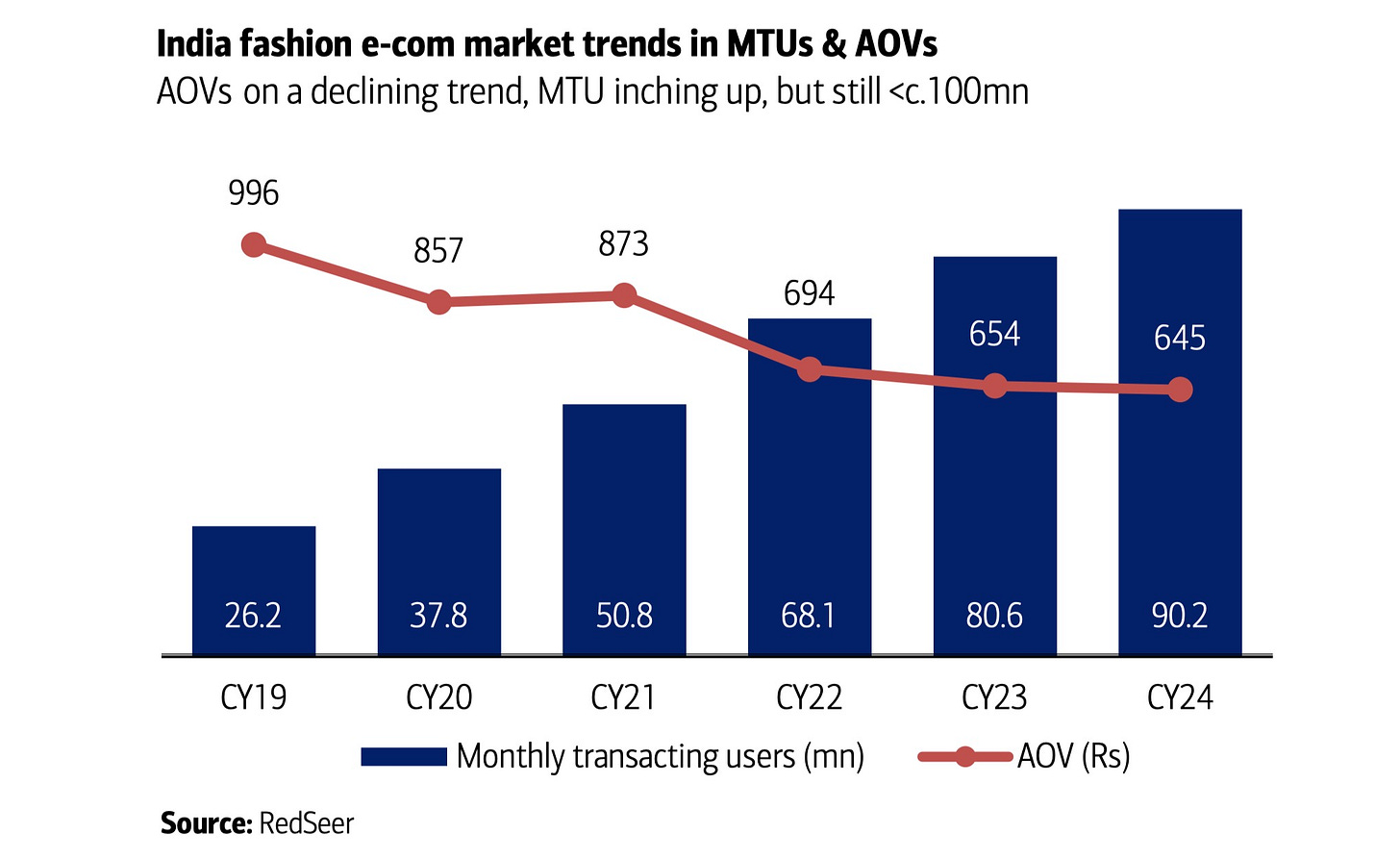

This dramatic shift in consumer behavior has transformed India's e-commerce with fashion now commanding 27% of online sales compared to 16% in 2020, as shoppers abandon big-ticket electronics for $5-8 impulse purchases.

Shein's operational model, on paper, promises the velocity that has eluded Reliance Retail in recent years. The Singapore-headquartered firm, which returns to India in partnership with Reliance after a four-year ban, has launched in the country with approximately 12,000 designs – a fraction of its American catalog – but each produced in initial batches of just 100 pieces that only get reordered after 75% sell through. Reliance plans to expand its supplier network from 150 to 1,000 Indian factories, a move that Bank of America estimates could slash inventory cycles from the mid-60s to the high-40s in days while freeing up roughly $187 million in working capital.

The partnership's physical footprint takes an unconventional approach, embedding compact Shein kiosks within more than 400 existing Reliance Trends outlets rather than pursuing standalone stores, a strategy that marries fresh inventory with established foot traffic while minimizing capital expenditure. This infrastructure also positions Reliance to export Indian-manufactured Shein products to American and British markets, circumventing the punitive tariffs that have hammered Chinese textile exports.

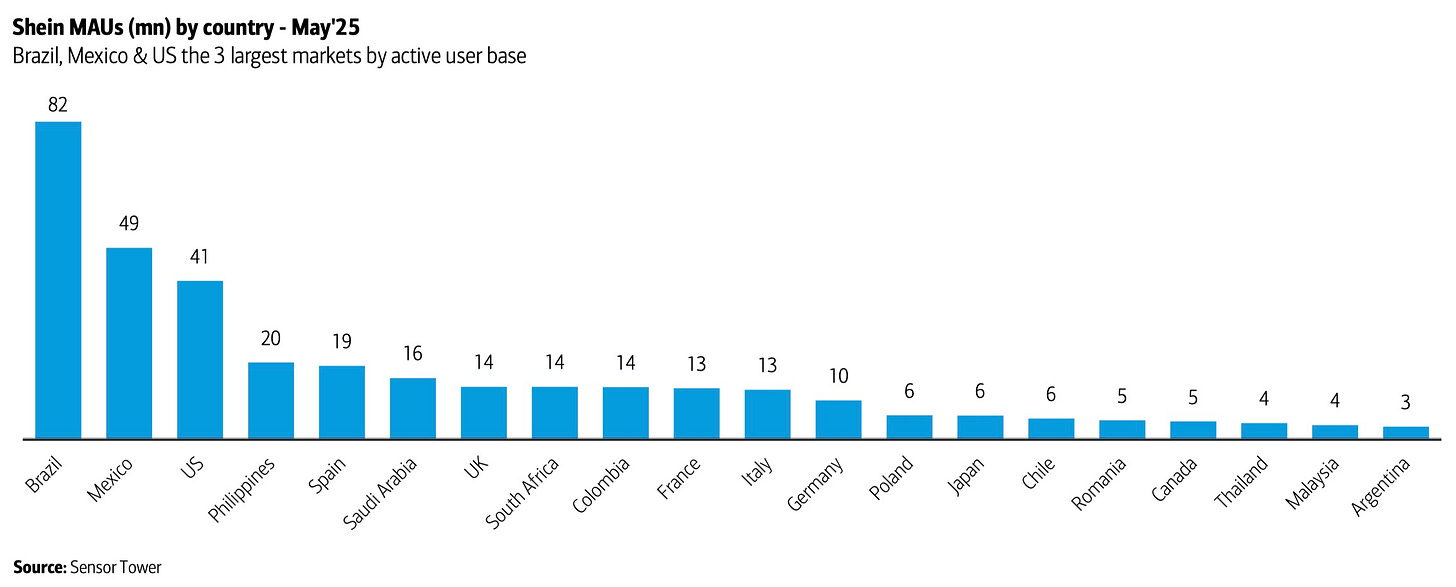

Early metrics suggest the digital component is gaining traction, with Sensor Tower data indicating approximately 650,000 monthly active users who open the Shein app 18 times per month and engage for more than three minutes per session, engagement figures that actually surpass many established Indian fashion platforms.

Moreover, manufacturing domestically delivers advantages beyond tariff arbitrage, as local production qualifies for government incentives while tapping into India's extensive textile manufacturing ecosystem that already supplies major global brands and possesses the infrastructure for rapid scaling. The country's improving logistics networks, from upgraded highways to modernized freight systems, provide the backbone for the frequent restocking that fast fashion demands.

Many other things have changed in India, especially during the period when Shein was banned in the south Asian market. Tata Group's Zudio discount chain has expanded aggressively into smaller cities and social-commerce platforms are enabling independent brands to reach national audiences at minimal cost. Incumbents including Myntra and AJIO (I will say they are competitors because of what we saw with Tata-Zara-Zudio) are also strengthening their own fast-fashion capabilities, including revamping the supply-chain to enable faster deliveries.

Consumer research indicates that shoppers primarily switch platforms for broader selection rather than lower prices, which might be a challenge for Shein, which has traditionally obsessed over rock-bottom pricing.

The partnership's financial logic remains persuasive despite the licensing fees Reliance must pay, as the company's fashion vertical generates some of the highest margins within its retail portfolio thanks partly to vertical integration through its own manufacturing network. While royalty payments will inevitably compress these margins, the collaboration could drive efficiencies across Reliance's entire fashion operation through sophisticated demand forecasting and inventory optimization techniques that Shein has perfected in other markets.

The broader context makes the timing crucial. India's demographic dividend – a median age of 24-25 years – creates a massive target market for fast fashion. This young population increasingly has disposable income and shows aggressive consumption patterns for fashion. The same demographic that drove fast fashion adoption globally is now hitting its stride in India, creating what could be the world's largest fast-fashion market.

The proliferation of options since Shein's forced exit has created a buyer's market where success hinges on flawless execution – curating the right product assortment, building supply chains that can match consumer demand in real-time, and creating differentiation that transcends price competition. The partnership's ability to combine Shein's data-driven design cycles and capital-efficient retail format with Reliance's manufacturing scale and market access could deliver the profit acceleration Ambani has promised shareholders, though fast fashion's unforgiving economics will magnify any missteps as rapidly as it rewards success.

For both companies, the stakes represent more than just another market entry, as Shein seeks to tap the world's largest untapped fast-fashion opportunity while growth decelerates in mature markets, and Reliance attempts to capture the only segment of Indian apparel retail delivering meaningful expansion.